A worldwide trend is gaining strength toward more strictly regulating virtual currencies that are traded online. China has gone so far as to ban the trading of virtual currencies, and Europe and the United States are searching for ways to strengthen regulations. In Japan, an exchange that lost a huge amount of virtual currency was subjected to an on-site inspection by the Financial Services Agency on Friday. The virtual currency market, which has grown extremely rapidly, appears to be at a turning point.

On Thursday, the Indian Finance Minister Arun Jaitley indicated in a speech to the nation's parliament that his government would seek to put a stop to illegal financing and other transactions linked to virtual currencies. The government does not consider crypto-currencies legal tender, he said in the speech. Virtual currency markets have subsequently seen a significant sell-off, reflecting concerns that the markets could be more tightly regulated worldwide.

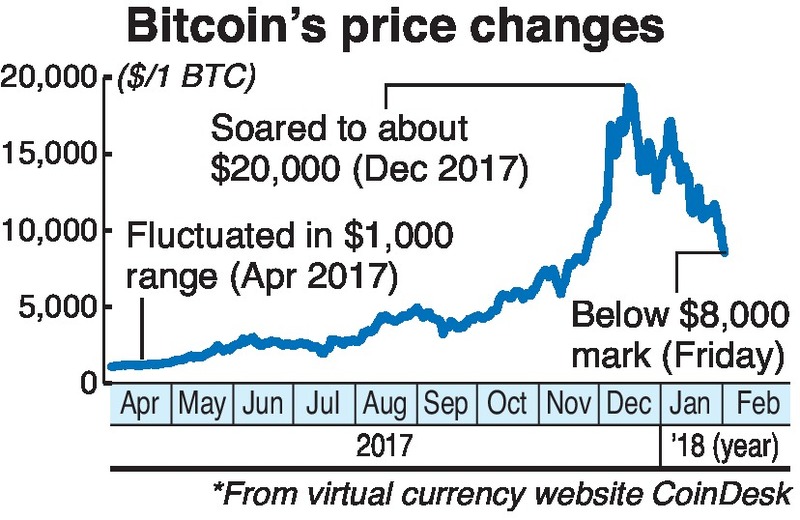

According to CoinDesk, a website that specializes in virtual currencies, the price of one bitcoin (BTC) temporarily fell below 8,000 dollars on Friday. This represents a drop of about 30 percent compared to five days before, and is less than half of the peak value of about 20,000, dollars reached in mid-December 2017.

De facto ban in China

A variety of countries are considering regulations on virtual currencies.

There has long been concern that the strong anonymity offered by virtual currencies will lead to malicious use, such as money laundering. Moreover, virtual currencies have been repeatedly stolen via cyber-attack as the rapid worldwide growth in the usage of virtual currencies has led exchange operators to hold vast amounts of customer assets.

Behind the calls for increased regulation also lies a dramatic increase in the number of people who hold virtual currencies for speculation purposes.

Asian countries have taken a particularly hard line. China, which once had the largest trading volume in the world, now has the strictest rules.

China's central bank, the People's Bank of China, implemented a total ban on initial coin offerings (ICO), in which companies and other vendors raise funds from investors by issuing their own virtual currencies or coins. China has essentially banned trading in virtual currencies, which has caused exchanges to close.

Chinese authorities say they acted because of negative effects on the financial market, but some analysts believe China wants to stop capital flight overseas.

Indonesia's central bank, Bank Indonesia, indicated in January that it would not permit virtual currency trading.

Europe and the United States are also exploring regulations. Senior officials of the U.S. Securities and Exchange Commission and others are scheduled to testify Tuesday in a U.S. Senate hearing on virtual currency scams and ICOs.

Germany and France have called for international cooperation. They are expected to jointly propose regulations at a March meeting of finance ministers and central bank governors from the Group of 20 nations.

Japan's rules 'not keeping up'

Japan was one of the first in the world to introduce a registration system for exchanges by establishing relevant legislation that takes virtual currencies into account as a means of payment.

However, rather than being used for payment, virtual currencies are being used more as a financial product for speculation purposes.

So Saito, a lawyer who is knowledgeable about virtual currencies, said Japan's regulations "did not envision [this kind of situation] and have not kept up with the current state of affairs."

Concerns have been voiced over a general lack of transparency -- including suspected market manipulations -- for some virtual currencies and exchange operators.

Some corporations have started to review their stances toward virtual currencies. Peach Aviation, a low-cost carrier, announced Friday that it would indefinitely postpone a plan to allow customers to purchase tickets using bitcoin.

The latest virtual currency theft will likely lead to heightened discussion in Japan regarding whether, or how, its regulatory scheme should be reassessed.

Read more from The Japan News at https://japannews.yomiuri.co.jp/