/Jack%20Henry%20%26%20Associates%2C%20Inc_%20website%20and%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Jack Henry & Associates, Inc. (JKHY), founded in 1976 and headquartered in Monett, Missouri, is a leading financial technology and IT services provider for banks, credit unions, and fintechs. With a market cap of $11 billion, the company operates through four main segments, Core, Payments, Complementary, and Corporate & Other, offering solutions for core banking, digital platforms, payments, fraud prevention, and security.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and JKHY fits right into that category with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the information technology services industry.

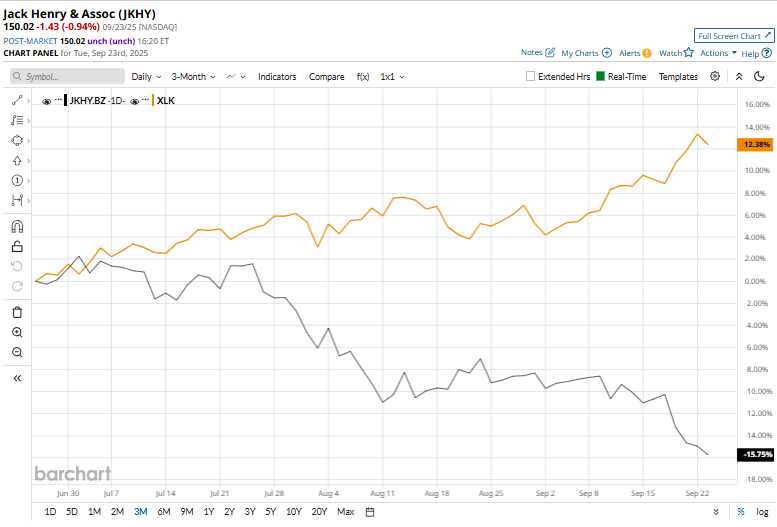

However, JKHY slipped 23.5% from its 52-week high of $196, achieved on Mar. 10. Over the past three months, JKHY stock dipped 17.1%, trailing Technology Select Sector SPDR Fund’s (XLK) 15.4% returns over the same time frame.

In the longer term, shares of JKHY dropped 14.4% on a YTD basis, lagging behind XLK’s YTD gains of 20.5%. Moreover, the stock plunged 14.2% over the past 52 weeks, underperforming XLK’s 26.2% returns over the last year.

To confirm the bullish trend, JKHY has been trading below its 50-day and 200-day moving averages since the end of July.

Jack Henry & Associates’ stock fell 2.3% on Aug. 25 after the company declared a quarterly dividend of $0.58 per share, payable on Sept. 26 to shareholders of record as of Sept. 5, but the shares recovered marginally in the following two sessions.

JKHY’s rival, Fidelity National Information Services, Inc. (FIS), has outpaced the stock, with a 21.5% uptick on a YTD basis and 24.9% gains over the past 52 weeks.

Wall Street analysts are cautious on JKHY’s prospects. The stock has a consensus “Hold” rating from the 17 analysts covering it, and the mean price target of $178.58 suggests a potential upside of 19% from current price levels.