There’s been a lot going right for Opendoor Technologies (OPEN) stock in 2025. EMJ Capital’s Eric Jackson spurred a rally in the online home-flipping stock when he suggested this summer that it could be the next Carvana (CVNA), which achieved a 100 times return over the last three years. That put Opendoor squarely in meme-stock status—something that it’s still benefiting from.

Opendoor changed management, bringing in Shopify’s (SHOP) chief operating officer, Kaz Nejatian, as CEO, and two founders returned to the board of directors. It’s also sure to benefit from the Federal Reserve’s move to slowly lower interest rates the rest of the year. All told, Opendoor stock is up more than 450% just this year—and seems well on its way to Jackson’s prediction.

Now the company’s getting yet another tailwind, as investment firm Jane Street disclosed a 5.9% passive stake in the company. OPEN stock rose 4% on the announcement this week.

Does OPEN stock have more room to run?

About Opendoor Stock

Based in San Francisco, Opendoor offers a platform that enables people to buy and sell real estate through the company’s app. The company, for many years, used a direct-to-customer model that allowed people to sell homes for cash, with Opendoor buying properties, making repairs, and selling them for a profit plus its service fee and closing costs.

This year, it began to shift to a sales agent model in some markets, giving sellers the choice of a cash offer or listing their house on the open market. Opendoor says that as the pilot program rolled out in the second quarter and agents did in-home assessments, twice as many customers received written cash offers and accelerated the process.

The company has been by far the best iBuyer stock on Wall Street, with its 468% gain in 2025, topping Offerpad Solutions (OPAD) (55.4%), Compass (COMP) (36%), and Zillow (Z) (5%).

But with that dramatic price gain comes an outrageous valuation—Opendoor isn’t profitable, so the best metric is the price-to-sales ratio. Opendoor’s is 322, which is higher than even Palantir Technologies (PLTR), which has been notorious on Wall Street this year for its extreme valuation. Offerpad has a P/S of 63, while Compass and Zillow are more reasonable at 18 and 6.2, respectively.

Opendoor Technologies Beats on Earnings

Opendoor’s second-quarter earnings showed revenue of $1.6 billion, up 4% from a year ago. The company posted a net loss of $29 million, or -3 cents per share, versus an expected loss of -4 cents per share.

The company said it sold 4,299 homes in the quarter, up 5% from a year ago, and had an inventory balance of $1.5 billion that represented 4,538 homes.

It ended the second quarter with 393 homes under contract, down 78% from a year ago. The company issued guidance for third-quarter revenue to be between $800 million and $875 million. That’s a steep drop from the $1.4 billion in the year-ago period.

But the most significant part of Opendoor’s story happened after the earnings report dropped. Ten days later, Opendoor announced a search for a new CEO, and then a month after that, announced Nejatian’s hire while indicating that Opendoor will be leaning hard into artificial intelligence (AI) to spur its business.

“He is a decisive leader who has driven product innovation at scale, ruthlessly reduced G&A expenses to drive profitability and deeply understands the potential for AI to radically reshape a company’s entire operations,” company founder and board chairman Keith Rabois said. “He is a proven executive with a founder’s brain. He is the right leader to unlock Opendoor’s unique data and assets as we build on Opendoor’s original mission, now enhanced as an AI-first company.”

What Do Analysts Expect for OPEN Stock?

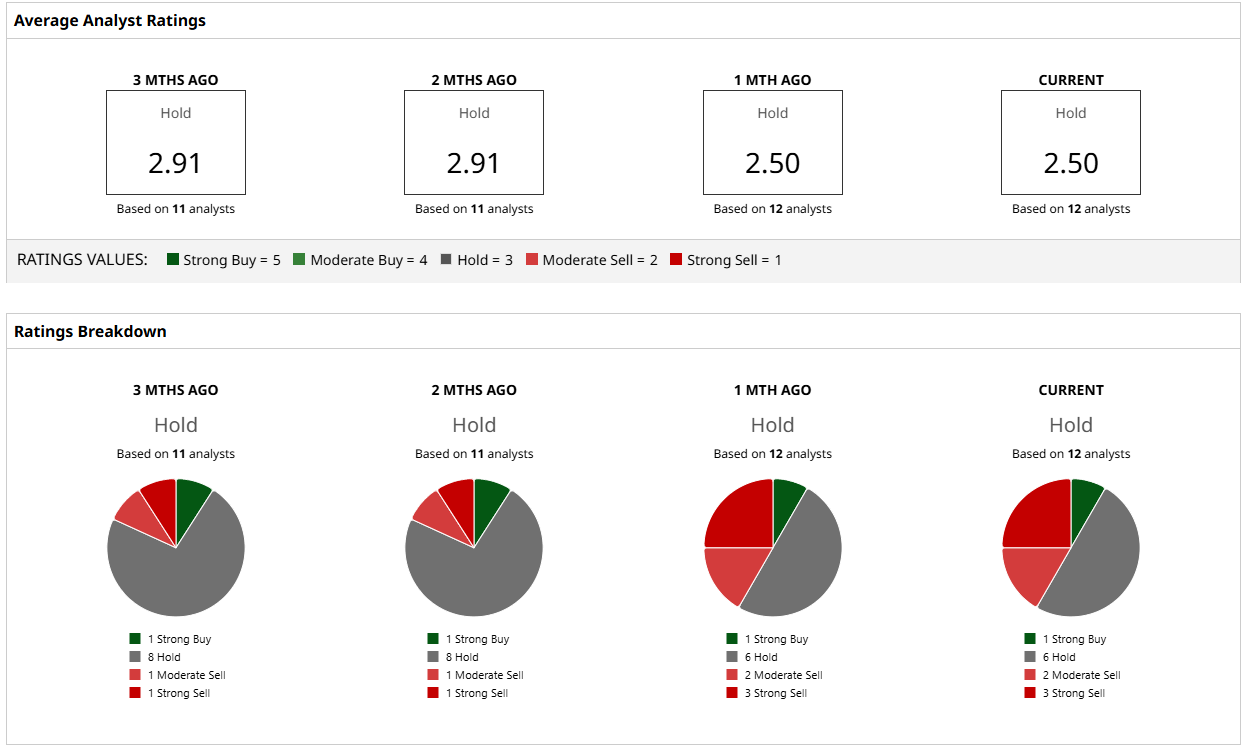

While OPEN is a popular stock to trade on Wall Street—thanks to its meme status—analysts are torn about the company’s future. Of 12 analysts who have coverage on the stock, only one lists it as a “Strong Buy,” with six others labeling it a “Hold,” and the remaining five at “Moderate Sell” and “Strong Sell.”

Meanwhile, Opendoor’s stock price has risen so quickly that it has far outstripped analysts’ price targets. The high price target for Opendoor is $2 per share, but the stock already trades above $9.

When you have a stock moving as quickly as Opendoor, and considering its valuation, any investor who puts money into OPEN stock should expect plenty of volatility. The specter of Opendoor embracing AI to increase sales is intriguing, and Jane Street's endorsement carries a lot of weight. But it’s impossible to guarantee that the company will continue its march higher or even maintain its current levels. If you’re going to invest in Opendoor, take a small position as part of a diversified portfolio—and don’t invest more than you’re willing to lose.