/J_B_%20Hunt%20Transport%20Services%2C%20Inc_%20cargo%20truck-by%20ablokhin%20via%20iStock.jpg)

J.B. Hunt Transport Services, Inc. (JBHT), headquartered in Lowell, Arkansas, provides surface transportation, delivery, and logistics services. With a market cap of $12.8 billion, the company transports a variety of products, including automotive parts, department store merchandise, paper and wood products, food and beverages, plastics, chemicals, and manufacturing materials and supplies. The transportation and logistics company is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Wednesday, Oct. 15.

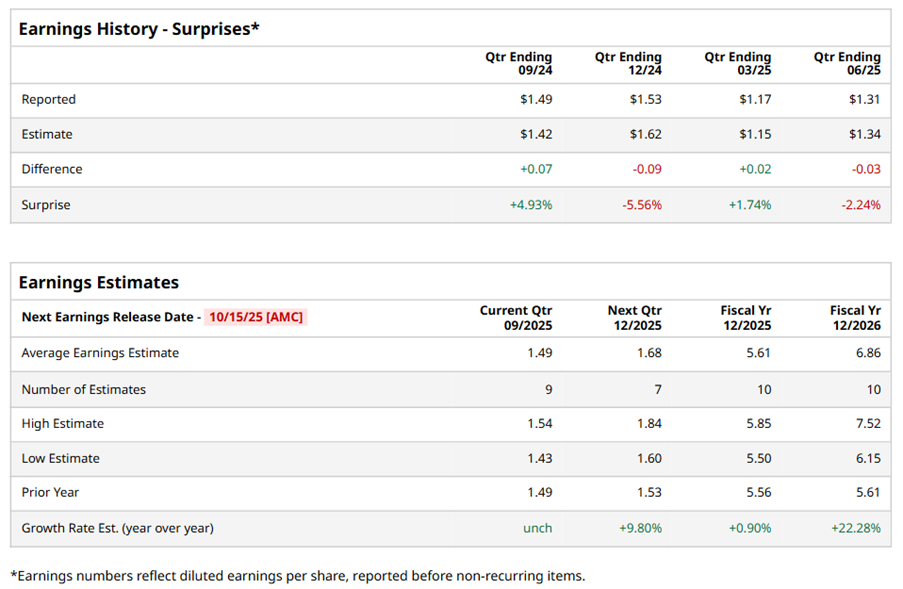

Ahead of the event, analysts expect JBHT to report a profit of $1.49 per share on a diluted basis, unchanged from the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect JBHT to report EPS of $5.61, up marginally from $5.56 in fiscal 2024. Its EPS is expected to rise 22.3% year over year to $6.86 in fiscal 2026.

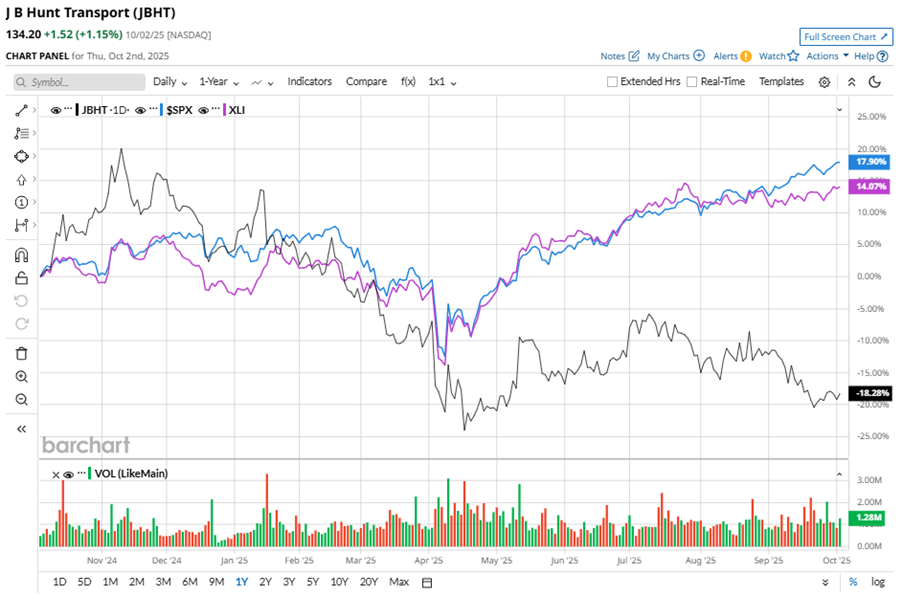

JBHT stock has considerably underperformed the S&P 500 Index’s ($SPX) 17.6% gains over the past 52 weeks, with shares down 20.2% during this period. Similarly, it considerably lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 14% gains over the same time frame.

On Jul. 15, JBHT shares closed down more than 2% after reporting its Q2 results. Its EPS of $1.31 did not meet Wall Street expectations of $1.34. The company’s revenue was $2.93 billion, falling short of Wall Street forecasts of $2.94 billion.

Analysts’ consensus opinion on JBHT stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 25 analysts covering the stock, 11 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 12 give a “Hold,” and one recommends a “Moderate Sell.” JBHT’s average analyst price target is $155.29, indicating a potential upside of 15.7% from the current levels.