/Jabil%20Inc%20logo%20on%20smartphone-by%20rafapress%20via%20Shutterstock.jpg)

Saint Petersburg, Florida-based Jabil Inc. (JBL) provides manufacturing services and solutions. With a market cap of $25 billion, the company offers digital prototyping, printed electronics, device integration, circuit designing, and volume board assembly services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and JBL perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the electronic components industry. Jabil's diversified model and global presence provide manufacturing flexibility, while its supply chain expertise reduces costs and accelerates fulfillment, giving it a competitive edge.

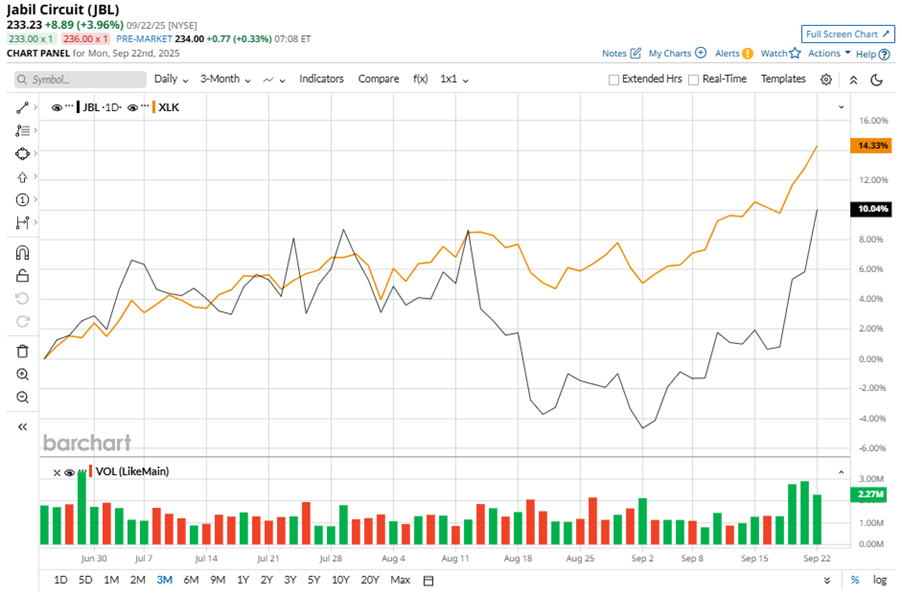

Despite its notable strength, JBL shares touched their 52-week high of $233.82 in the last trading session. Over the past three months, JBL stock has gained 13.1%, underperforming the Technology Select Sector SPDR Fund’s (XLK) 17.5% gains during the same time frame.

In the longer term, shares of JBL rose 62.1% on a YTD basis and climbed 104.7% over the past 52 weeks, considerably outperforming XLK’s YTD gains of 21.6% and 27% returns over the last year.

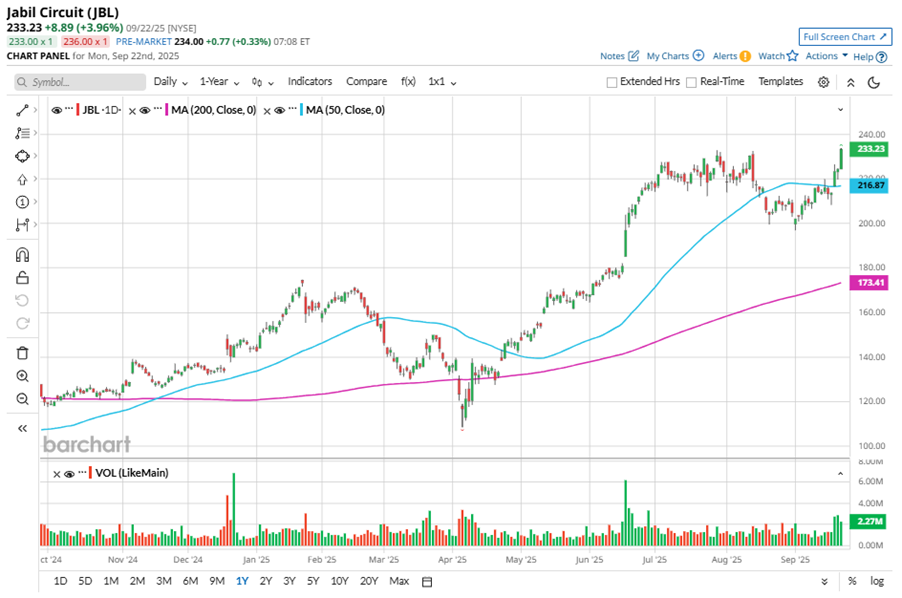

To confirm the bullish trend, JBL has been trading above its 50-day and 200-day moving averages over the past year, experiencing some fluctuations.

Jabil is outperforming due to strong growth in key areas, including cloud, data center infrastructure, and capital equipment, driven by rising demand for AI-related solutions. Its Intelligent Infrastructure segment, as well as the digital commerce and warehouse automation markets, also contributed to the positive performance.

On Jun. 17, JBL shares soared 8.9% after reporting its Q3 results. Its adjusted EPS of $2.55 exceeded Wall Street expectations of $2.33. The company’s revenue advanced 15.7% year-over-year to $7.8 billion. JBL expects full-year adjusted EPS to be $9.33, and its revenue is expected to be $29 billion.

JBL’s rival, Fabrinet (FN), has outpaced the stock with 77.1% gains on a YTD basis but lagged behind the stock with a 68.2% uptick over the past 52 weeks.

Wall Street analysts are bullish on JBL’s prospects. The stock has a consensus “Strong Buy” rating from the 10 analysts covering it, and the mean price target of $234.89 suggests a marginal potential upside from current price levels.