Lululemon Athletica (LULU) is a Canadian multinational company recognized for designing, distributing, and retailing premium athletic apparel, footwear, and accessories. It started as a yoga-inspired brand and has expanded into running, training, and lifestyle segments for both men and women. The company emphasizes innovation through its proprietary performance fabrics and functional design developed at its “Whitespace” R&D lab.

Founded in 1998 in Vancouver, the company now operates more than 700 stores across North America, Europe, and the Asia-Pacific regions.

Lululemon Struggles in the Market

Lululemon has faced steep declines in 2025, underperforming the S&P 500 ($SPX) markedly. Over the past five days, the stock is up 6%, while it rose 2% in the past month but remains down 32% over six months. Year-to-date (YTD), shares have plunged 54%. In contrast, the S&P 500 gained over 13% during the same period, amplifying Lululemon’s relative weakness.

The underperformance follows soft U.S. demand and margin pressures, though rising international revenue in recent quarters suggests a potential recovery route.

Lululemon Slides Despite Strong Results

Lululemon reported its Q2 2025 results on Sept. 4, posting earnings per share of $3.10, surpassing analyst expectations of $2.87. Total revenue rose 7% year-over-year (YoY) to $2.53 billion but fell slightly short of the $2.54 billion consensus estimate. Despite the earnings beat, shares dropped over 17% following the report, as investors reacted to a weaker full-year outlook and tariff-related margin pressures.

Comparable sales increased 1%, with international markets, particularly China, driving growth, while the U.S. segment reported flat performance reflecting soft apparel demand.

Lululemon’s operating income fell 3% to $524 million as gross margins contracted by 110 basis points to 58.5% due to higher supply chain and tariff costs. Inventories rose 21% YoY to $1.7 billion, attributed to seasonally higher stock builds and slower domestic sell-through.

The balance sheet remained healthy, supported by $1.2 billion in cash and $393 million in available revolving credit capacity. Digital sales continued to play a major role, contributing 39% of total revenue, underscoring strong online engagement despite retail headwinds.

For guidance, Lululemon trimmed its fiscal 2025 revenue expectations to $10.85–$11 billion and lowered EPS projections to $12.77–$12.97 from earlier forecasts above $13.50. Management emphasized renewed efforts to improve its U.S. business, accelerate product innovation, and boost profitability through international expansion in China and Europe.

Lululemon Downgraded by Analyst

Bernstein has downgraded Lululemon from “Outperform” to “Market Perform,” citing growing uncertainty around the company’s latest product revamp aimed at reigniting sales momentum.

Analyst Aneesha Sherman expressed concern that Lululemon’s new Spring 2026 collection, led by a recently appointed designer and comprising 35% fresh styles in its Lifestyle category, introduces excessive risk at a time when price markdowns and store traffic are already under pressure. She noted that despite prior “newness” efforts in color and size variety, the strategy failed to lift U.S. sales, which have slid from double-digit growth to single digits.

Sherman highlighted that Lululemon’s core U.S. market remains its weakest, burdened by stiff competition and merchandising missteps that resulted in negative sales trends through 2024–2025. Continued deterioration in comparable-store performance suggests that stabilization may take longer than management anticipated.

Bernstein’s outlook now assumes low single-digit earnings growth with slowing revenue and shrinking margins as the company navigates a more fragmented athletic wear market. Given limited visibility on the impact of the new designer lineup, the firm lowered its price target by 14% to $190, reflecting an upside of 7% from the market rate.

Should You Target Lululemon?

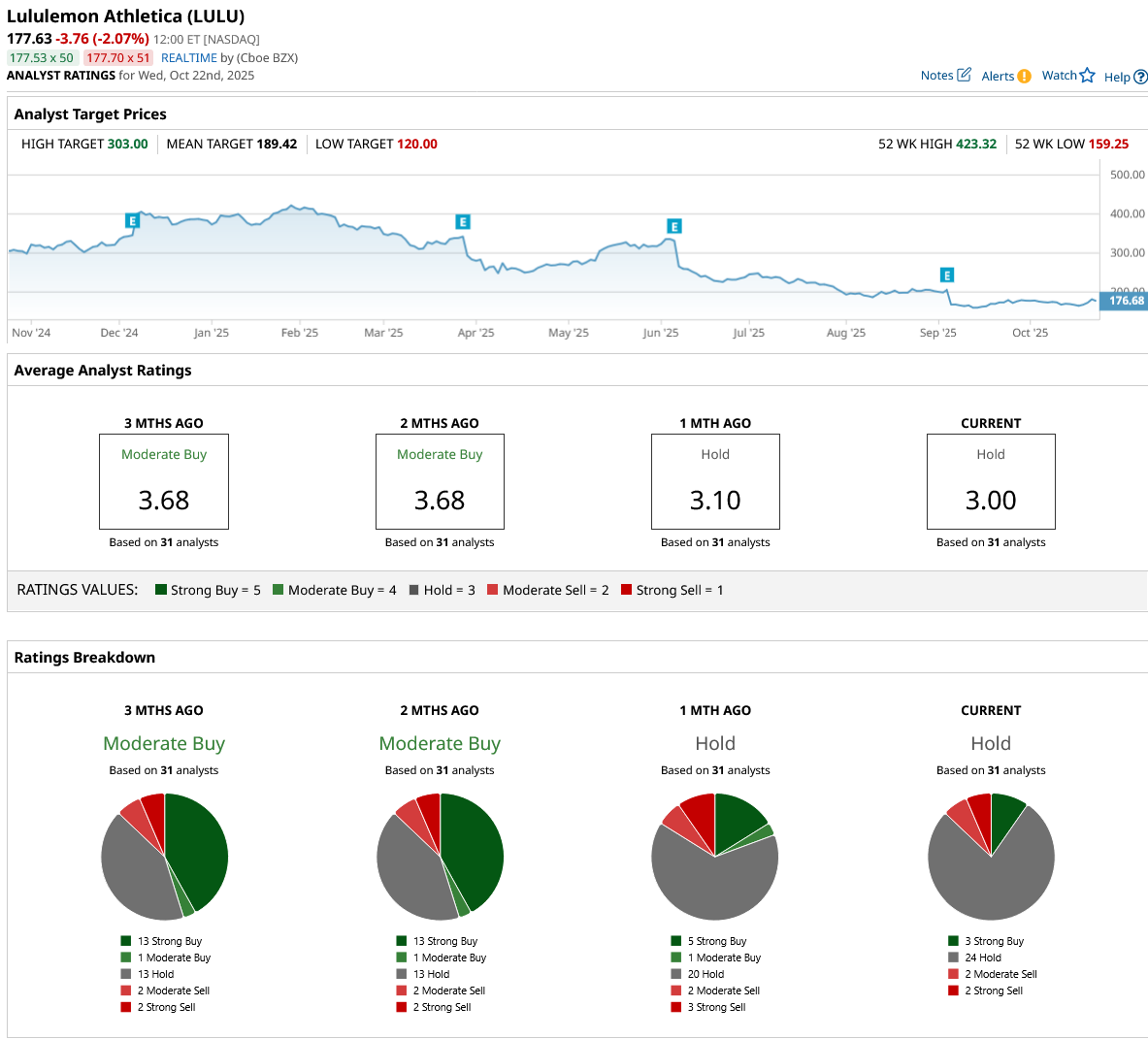

Lululemon has seen a falloff in recent times as it drops from a consensus “Moderate Buy” rating to a “Hold” rating from analysts with a mean price target of $189.42, signifying 6.7% upside potential. The stock has been rated by 31 analysts so far, receiving three “Strong Buy” ratings, 24 “Hold” ratings, two “Moderate Sell” ratings, and two “Strong Sell” ratings.