Citigroup Inc. (NYSE:C) CEO Jane Fraser revealed the company’s intention to issue a stablecoin on Tuesday as part of the banking giant’s broader dive into digitization.

What Happened: During Citi’s second-quarter earnings call, Fraser deemed stablecoins as the “next evolution” in the digitization of payments, and said the company is looking to issue a Citi stablecoin in the future

Fraser detailed four core areas of exploration for the bank regarding stablecoins, including reserve management, cash and coin on and off-ramps, tokenized deposit space and custodial solutions for crypto assets.

Fraser called the tokenized deposit space the most important, an area where she said Citi is “very active.”

See Also: Stablecoin Issuers Just Got A New Income Stream—And It’s Built Into The Blockchain

Why It Matters: This announcement comes at a time when major banks are intending to integrate dollar-pegged stablecoins with their operations.

Jamie Dimon, CEO of the world’s largest bank JPMorgan Chase & Co. (NYSE:JPM), said big banks are lagging in the stablecoin race and need to embrace them as a way to keep pace with payment rivals.

Citigroup has been proactive in its digital strategy. In 2023, the bank launched Citi Token Services, a service centered around smart contracts aimed at revolutionizing instant payments.

The bank reported its second-quarter financials, with revenue and profit beating expectations, largely driven by its interconnected businesses.

Price Action: Citi shares rose 0.09% in after-hours trading after closing 3.68% higher at $90.72 during Tuesday’s regular trading session.

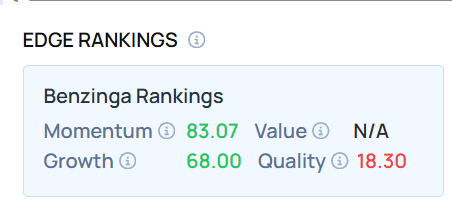

The stock recorded a high momentum score as of this writing. Use Benzinga Edge Stock Rankings to see how it compares to JPMorgan and other major banking firms.

Photo Courtesy: Konektus Photo on Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.