Cipher Mining Inc. (NASDAQ:CIFR) has captured the market’s attention after quantitative trading behemoth Jane Street Group, LLC disclosed a 5% passive stake in the company. The Schedule 13G filing, detailing an aggregate 19.68 million share position, was first highlighted in an SEC filing dated Oct. 24.

CIFR surged after-hours. Check out the price here.

Eric Jackson, Daniel Newman Make A Bullish Case For CIFR

Jane Street’s move comes amid a fierce debate over CIFR’s valuation, which has been bet on by prominent bulls, including Eric Jackson of EMJ Capital. Not only CIFR, but Jane Street also disclosed a 5% stake in Hut 8 Corp. (NASDAQ:HUT) as per its SEC filing, just after Jackson announced a new long position in that firm.

This investor group, which also includes the CEO of Futurum Group, Daniel Newman, is reframing CIFR from a Bitcoin miner into a key “AI utility powerhouse.”

Newman has publicly called CIFR his “#1 AI utility play,” citing the company’s $5 billion market cap, $1.3 billion in cash, “zero debt,” and a pipeline of major megawatt deals to service the “insatiable demand for AI capacity.”

Rittenhouse Research Mocks Jane Street For CIFR Position

The investment immediately drew sharp, sarcastic reactions. An X post by Rittenhouse Research saying, “they intend to hold this position for years, maybe even decades!” mocked the idea that Jane Street, a firm known for proprietary trading and market-making, was acting as a “fundamental, long-duration value investor.”

Rittenhouse suggested the position is more likely part of a “delta-neutral options strategy” rather than a simple long-term bet.

In a CoinDesk report from May, Rittenhouse Research’s note on Galaxy Digital Inc. (NASDAQ:GLXY) highlighted Cipher Mining’s struggles to pivot to AI, quoting CEO Tyler Page on the difficulty of convincing $1 trillion-market-cap counterparties. They contrast this with Galaxy’s successful transition.

See Also: OPEN, IREN And Now HUT: Eric Jackson Takes Long Position In Hut 8, Citing Pivot To AI Infrastructure

Short Seller Scrutinized Blatant CIFR Promotion

This intense promotion has also attracted high-profile skeptics and highlighted unusual market dynamics. Famed short-seller Jim Chanos, who has criticized the “ridiculous assumptions” in the sector’s bull case, recently aimed at Mike Alfred, a director at competitor IREN Ltd. (NASDAQ:IREN).

Chanos publicly questioned the IREN director, asking if his board was “comfortable with you openly promoting the stock of a competitor? $CIFR.” Alfred has repeatedly posted bullishly about CIFR, including speculating about a potential deal with Oracle.

CIFR Has Delivered Staggering Returns In 2025

Shares of CIFR closed 7.11% on Thursday at $17.26 per share, and it rose 8.49% in after-hours trading. The stock has advanced 257.25% year-to-date and 208.68% over the year.

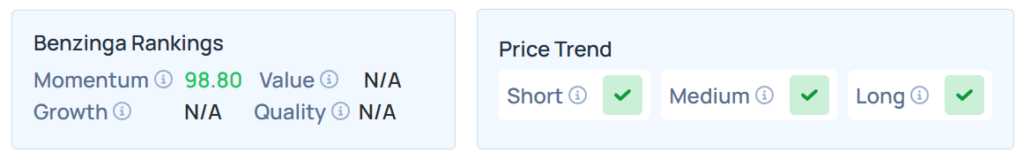

CIFR maintained a stronger price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

On Friday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher.

Meanwhile, on Thursday, the S&P 500 index ended 0.58% higher at 6,738.44, whereas the Nasdaq 100 index rose 0.88% to 25,097.42. On the other hand, Dow Jones advanced 0.31% to end at 46,734.61.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock