/PTC%20Inc%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Headquartered in Boston, Massachusetts, and carrying a market capitalization of approximately $24.7 billion, PTC Inc. (PTC) delivers an extensive suite of software solutions, spanning computer-aided design modeling, product lifecycle management, data orchestration, and experience creation products.

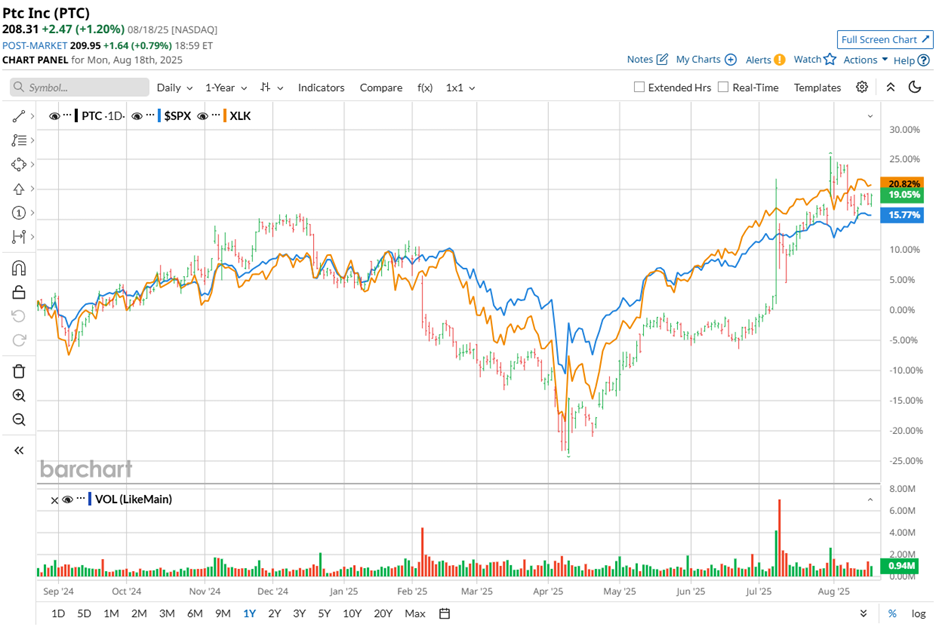

Over the past 52 weeks, PTC stock has climbed 20%, outpacing the S&P 500 Index ($SPX), which rose 16.1% during the same stretch. Year-to-date (YTD), the stock has advanced 13.3%, maintaining its edge over the SPX’s 9.7% gain.

Within the technology sector, however, PTC has slightly trailed the S&P 500 Technology Sector SPDR (XLK), which recorded a 20.3% gain over the past year. Although, on a YTD basis, PTC has exceeded XLK’s 14.5% growth, signifying consistent momentum.

Momentum accelerated on July 31, when PTC shares rose 6.1%, following a day after the announcement of its fiscal third-quarter 2025 results, which surpassed Wall Street expectations.

Revenue for the period increased 24.2% year over year (YoY) to $643.9 million, comfortably above the analyst estimate of $582.4 million. Adjusted EPS climbed 67.3% annually to $1.64 and surpassed the Street's forecast.

For the fiscal year 2025, ending in September, analysts forecast PTC to achieve EPS growth of 47.4%, reaching $5.41 on a diluted basis. The company has demonstrated a consistent pattern of outperforming consensus estimates across the past four quarters.

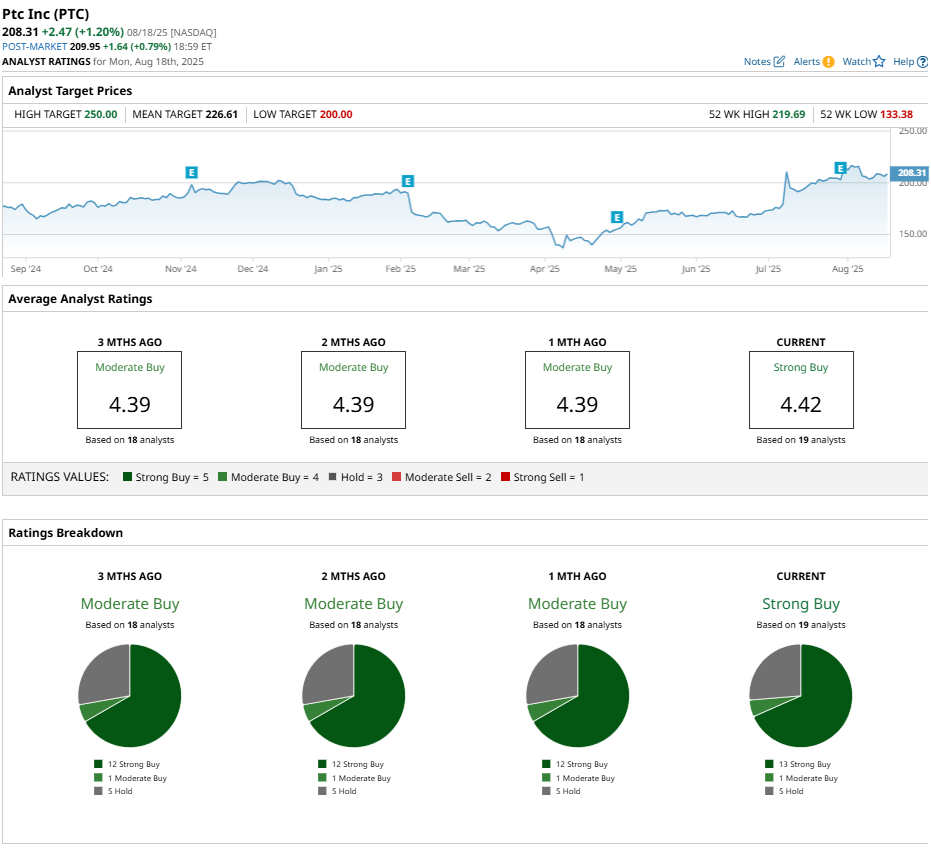

Among 19 analysts covering PTC stock, the consensus rating is a "Strong Buy," an upgrade from a “Moderate Buy” rating a month back. The current consensus consists of 13 "Strong Buy" ratings, one "Moderate Buy," and five “Hold” recommendations.

The current analyst sentiment has grown slightly more bullish compared with three months ago, when 12 analysts held "Strong Buy" ratings.

On July 31, BMO Capital raised its price target on PTC to $231 from $187, maintaining an “Outperform” rating, citing fiscal Q3 results that were "better than feared" and noting modest improvements in deal trends.

The same day, Barclays PLC (BCS) lifted its price target from $203 to $233, upholding its “Overweight” rating. The upward revision followed closely on the heels of the company’s earnings release for Q3.

The mean price target of $226.61 represents an 8.8% premium to PTC’s current price levels. Meanwhile, the Street-high price target of $250 suggests a potential upside of 20%.