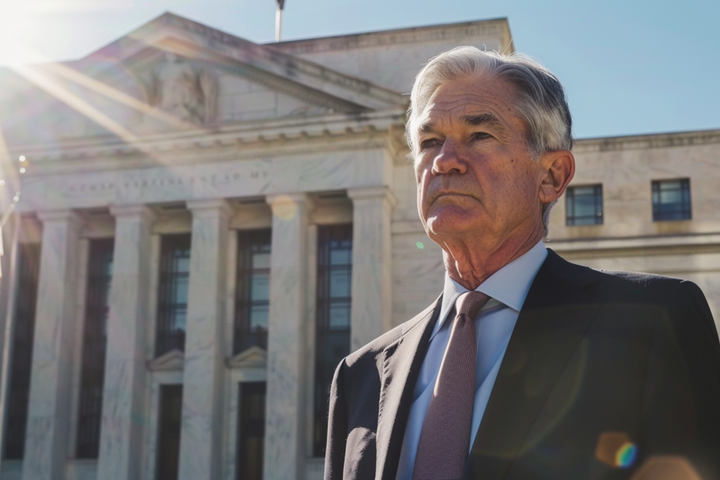

The Federal Reserve's Jackson Hole Economic Symposium kicks off Thursday, but all eyes are on Chair Jerome Powell's speech Friday at 10 a.m. ET. Markets are hoping for clues on interest rate cuts, but Powell is unlikely to commit just yet.

- VOO ETF has dropped nearly 2% this week. Time to buy the dip?

The theme of this year's event, "Labor Markets in Transition," couldn't be more timely, as the Fed grapples with a cooling jobs market and inflation that continues to run above target.

Powell is set to speak on the "Economic Outlook and Framework Review," a topic that may offer insight into how the Fed is weighing risks ahead of its September 17 rate decision.

What The Fed Minutes Told Us

According to the Fed's July meeting minutes, the majority of officials judged that "upside risk to inflation was the greater of the two risks", compared to unemployment.

They also noted that tariff effects were becoming "more apparent in the data," particularly in goods price inflation.

Participants cautioned that the inflationary impact of tariffs remains hard to quantify, but many observed that "domestic businesses and consumers were predominantly bearing the tariff costs."

At the same time, labor cracks are widening. Some officials warned that "low levels of private payroll gains" and the narrow scope of hiring suggested emerging weakness.

Still, most agreed that the job market remained at or near full employment.

Powell May Keep His Options Open

Analysts broadly expect Powell to avoid making strong commitments.

Bank of America strategists don't believe Powell will validate market expectations for a September rate cut.

Powell’s comments on “a low breakeven rate of job growth (i.e., a slowdown in labor supply) or the stability of the unemployment rate would be hawkish,” strategists at Bank of America said.

Goldman Sachs expects Powell to update his July stance that the Fed is "well positioned to wait for more information", suggesting he may now emphasize downside labor market risks.

The bank’s economist David Mericle still doesn't expect Powell to "decisively signal a September cut," but believe he'll make clear that he's "likely to support one."

Chris Zaccarelli, chief Investment Officer at Northlight Asset Management, said the minutes underscore why the Fed didn't cut in July — because inflation still outweighed jobs risk — but the September outlook remains fluid.

"On Friday in Jackson Hole, Chair Powell is likely to keep his cards close to his vest," Zaccarelli said, adding that Powell will stress the Fed's dual mandate and the need to see more data: the August jobs report (due Sept. 5) and inflation reports (Sept. 10-11).

Allspring's fixed income strategist George Bory expects Powell to reiterate caution due to lingering inflation risks from "tariffs and fiscal stimulus", while possibly hinting at a lower "neutral rate."

Still, the Fed is likely to reiterate that policy is "in a good place" for now.

Rate Cut Bets Stay Strong—But That Leaves Room For A Market Letdown

Futures markets are still pricing in a 79% chance of a 25 basis-point cut in September, and nearly a 90% probability of two cuts by year-end, according to CME FedWatch data.

That's a sizable cushion of optimism—one that could quickly unravel if Chair Jerome Powell adopts a more hawkish or noncommittal tone in Jackson Hole.

Markets have grown increasingly confident that the Fed will pivot soon, buoyed by softer job gains and recent signals from some Fed officials.

But if Powell emphasizes inflation's resilience or plays down labor market risks, traders may be forced to quickly recalibrate expectations, potentially triggering volatility in stocks, bonds and rate-sensitive assets.

Now Read:

Image created using artificial intelligence via Midjourney.