With a market cap of $62.4 billion, Workday, Inc. (WDAY) is a leading provider of enterprise cloud applications for financial management and human capital management. Its platform unifies finance, HR, planning, analytics, and other business solutions, enabling organizations to gain real-time insights and improve decision-making.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Workday fits this criterion perfectly. Serving a wide range of industries globally, Workday helps businesses streamline operations, enhance workforce management, and drive digital transformation.

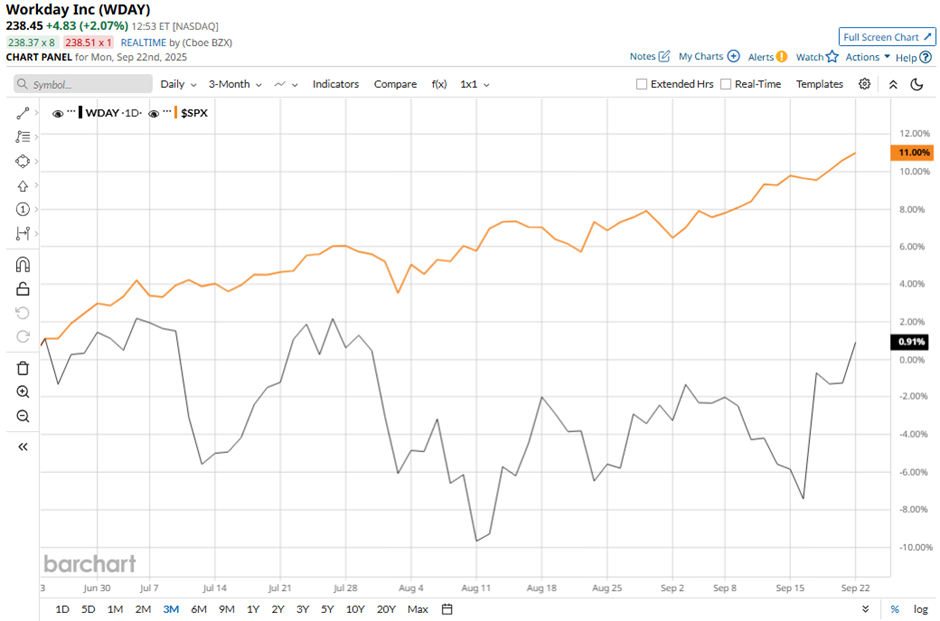

Shares of the Pleasanton, California-based company have fallen 18.9% from its 52-week high of $294. Workday’s shares have increased marginally over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 11.9% gain over the same time frame.

In the longer term, WDAY stock is down 7.6% on a YTD basis, underperforming SPX’s 13.6% rise. Moreover, shares of the company have dropped nearly 4% over the past 52 weeks, compared to the 17.1% return of the SPX over the same time frame.

The stock has been trading below its 200-day moving average since late May.

Shares of Workday fell 2.8% following Q2 2026 results on Aug. 21 despite reporting better-than-expected adjusted earnings of $2.21 per share and revenue of $2.34 billion. Professional services revenue came in at $179 million, down from last year and below estimates, while guidance for Q3 subscription revenue growth of 12% to $2.41 billion and fiscal 2026 outlook of 13% growth to $9.51 billion signaled a slowdown.

In comparison, rival Salesforce, Inc. (CRM) has shown a more pronounced decline than WDAY stock. CRM stock has decreased 25.7% on a YTD basis and 6.9% over the past 52 weeks.

Despite the stock’s weak performance, analysts remain bullish on WDAY. It has a consensus rating of “Strong Buy” from the 39 analysts in coverage, and the mean price target of $280.44 is a premium of 17.7% to current levels.