The government presented three new intermediate indicators for restoring fiscal health at a meeting of the Council on Economic and Fiscal Policy this week, including the fiscal deficit as a percentage of gross domestic product in fiscal 2021.

The government will use the new indicators as a guide to ensure that it achieves its final target of bringing the primary balance into the black by fiscal 2025. However, it is hard to call them stringent indicators, and they could ultimately result in looser fiscal discipline.

Making policy clear

At the Monday meeting, private-sector members proposed the creation of three new indicators. They will be included in a new plan for achieving fiscal soundness that the government will decide on in June.

"They are quite reasonable both economically and logically," Toshimitsu Motegi, minister in charge of economic revitalization, said at a press conference after the meeting.

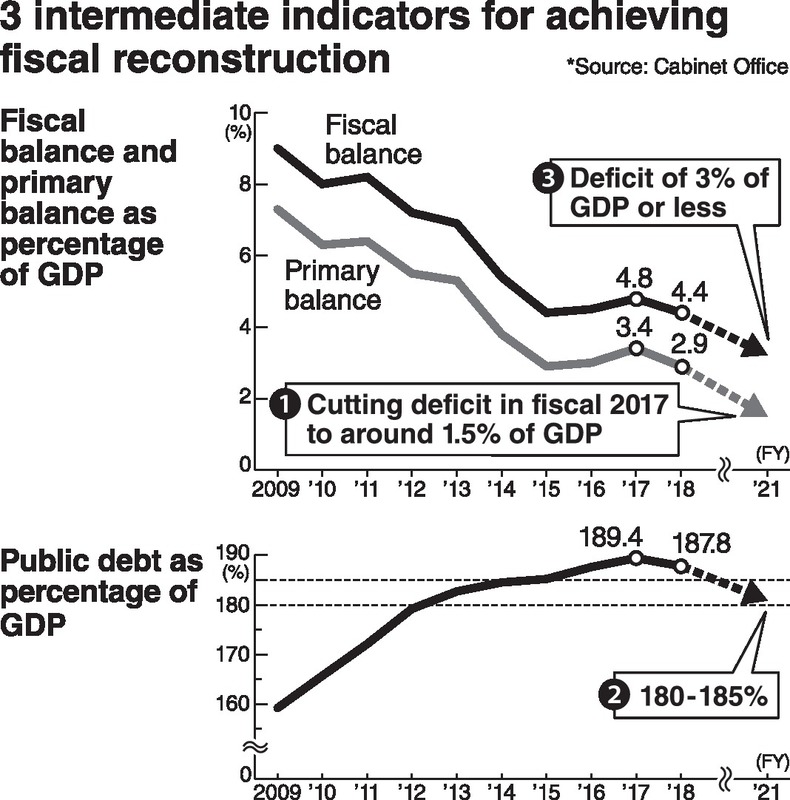

The three new indicators are:

1. Reducing the deficit in the primary balance as a percentage of GDP from 3.4 percent in fiscal 2017 to around 1.5 percent by fiscal 2021.

2. Reducing public debt as a percentage of GDP from 189.4 percent in fiscal 2017 to the low 180-percent range by fiscal 2021.

3. Reducing the fiscal deficit as a percentage of GDP from 4.8 percent in fiscal 2017 to 3 percent or less by fiscal 2021.

In 2015, the government formulated a plan for achieving fiscal soundness, which set forth an intermediate indicator of cutting the deficit in the primary balance to about 1 percent of GDP by fiscal 2018.

In the latest plan, the government will increase the number of indicators to assess the progress of fiscal reconstruction from various perspectives. All indicators will be improved by the growth of GDP, which clearly reflects the policy of Prime Minister Shinzo Abe's administration to achieve a balance between economic growth and fiscal reconstruction.

'Too optimistic'

However, all the indicators are expected to be achieved by fiscal 2021, according to an estimate released in January by the Cabinet Office.

Even in a scenario that assumes low economic growth, the indicators for the fiscal deficit and public debt are expected to be achieved, as the fiscal deficit will be reduced from 4.8 percent of GDP in fiscal 2017 to 2.8 percent of GDP in fiscal 2021, and public debt will be reduced from 189.4 percent of GDP to 183.4 percent of GDP over the same period.

As for the indicator for the deficit in the primary balance, it will be reduced from 3.4 percent of GDP to 1.8 percent of GDP over the same period. While that falls short of the target of halving the deficit in the primary balance to 1.5 percent, the target can still be achieved through further spending cuts.

In the new plan, the government intends not to include numerical targets for curbing the growth of social security expenditures, which account for about one-third of total spending. Pressure to spend will increase in future budget compilations, which could cause fiscal discipline to be relaxed.

There are also concerns as to whether the economy will grow as desired.

The Cabinet Office estimates that nominal GDP will grow by 1.9 to 2.5 percent from fiscal 2017 through fiscal 2021. The estimates are higher than the 1.6 percent in fiscal 2017, and some say the government's estimates are too optimistic.

The possibility of a global rise in long-term interest rates due to U.S. interest rate hikes is another cause for concern. If long-term rates rise in Japan, interest payments on past loans will increase, which could make it difficult for the government to improve the primary balance.

Read more from The Japan News at https://japannews.yomiuri.co.jp/