/Thermo%20Fisher%20Scientific%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $155.6 billion, Thermo Fisher Scientific Inc. (TMO) stands as a global leader in serving science, providing cutting-edge technologies, services, and solutions that drive research and enhance healthcare. The Waltham, Massachusetts-based company operates through four core segments: Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics, and Laboratory Products & Biopharma Services.

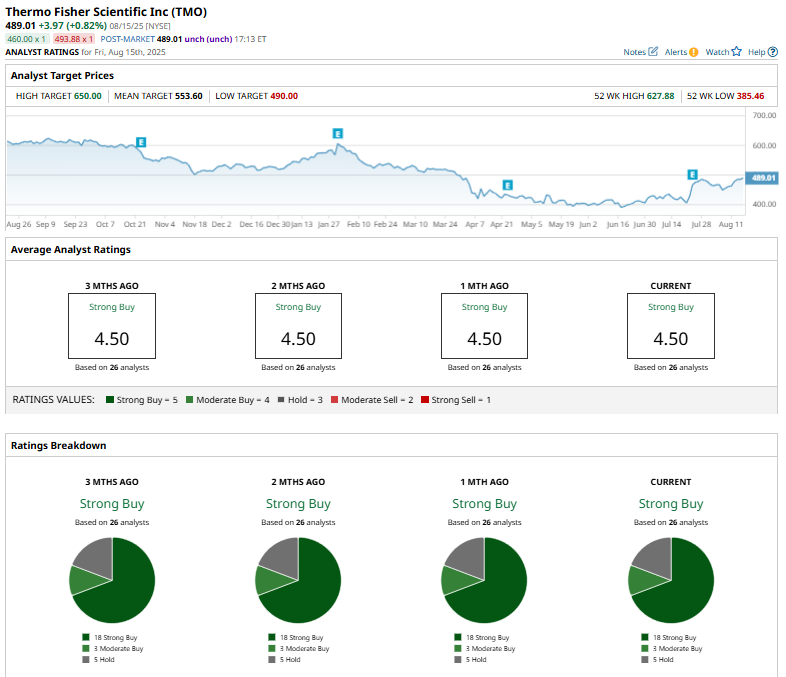

Shares of TMO have underperformed the broader market, dropping 19% over the past year and 6% in 2025. In comparison, the broader S&P 500 Index ($SPX) has gained 16.4% over the past 52 weeks and 9.7% on a YTD basis.

Looking closer, the stock has also trailed behind the Health Care Select Sector SPDR Fund's (XLV) 10.8% decline over the past 52 weeks and a marginal fall year-to-date.

Thermo Fisher released its Q2 2025 earnings on July 23, and its shares popped 9.1%. It reported revenue of $10.85 billion, a 3% year-over-year increase (with 2% organic growth). Adjusted EPS was $5.36, compared to $5.37 in the prior year, while adjusted operating income rose to $2.38 billion from $2.35 billion in the year-ago quarter. Thermo Fisher also highlighted the launch of next-generation instruments, including Orbitrap Astral Zoom, Orbitrap Excedion Pro, and the Krios 5 Cryo-TEM, as well as an expanded DynaDrive single-use bioreactor portfolio.

For the fiscal year ending in December 2025, analysts expect TMO’s adjusted EPS to grow 3% year-over-year to $22.52. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

Among the 26 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, three “Moderate Buys,” and five “Holds.”

This configuration has been stable over the past months.

On July 28, UBS analyst Dan Leonard downgraded Thermo Fisher to “Neutral” from “Buy,” cutting the price target to $460 from $500, citing concerns that persistent headwinds could weigh on life sciences R&D, which accounts for about half of the company’s sales. UBS also forecast 2026 organic sales growth of 4%, 200 basis points below consensus, and reduced its longer-term outlook.

TMO’s mean price target of $553.60 implies a modest potential upside of 13.2% from the current price levels. Similarly, the Street-high price target of $650 indicates that the stock could soar by 32.9%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.