/Otis%20Worldwide%20Corp%20logos-by%20viewimage%20via%20Shutterstock.jpg)

Otis Worldwide Corporation (OTIS) is a leading global player in the transport systems sector, specializing in the design, manufacture, installation, and servicing of elevators, escalators, and moving walkways. Headquartered in Farmington, Connecticut, Otis is recognized as the world’s largest manufacturer of vertical transportation systems, a legacy built on the invention of the safety elevator in 1852. Its market cap is approximately $34.6 billion.

OTIS stock has lagged the broader market in 2025, with shares down roughly 4.8% year-to-date (YTD), while the S&P 500 Index ($SPX) surged by 9.6%. Over the past 52 weeks, OTIS is down by 4.5%, still trailing the SPX’s 20.6% rise.

Zooming in further, OTIS also underperformed the Industrial Select Sector SPDR’s (XLI) 15.3% rally YTD and 22.9% gain over the past year.

The underperformance reflects a mix of factors, including mixed quarterly results such as solid revenue growth but earnings misses combined with a market rotation toward faster-growing industrial names benefiting more directly from artificial intelligence (AI)-driven infrastructure and demand.

Otis delivered mixed results in Q2 2025 on July 23, reporting an adjusted EPS of $1.05, down marginally year-over-year (YoY) but surpassing the consensus estimate. However, net sales came in at $3.6 billion, falling short of projections and representing a modest decline of around 1% annually.

For the current fiscal year, ending in December 2025, analysts expect OTIS to report EPS growth of 5.2% YoY to $4.03, on a diluted basis. The company has topped the earnings consensus estimate in two out of the four trailing quarters, missing on the other two occasions.

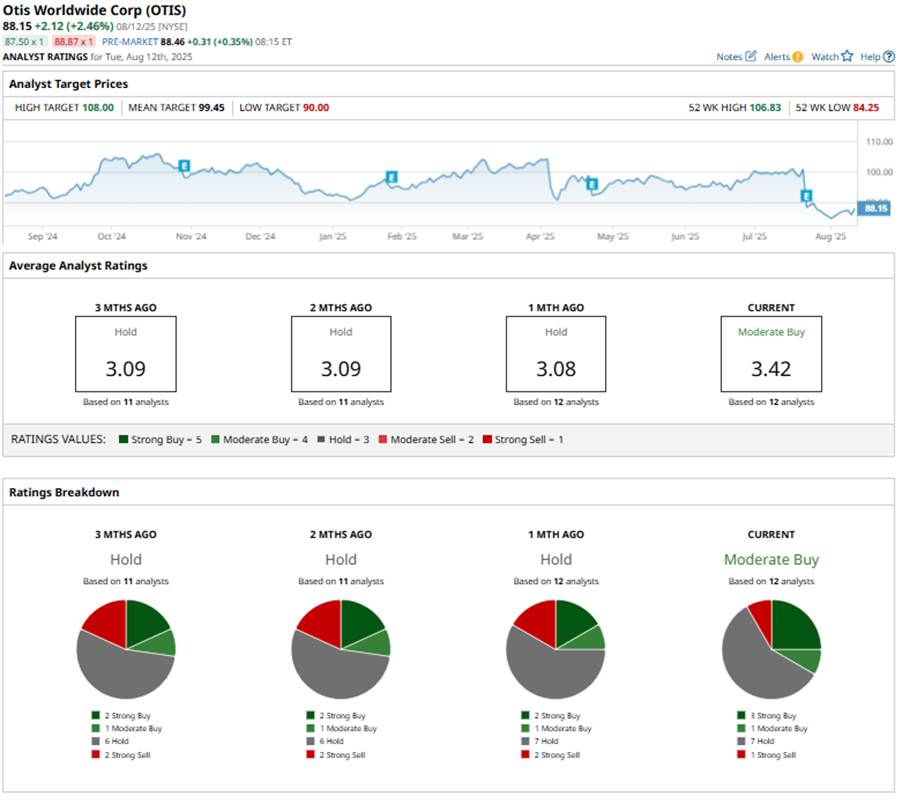

Among the 12 analysts covering OTIS stock, the consensus rating is a “Moderate Buy,” an upgrade from the “Hold” rating a month back. The current rating is based on three “Strong Buys,” one “Moderate Buy,” seven “Hold” ratings, and one “Strong Sell.”

The current configuration has remained largely consistent over the past few months. But compared to three months ago, it reflects a slightly improved sentiment, with a reduction in “Strong Sell” ratings.

On July 28, RBC Capital cut its price target on OTIS to $105 from $108 while maintaining an “Outperform” rating. The brokerage firm cited the company’s fourth straight guidance reduction in Q2, noting that Otis must regain its prior track record of steady operational delivery, but still views it as one of the highest-quality names in its coverage.

The mean price target of $99.45, which represents a premium of 12.8% to OTIS’ current price. The Street-high price target of $108 suggests an upside potential of 22.5%.