/Universal%20Health%20Services%2C%20Inc_%20logo%20on%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $11.7 billion, Universal Health Services, Inc. (UHS) owns and operates acute care hospitals, behavioral health facilities, and outpatient centers through its subsidiaries. The company delivers a broad range of medical and behavioral health services, along with commercial insurance and management support functions.

Shares of the King of Prussia, Pennsylvania-based company have underperformed the broader market over the past 52 weeks. UHS stock has decreased 21.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.3%. In addition, shares of the company have risen 2.5% on a YTD basis, compared to SPX's 9.5% increase.

Moreover, the hospital and health facility operator stock has also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 12.4% decline over the past 52 weeks.

Shares of Universal Health rose 5.1% following its Q2 2025 results on Jul. 28. The company reported adjusted EPS of $5.35 beating estimates and jumping 24.1% year-over-year, while revenue of $4.3 billion exceeded forecasts and grew 9.6%. Strong admissions growth at both acute care and behavioral health facilities drove solid segment contributions, lifting adjusted EBITDA above expectations. Investor sentiment was further boosted by management’s raised 2025 guidance, now projecting EPS of $20 - $21.

For the fiscal year ending in December 2025, analysts expect UHS’ adjusted EPS to grow 23% year-over-year to $20.43. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

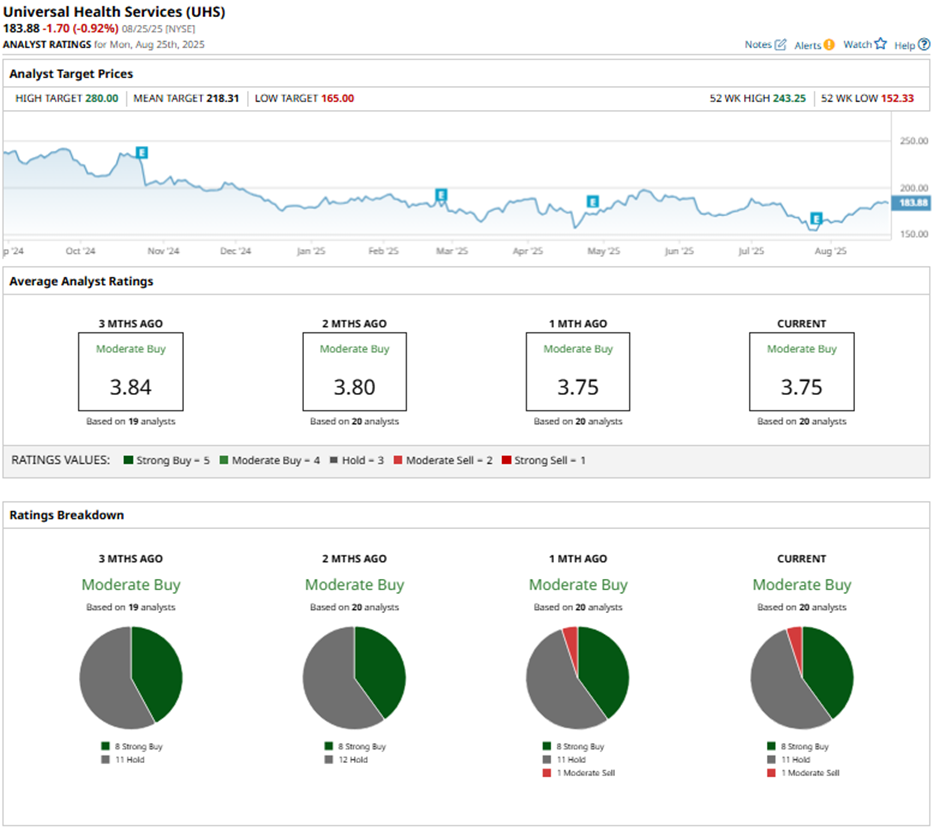

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 11 “Holds,” and one “Moderate Sell.”

On Aug. 19, RBC Capital raised Universal Health’s price target to $206 while maintaining a “Sector Perform" rating.

The mean price target of $218.31 represents a 18.7% premium to UHS’ current price levels. The Street-high price target of $280 suggests a 52.3% potential upside.