/Walgreens%20Boots%20Alliance%20Inc%20store-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Walgreens Boots Alliance, Inc. (WBA), headquartered in Deerfield, Illinois, operates as a healthcare, pharmacy, and retail company. Valued at $10.1 billion by market cap, the company offers a wide variety of prescription and non-prescription drugs, as well as primary and acute care, wellness, pharmacy, and disease management services, and health and fitness.

Shares of this retail pharmacy giant have underperformed the broader market over the past year. WBA has declined 4.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17%. However, in 2025, WBA stock is up 24.7%, surpassing the SPX’s 8.2% rise on a YTD basis.

Zooming in further, WBA’s outperformance is also apparent compared to the Health Care Select Sector SPDR Fund (XLV). The exchange-traded fund has declined about 10.7% over the past year. Moreover, WBA’s double-digit gains on a YTD basis outshine the ETF’s 2.5% dip over the same time frame.

On Jun. 26, WBA shares closed up marginally after reporting its Q3 results. Its adjusted EPS of $0.38 surpassed Wall Street's expectations of $0.34. The company’s revenue was $39 billion, beating Wall Street forecasts of $36.6 billion.

For the current fiscal year, ending in August, analysts expect WBA’s EPS to decline 41% to $1.70 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

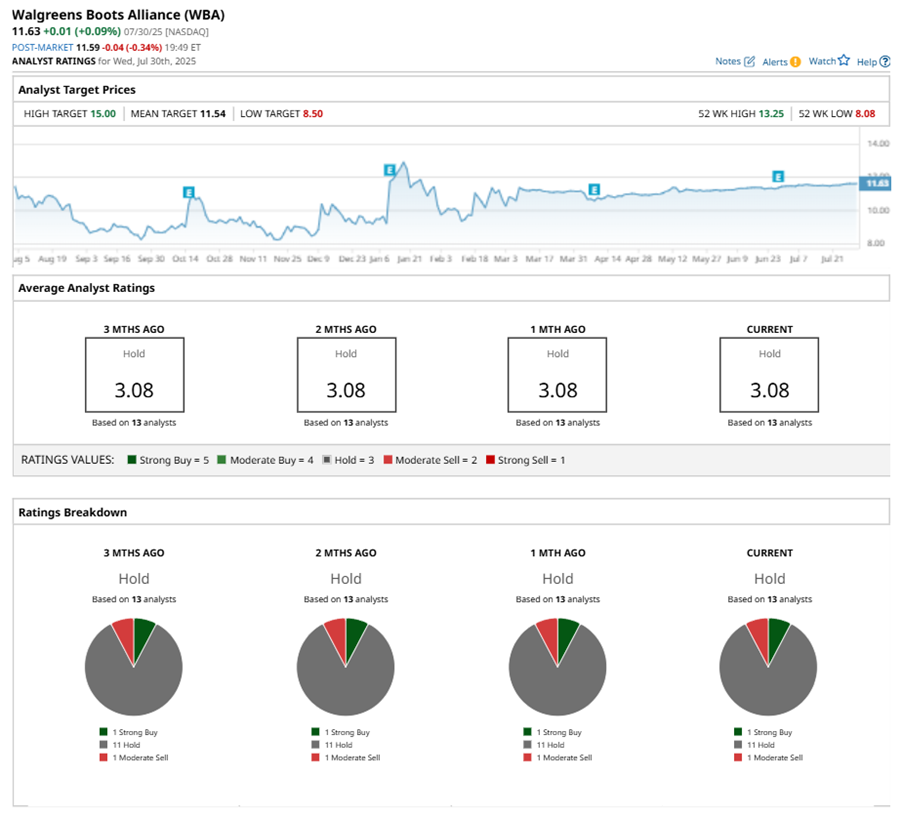

Among the 13 analysts covering WBA stock, the consensus is a “Hold.” That’s based on one “Strong Buy” rating, 11 “Holds,” and one “Moderate Sell.”

The configuration has been consistent over the past three months.

On Jun. 26, Evercore ISI analyst Elizabeth Anderson CFA reiterated a “Hold” rating on WBA with a price target of $11.45.

While WBA currently trades above its mean price target of $11.54, the Street-high price target of $15 suggests a 29% upside potential.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.