Welltower Inc. (WELL) is a leading healthcare REIT with a $112.4 billion market cap. Headquartered in Toledo, Ohio, the company specializes in senior housing, post-acute care, and outpatient medical properties across North America and the U.K.

Shares of WELL have delivered a robust performance over the past year, with its shares soaring 43.1%, sharply outpacing the S&P 500 Index’s ($SPX) 19.3% rally. In 2025 alone, the stock has advanced 33.3%, outpacing the $SPX, which has returned 8.4% on a YTD basis.

Zooming in further, WELL stock has outperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 1.9% decline over the past 52 weeks and marginal rise on a YTD basis.

On Jul. 28, Welltower released its fiscal 2025 second-quarter earnings and its shares climbed 4.9% in the next trading session. The company achieved revenue of $2.55 billion, exceeding the consensus estimate of $2.47 billion, and posted earnings per share of $0.45, meeting forecasts. Normalized Funds from Operations per share increased by 21.9% year-over-year to $1.28, driven by a 13.8% rise in same-store net operating income.

For the current fiscal year, ending in December, analysts expect Welltower’s EPS to grow 18.1% to $5.10. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

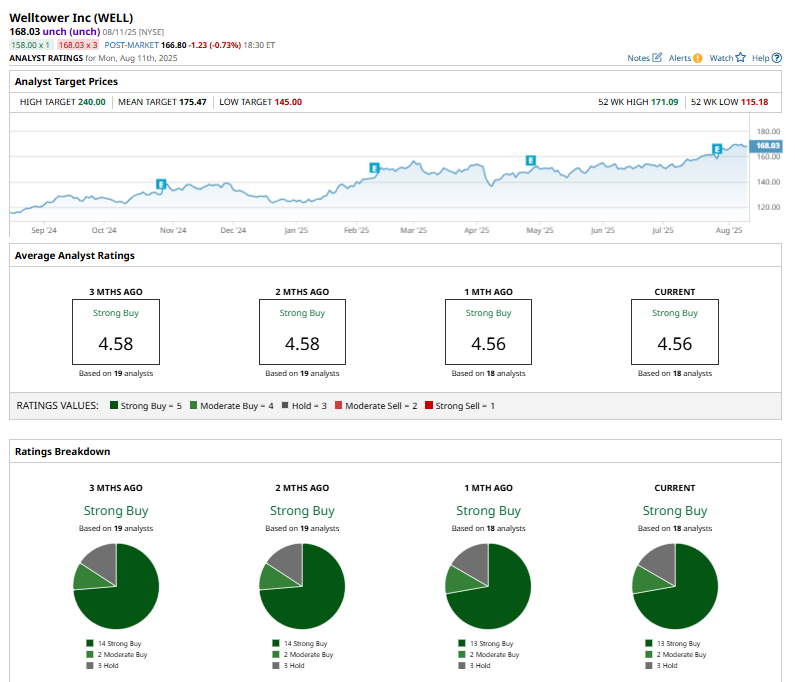

Among the 18 analysts covering WELL stock, the consensus rating is a “Strong Buy.” That’s based on 13 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

This configuration is slightly less bullish than two months ago, with 14 “Strong Buy” ratings.

On July 30, Evercore ISI analyst Steve Sakwa maintained an "In-Line" rating on Welltower and raised the price target by 8.02%, from $162 to $175.

The mean price target of $175.47 represents a 4.4% premium to the current market prices. Its Street-high price target of $240 implies the stock could rally as much as 44.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.