PPL Corporation (PPL) is a Pennsylvania-based regulated utility company that primarily generates revenue from electricity transmission and distribution. With a market capitalization of $26.8 billion, the company serves millions of customers through its utility operations in Pennsylvania, Kentucky, and Rhode Island.

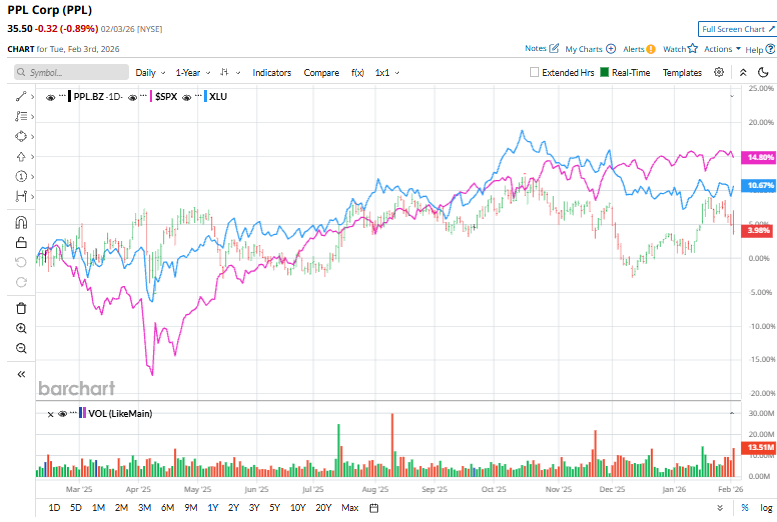

Shares of this leading utility company have underperformed the broader market over the past year. PPL has gained 5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. In 2026, however, PPL’s stock is up 1.4%, surpassing SPX’s 1.1% rise on a YTD basis.

Zooming in further, PPL has lagged behind the State Street Utilities Select Sector SPDR Fund (XLU), which has gained about 10.5% over the past year.

On Nov. 5, PPL shares closed up marginally after reporting its Q3 results. Its adjusted EPS of $0.48 exceeded Wall Street expectations of $0.46. The company’s revenue was $2.24 billion, exceeding Wall Street's $2.17 billion forecast. PPL expects full-year adjusted EPS in the range of $1.78 to $1.84.

For FY2025 that ended in December, analysts expect PPL’s EPS to grow 7.7% to $1.82 on a diluted basis. The company’s earnings surprise history is mixed. It surpassed the consensus estimate in two of the last four quarters, while missing on other two quarters.

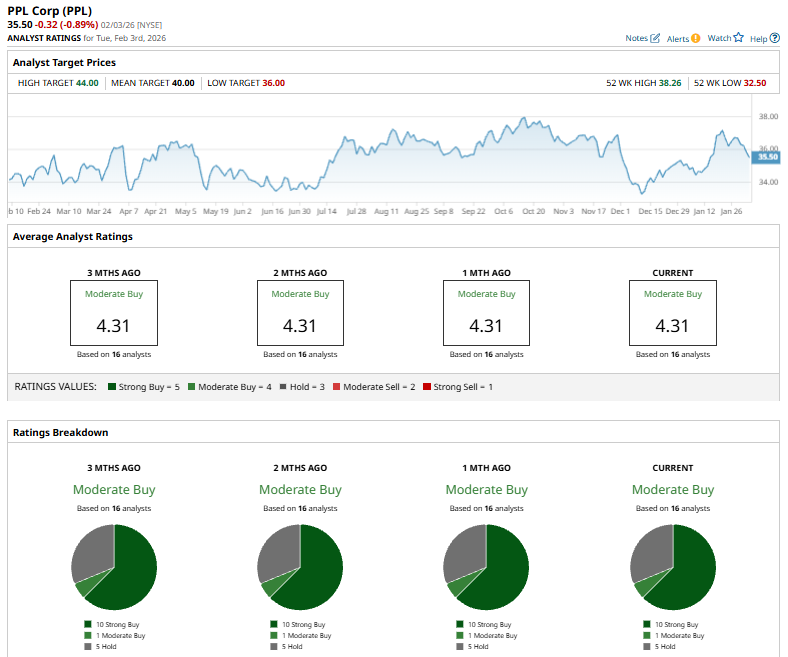

The consensus rating among the 16 analysts covering PPL stock is a “Moderate Buy” overall. That’s based on ten “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

This consensus is slightly more bullish than two months ago, when seven analysts recommended a “Strong Buy” for the stock.

On Jan. 22, Barclays analyst Nicholas Campanella reaffirmed his “Equal-Weight” rating on PPL Corporation while cutting the price target from $40 to $37, a 7.5% reduction, reflecting a more cautious outlook on the stock’s near-term valuation.

PPL's mean price target of $40 represents a premium of 12.7% from the prevailing price levels. The Street-high price target of $44 suggests an upside potential of 23.9%.