Bank of Japan Gov. Haruhiko Kuroda, whose reappointment is expected to be approved at the Diet, has persistently implemented a massive monetary easing policy in an effort to raise the nation's annual inflation rate to 2 percent, but the central bank's exit strategy from the policy remains unseen despite concerns about side effects due to the lengthening continuation of the policy.

Also, the actual inflation rate has remained as low as about 1 percent amid consumers' deep-rooted propensity to spend less.

The government presented a proposal Friday to receive Diet approval for reappointing Kuroda.

Tight-lipped on exit

At the Financial Affairs Committee of the House of Representatives on Friday, Kuroda repeated previously expressed views. "We have not yet reached the phase in which [we need] to indicate the timing of the exit or measures during" the exit, he said.

The BOJ has refrained from publicly discussing an exit strategy, considering it may have a huge impact on the market when the inflation rate remains at only around 1 percent.

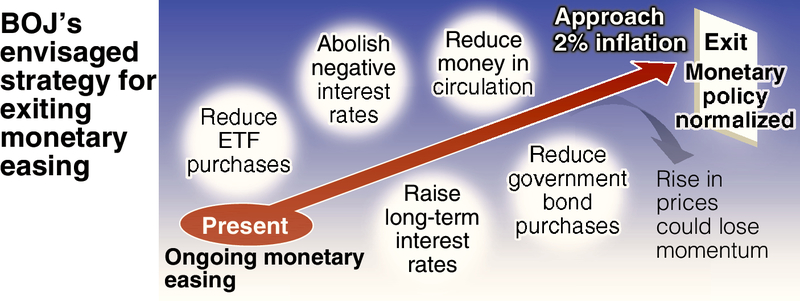

And yet, it is impossible for the central bank to eternally continue the current massive easing policy -- in which it has suppressed the benchmark long-term interest rate (10-year government bond yields) at around zero percent by purchasing large volumes of government bonds -- because there is a limit to the amount of government bonds circulating in the market.

The central bank possesses over 40 percent of all outstanding government bonds. It is almost certain for the bank to have no choice but to revise the policy at some point after Kuroda's reappointment.

The BOJ has already begun research on a possible exit strategy by studying the example of the U.S. Federal Reserve Board, which has entered a phase of raising interest rates, according to a person knowledgeable about the issue.

Hurdles to overcome

Nevertheless, it is extremely difficult to carry out an exit strategy of terminating such policies as purchasing large volumes of government bonds and applying a negative interest rate.

The BOJ has set long-term interest rates at around zero percent and applied a negative interest rate to part of private banks' deposits at the BOJ. In addition, the central bank has bought exchange-traded funds, or ETFs, at an annual pace of about 6 trillion yen.

If the BOJ raises its long-term interest rate target, it will narrow the interest rate gap with the United States, making it likely to accelerate appreciation of the yen against the dollar. It may also weaken Japanese export companies' competitiveness and negatively affect the nation's economy.

Normalizing the monetary policy requires the BOJ to gradually reduce the amount of government bonds it purchases, put an end to the negative interest rate policy, and stop buying ETFs.

However, if the central bank implements these policy changes with the wrong timing, the market -- which is accustomed to the BOJ's support of the economy -- might become nervous.

"Turmoil could occur in the market unless the BOJ shows in an easily comprehensible fashion how it thinks about the exit strategy," Yasuhide Yajima, chief economist at NLI Research Institute, said.

Calls grow to review 2% target

In a joint statement in January 2013 about raising the inflation rate to 2 percent, the government and Bank of Japan said they aimed to "realize the target as early as possible."

Despite the nation's massive monetary easing policy, Kuroda, who has served as the central bank governor for about five years, has yet to achieve the target. As pay increases continue to fail to progress as expected, there are smoldering opinions in the market for reviewing the government-BOJ statement on inflation.

The statement focused on collaboration between the government and the central bank for taking policy measures for overturning the economy's deflationary trend as early as possible -- the central bank promoting monetary easing with a 2 percent inflation target on a year-on-year basis, and the government making efforts to strengthen competitiveness and restore fiscal health.

At a press conference in January this year, Kuroda said, "I think there is no need to change anything [in the joint statement]."

However, it has been pointed out that the central bank will not be able to stop its monetary easing policy without changing the target -- which would worsen any adverse side effects from the easing policy.

Hajime Takata, a chief economist at Mizuho Research Institute, said, "An environment should be fostered in which it is easier for the central bank to change its policy, such as by setting mid- and long-term [inflation] targets."

Read more from The Japan News at https://japannews.yomiuri.co.jp/