The government plans to develop a framework of "information banks" that store personal information such as online shopping and use of electronic money as early as autumn.

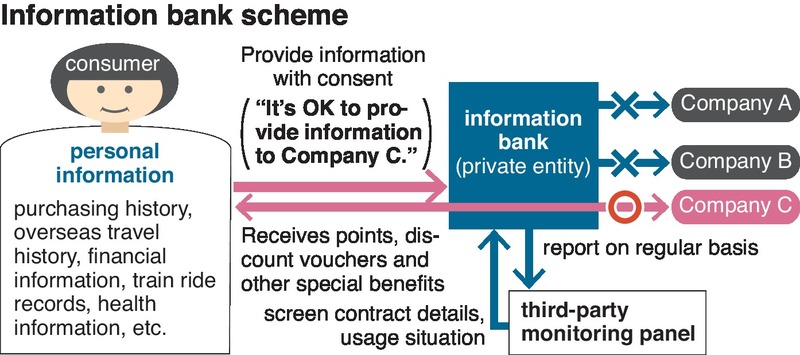

The envisioned information banks will collect such personal information with the consent of individuals, and provide the data to private companies that want to utilize consumer information for their businesses.

As part of its economic growth strategies, the government aims to help create new types of business through the use of such personal information.

The government also plans to launch a third-party panel to check if the information is properly handled.

Information banks are expected to be established by such companies as computer system companies.

An information technology industry organization will screen applications for establishing information banks. It will evaluate the applicant firms based on criteria -- such as financial stability, protective measures for personal information and legal competency for liability in damages -- set by the government for giving an approval for the launch.

Centers to deal with complaints and inquires will be set up at both information banks and the industry group. The government estimates from 10 to 20 such banks will be launched.

In the information bank system, first of all, individuals' consent is required for storing personal data with the information banks.

The banks will store a broad range of information -- from individuals' age, sex, financial and health information to their history of shopping, overseas travel and daily train rides.

With big data collected and stored by information banks, companies can request the banks provide the data, which is considered useful for sales and development of new products.

Thus the companies will be able to obtain information with such parameters as "products purchased by female in their 30s and 40s in the Kansai region" and "types of travel favored by males aged 60 or older in eastern Japan."

When companies request information, the banks will check with the targeted individuals each time to ask if they agree to allow the banks to provide their information to the firms.

Individuals who are the subject of a company's request will be allowed to choose the companies and types of information they are willing to share, such as, "It is OK to give my data to Company A, but not to Company B," or "I will provide my purchasing history, but not train ride records."

Individuals, in return, will receive points that can be exchanged for goods, discount vouchers and other special benefits from the companies that acquired information. The banks are to provide the information to the businesses for a fee.

The third-party panel will comprise lawyers, consumer group representatives and data security experts, among others. The banks will be required to report to the panel the state of the operation on a regular basis and the panel will check how the information is used.

Should there be any problem, the panel can exercise its right to suspend the operation of banks.

While a large amount of personal information stored in databases is shared at various occasions, many people are worried about how their personal information is used.

With this framework, the government aims to dispel concerns of individuals over digitized personal data and at the same time make it easier for companies to use personal information.

Read more from The Japan News at https://japannews.yomiuri.co.jp/