/Zimmer%20Biomet%20Holdings%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $19.6 billion, Zimmer Biomet Holdings, Inc. (ZBH) is a global medical technology company specializing in musculoskeletal healthcare solutions. The company designs, manufactures, and markets products ranging from orthopedic reconstructive implants to sports medicine, spine, craniomaxillofacial, and thoracic solutions.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks and Zimmer Biomet fits this criterion perfectly. Its innovations support surgeons and healthcare providers worldwide in treating disorders and injuries of bones, joints, and soft tissues.

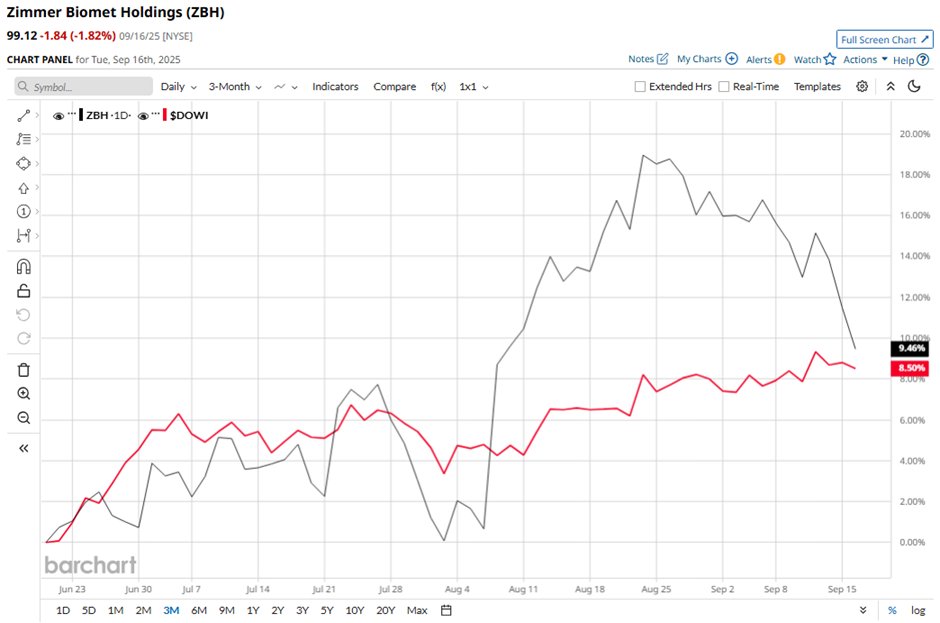

Shares of the Warsaw, Indiana-based company have declined 13.6% from its 52-week high of $114.72. Over the past three months, its shares have returned 7.6%, aligning with the broader Dow Jones Industrials Average's ($DOWI) gain during the same period.

Longer term, ZBH stock has decreased 6.2% on a YTD basis, lagging behind DOWI's 7.6% increase. Moreover, shares of the medical device maker have dropped 7.7% over the past 52 weeks, compared to DOWI’s 9.9%rise over the same time frame.

Yet, the stock has been trading above its 50-day moving average since early August.

Shares of Zimmer Biomet climbed nearly 8% on Aug. 7 after the company reported better-than-expected Q2 2025 results, posting adjusted EPS of $2.07 and revenue of $2.08 billion. Investor sentiment was further boosted as the company raised its 2025 adjusted EPS forecast to $8.10 - $8.30, well above analyst estimates. Additionally, management cut its expected tariff headwinds to about $40 million.

However, ZBH stock has lagged behind its rival, Penumbra, Inc. (PEN). PEN stock has surged 10.7% YTD and 40.1% over the past 52 weeks.

Despite the stock’s underperformance over the past year, analysts remain moderately optimistic about its prospects. ZBH stock has a consensus rating of “Moderate Buy” from 27 analysts in coverage, and the mean price target of $110.96 represents a premium of 11.9% to current levels.