Jamie Dimon isn't buying the AI bubble hype, but he's not sugarcoating the fallout either.

In an interview with Fortune, the JPMorgan Chase & Co. (NYSE:JPM) CEO doubled down on his belief that artificial intelligence is not a fad and that the payoff will come. But it will replace jobs at a pace that could cause major problems if governments and businesses fail to prepare.

"You'll have a revolution," Dimon cautioned.

Real Innovation Vs Bubble

Dimon compared the current AI hype to the early days of the internet, when companies like Google and Meta emerged as major technology players.

He said he was somewhat cautious about conditions in the current market, but urged people not to label all of AI as a speculative frenzy.

The companies at the center of the AI boom, including OpenAI and Nvidia Corp (NASDAQ:NVDA), are investing billions of dollars in each other. Views on the long-term payoff and the risks have been mixed.

Hedge fund manager Howard Marks said current market valuations were "high, but not crazy." On the other hand, the International Monetary Fund (IMF) Chief Economist, Pierre-Olivier Gourinchas, warned that the AI investment boom might be an economic bubble that could burst, comparable to the dot-com bust in the early 2000s.

"You can't look at AI as a bubble, though some of these things may be in the bubble. In total, it'll probably pay off," Dimon said.

See also: JPMorgan CEO Sounds Alarm On Stock Market Fall: ‘Far More Worried About That…’

Protect The Public: Dimon

Dimon reiterated his view that AI would eliminate jobs. “People should stop sticking their head in the sand…,” he said.

“I do think there should be proper thoughtful regulations and guardrails to protect the public,” referring to being better prepared for the job losses that could come as more companies and industries increasingly deploy AI into their systems and processes.

Last week, Dimon, who runs the largest bank in the U.S., said the chances of the U.S. stock market crashing are far greater than many financiers believe, adding that he is “far more worried than others” about a serious market correction, which he predicted could come in the next six months to two years

Price Action: Despite reporting a rise in third-quarter profits on Tuesday, boosted by gains at its trading division and a recovery in investment banking fees, JPMorgan shares closed down 1.9%. The drop came on the back of Dimon’s cautious outlook on the U.S. economy. Shares were up 0.3% in Wednesday’s pre-market trade, adding to gains of over 25% year-to-date, according to Benzinga Pro.

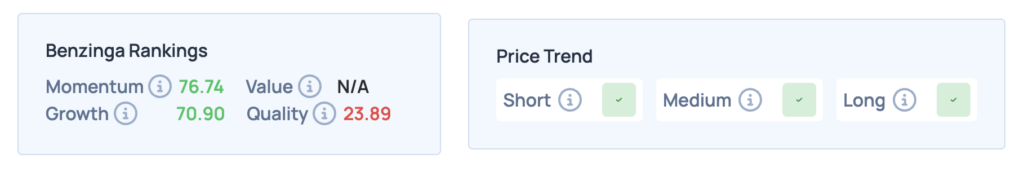

Benzinga’s Edge Rankings show strong momentum and growth, and the stock's price trend is positive across short, medium, and long-term periods.

Read Next:

Image via Shutterstock