JPMorgan Chase & Co. (NYSE:JPM) CEO Jamie Dimon has still not ruled out a possible recession in 2026, even though U.S. GDP is tracking upwards right now.

“I hope for the best and plan for the worst,” Dimon told Bloomberg TV in an interview on Tuesday, adding he thought a recession could still happen next year.

Veteran Banker’s Views Closely Watched By Investors

Billionaire banker and Wall Street veteran Dimon’s comments are closely watched by markets, more so because of his blunt and hot takes on the economy.

Last month, he said the U.S. economy was weakening after a lackluster jobs report from the Bureau of Labor Statistics (BLS).

“I am a little more nervous about inflation not coming down like people expect,” Dimon said on Tuesday. Consumer prices increased 2.9% in the year to August, up from 2.7% the previous month.

Dimon’s comments come even as the U.S. economy grew at a 3.8% annual rate in the second quarter — its fastest pace since the third quarter of 2023. It echoes similar comments from Moody’s Analytics’ Chief Economist Mark Zandi, who warned that recession risks "remain uncomfortably high.”

Dimon also said the ongoing government shutdowns are “a bad idea”, but said they wouldn’t really affect markets.

“I’ve seen … 6 shutdowns, I don’t think it affected the economy, markets in any real way,” he added.

M&A Is Hot

M&A activity has seen an uptick in recent months, following a blip fuelled by President Donald Trump’s sweeping tariff announcements earlier this year. Investors are riding the AI wave and shrugging off tariff worries to ink mega-deals. Global dealmaking surged to $2.6 trillion through August, marking the highest seven-month total since 2021's pandemic-era peak.

JPMorgan itself committed $20 billion of financing for the Electronic Arts take-private deal announced last week, which ranks as the largest-ever debt commitment by a single bank for a leveraged buyout.

“We did that whole deal in 11 days …,” Dimon said. “And there’s a lot of merger talk, a lot of firepower.”

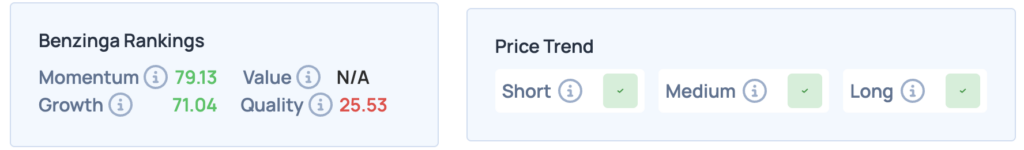

JPMorgan, the largest bank in the U.S., has a momentum rating of about 79%, according to Benzinga's Edge Rankings. The price trend looks strong in the short, medium, and long terms.

See how JPM has performed here.

Image: Shutterstock