On Thursday morning, Delta Air Lines (DAL), the largest U.S. commercial airline by market capitalization, delivered an earnings update that cheered investors. Welcome to the world of investing in airline stocks. Where fortunately, the volatility is in the market, not in the skies.

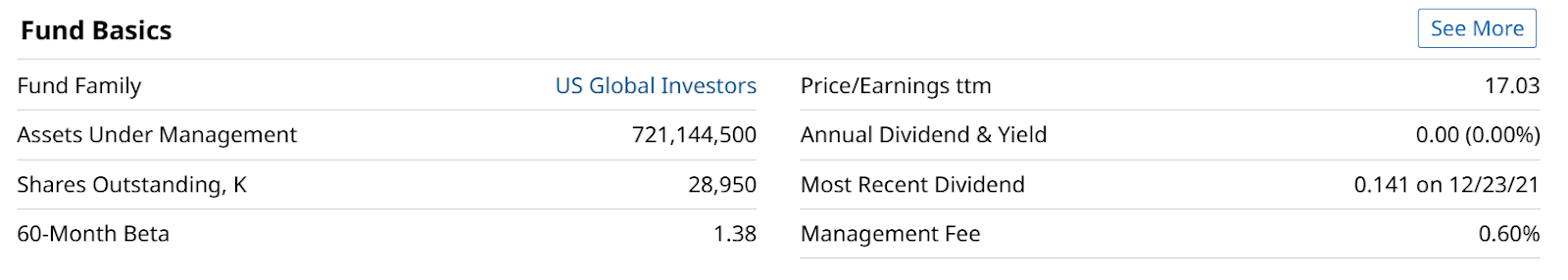

The primary ETF traders use to access a basket of airline and related stocks is the US Global Jets ETF (JETS). This more-than-$700-million-in-assets fund marked its tenth anniversary in April. And as its nearly 1.4x beta over the past 5 years indicates, long-term investors have experienced some unexpected turbulence on its lengthy non-stop flight.

JETS’ Journey Has Required Both Seatbelts and Oxygen Masks

How unsteady has it been? Look out your window at this chart below, to see a very cloudy decade for JETS. There’s no dividend here now, and while there was one prior to the pandemic, it never amounted to much.

So if you had purchased JETS on its IPO in 2015, you’d still be taxiing, 10 years later. And, you’d be stuck toward the middle of a long-term price range that peaked around $35 and dropped as low as $11.

Translation: The JETS ETF and individual airline stocks are not great investments. But anything can be a great trade. So with DAL’s upbeat news in mind, let’s see if there are any flyers here.

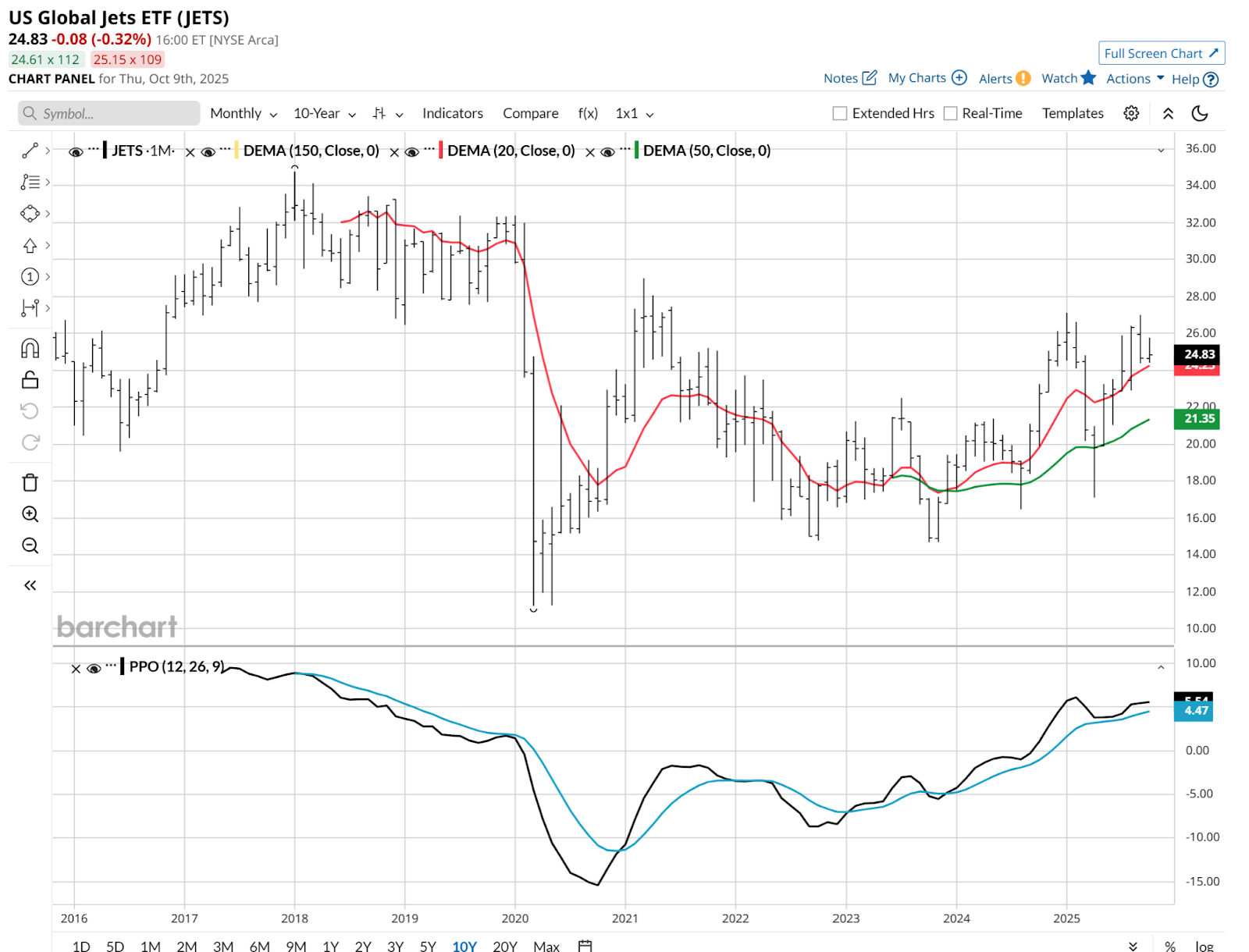

To do that, we start with a look at the top holdings.

When looking at potential names here, we should note that about one-third of JETS is occupied by a trio of big U.S. airlines. The rest are regional carriers as well as stocks of companies who are part of the support system for those airlines. I’d refer to that as the airline industry “food chain,” but the concept of airline food is not very appetizing to most people.

Flight Charts to Watch

Here’s the chart of JETS, as well as those of 3 stocks that I find interesting. Read on to see what I mean by “interesting.”

First, as to JETS itself, it has not only gone nowhere for 10 years, but for 2025 to date as well. This is about as uncommitted a chart as you’ll find. That is, it provides no clear directional bias to me. Indeed, DAL’s pop this week, and its high weighting within JETS, simply brought the chart back to firmer neutral territory.

DAL’s nice day makes the daily chart below look artificially attractive. Sort of like how those pillows you get on board look OK from a distance. Then you place one behind your head, and still can’t tell there’s a pillow there. That’s my way of saying not to get too excited about this one just yet.

The real “tell” within the stock holdings of JETS might be this one. Booking Holdings (BKNG). It is attractive… if you are looking to short it. There is currently no ETF to do that, but put options are a consideration for those so inclined.

Regardless, this chart looks ugly to me. And it seems to signal that the U.S. consumer is, at last, fading in strength.

Finally, I know what you’re thinking at this point: “if you’re trying to find a decent-looking chart within JETS’ holdings, just look at that Panama-based airline with a fleet of more than 100 aircraft, servicing many parts of Latin America.”

OK, maybe you didn't think that. I certainly wasn’t. But I landed there.

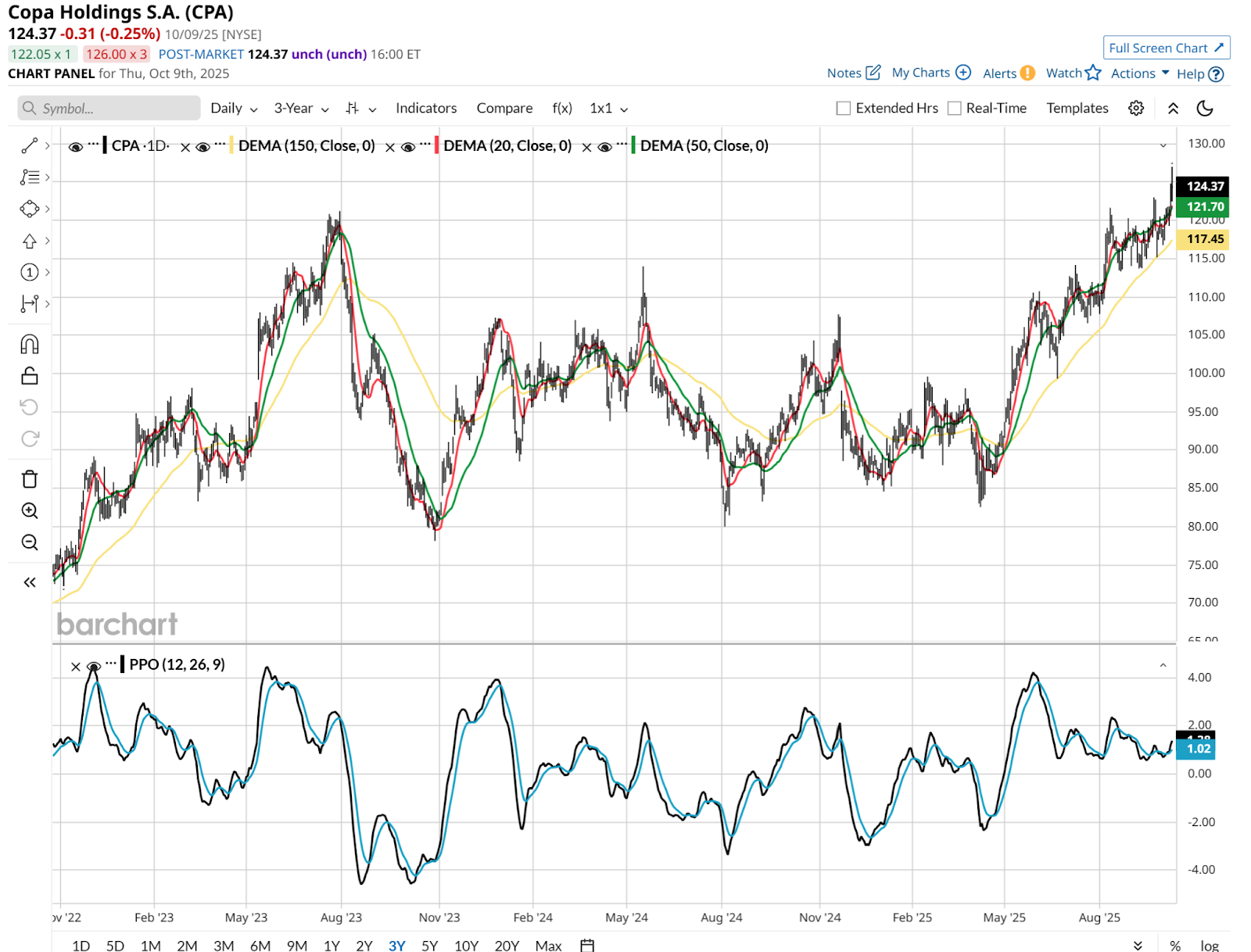

I’m talking about Copa Holdings S.A. (CPA), which just broke out to a new high recently.

It is the proverbial “best of a bad bunch” within JETS currently. And it is a reminder that increasingly, the “usual suspects” in this or any industry are not the only places to look for profits.