/Zoetis%20Inc%20HQ%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $67.6 billion, Zoetis Inc. (ZTS) is a global leader in animal health. The company develops, manufactures, and commercializes medicines, vaccines, diagnostics, biodevices, genetic tests, and precision animal health solutions for both livestock and companion animals.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Zoetis fits this criterion perfectly. With a diversified portfolio and strategic collaborations, Zoetis continues to expand its reach, driven by rising pet ownership, increased spending on animal care, and innovation in veterinary health.

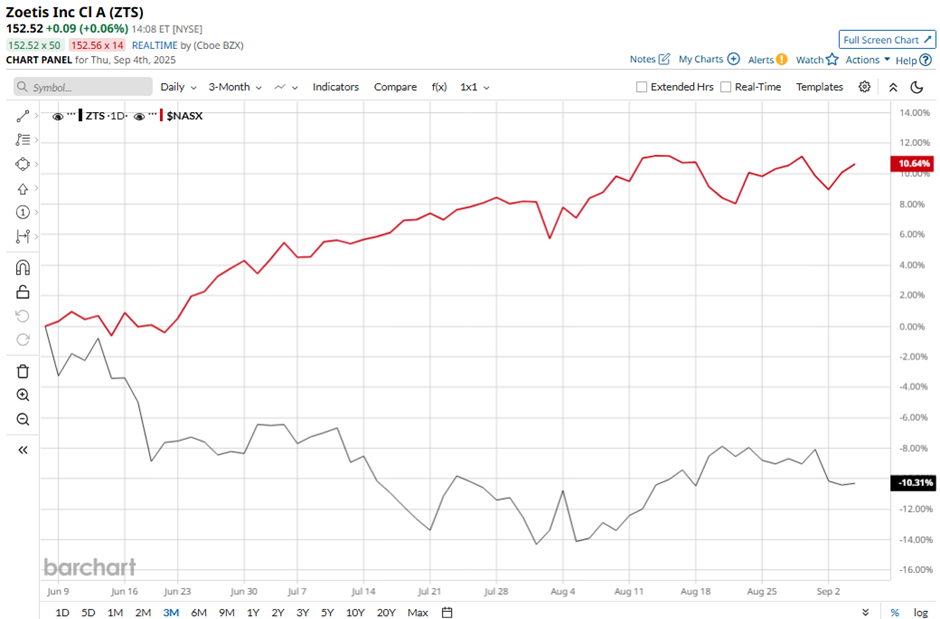

Despite this, shares of the Parsippany, New Jersey-based company have declined 24.1% from its 52-week high of $200.33. The stock has dipped 9.9% over the past three months, underperforming the Nasdaq Composite’s ($NASX) nearly 11% increase over the same time frame.

In the longer term, ZTS stock is down 6.7% on a YTD basis, lagging behind NASX’s 11.8% gain. Moreover, shares of the animal health company have decreased 18.9% over the past 52 weeks, compared to NASX’s 26.4% return over the same time frame.

ZTS stock has been trading below its 200-day moving average since November last year.

Despite posting better-than-expected Q2 2025 adjusted EPS of $1.76 and revenue of $2.5 billion, Zoetis shares fell 3.8% on Aug. 5 due to weakness in certain product lines. U.S. sales of monoclonal antibody OA pain treatments Librela and Solensia declined, likely on fears of side effects in some dogs, partially offsetting the 9% growth in companion animal sales. Additionally, U.S. livestock product sales plunged 21% to $180 million.

In contrast, rival United Therapeutics Corporation (UTHR) has outpaced ZTS stock. UTHR stock has risen 7.4% on a YTD basis and 7.3% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain bullish on Zoetis. The stock has a consensus rating of “Strong Buy” from 16 analysts in coverage, and the mean price target of $193.71 is a premium of 27% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.