Seattle, Washington-based Weyerhaeuser Company (WY), is one of the world's largest private owners of timberlands, and owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada. Valued at $17.9 billion by market cap, the company primarily grows and harvests trees, develops and constructs real estate, and makes a range of forest products.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and WY perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the REIT - specialty industry. Weyerhaeuser's strengths include its extensive timberland holdings, which ensure a sustainable supply of raw materials and contribute to its strong brand reputation for environmental stewardship. The company's operational efficiency optimizes production, reduces waste, and lowers costs, enabling competitive pricing and adaptability to market demands.

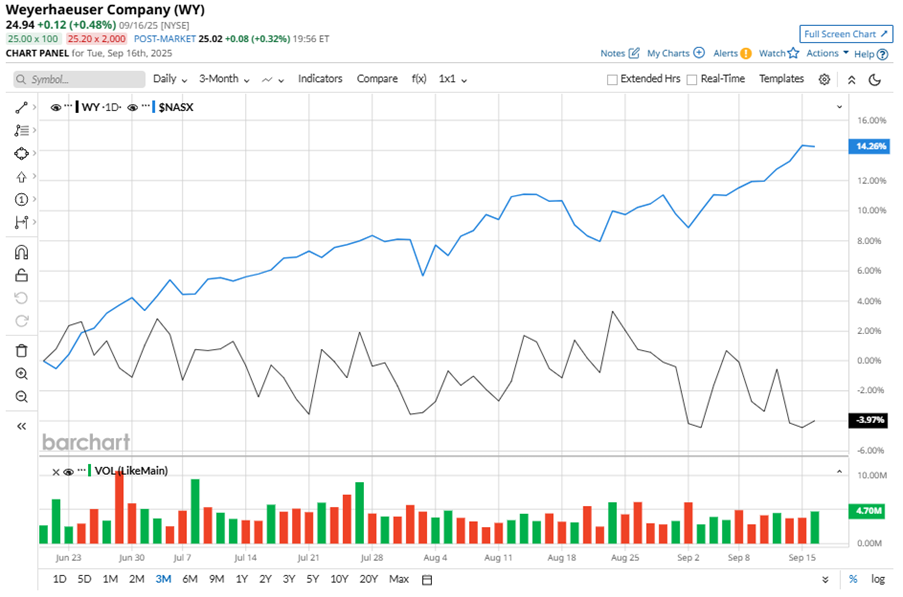

Despite its notable strength, WY slipped 26.7% from its 52-week high of $34.03, achieved on Sep. 27, 2024. Over the past three months, WY stock has declined 6.6%, underperforming the Nasdaq Composite’s ($NASX) 13.4% gains during the same time frame.

In the longer term, shares of WY dipped 11.4% on a YTD basis and fell 23.3% over the past 52 weeks, underperforming NASX’s YTD gains of 15.7% and 27% returns over the last year.

To confirm the bearish trend, WY has been trading below its 50-day and 200-day moving averages since late October, 2024, with some fluctuations.

Weyerhaeuser's underperformance is due to seasonal decline in construction projects and lumber demand, and ongoing U.S.-Canada tariff issues impacting lumber prices. These factors may lead to lower wood prices, elevated price variance in the lumber futures market, and increased costs in its Timberlands segment.

On Jul. 25, WY shares closed up more than 3% after reporting its Q2 results. Its EPS of $0.12 beat Wall Street expectations of $0.10. The company’s revenue was $1.9 billion, topping Wall Street forecasts of $1.8 billion.

In the competitive arena of REIT - specialty, PotlatchDeltic Corporation (PCH) has taken the lead over WY, showing resilience with a 3.3% uptick on a YTD basis and 10.8% losses over the past 52 weeks.

Wall Street analysts are reasonably bullish on WY’s prospects. The stock has a consensus “Moderate Buy” rating from the 13 analysts covering it, and the mean price target of $33.09 suggests an ambitious potential upside of 32.7% from current price levels.