With a market cap of $51.3 billion, Realty Income Corporation (O) is a leading REIT specializing in the acquisition and management of diversified commercial properties under long-term net lease agreements. With a global portfolio of over 15,600 properties across the U.S., U.K., and Europe, the company delivers consistent monthly dividends and has increased its dividend for more than 30 consecutive years.

Shares of the San Diego, California-based company have lagged behind the broader market over the past 52 weeks. O stock has dropped 2.7% over this time frame, while the broader S&P 500 Index ($SPX) has increased 17.8%. Moreover, shares of Realty Income are up 6.4% on a YTD basis, compared to SPX’s 8.9% rise.

Zooming in further, the REIT’s underperformance becomes more evident when compared to the Real Estate Select Sector SPDR Fund’s (XLRE) 1.8% gain over the past 52 weeks.

Despite reporting Q1 2025 revenue of $1.4 billion beat expectations and AFFO per share of $1.06 met analyst estimates on May 5, Realty Income's stock fell marginally the next day. Portfolio occupancy declined by 20 basis points to 98.5%, and the company flagged a potential 75 basis point rent loss in 2025 from legacy M&A properties, raising questions about future cash flow stability. Additionally, management expressed caution in raising investment guidance amid U.S. market challenges, highlighting a limited pipeline of risk-adjusted opportunities compared to Europe.

For the current fiscal year, ending in December 2025, analysts expect Realty Income’s AFFO per share to grow 1.9% year-over-year to $4.27. The company’s earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion..

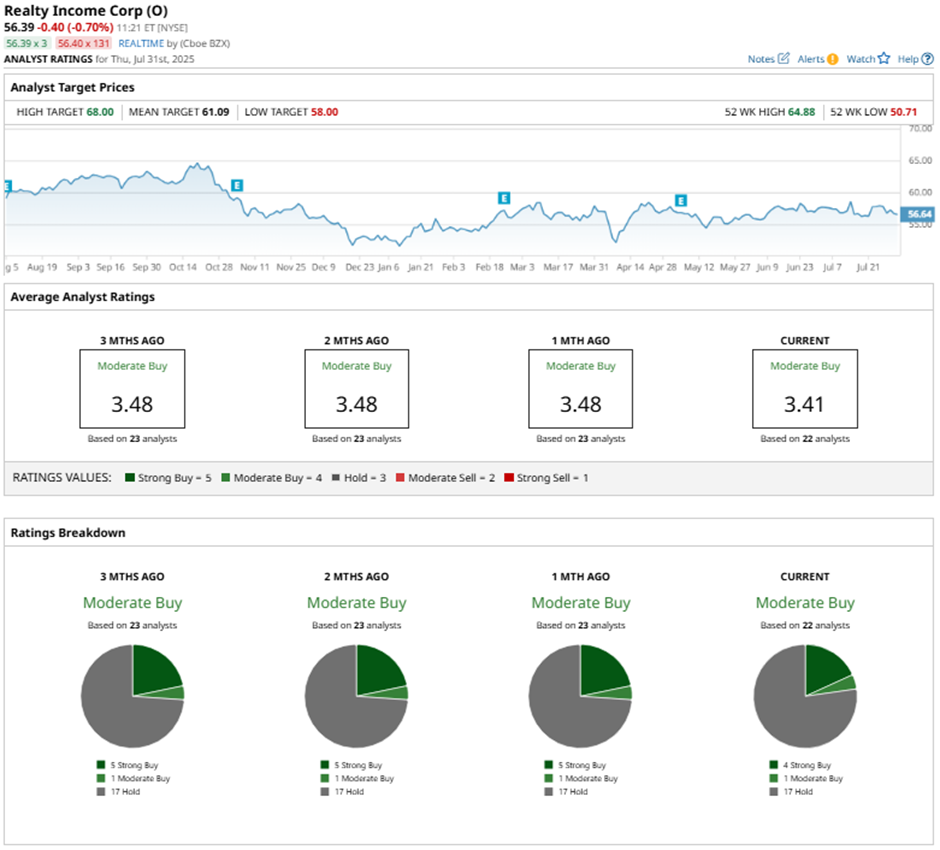

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings, one “Moderate Buy,” and 17 “Holds.”

This configuration is slightly less bullish than three months ago, with five “Strong Buy” ratings on the stock.

As of writing, the stock is trading below the mean price target of $61.09. The Street-high price target of $68 implies a potential upside of 20.6% from the current price.