/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

Boasting a market cap of $4.5 trillion, California-based NVIDIA Corporation (NVDA) is a global leader in accelerated computing and artificial intelligence. Best known for its industry-defining graphics processing units (GPUs), the company powers high-performance computing, data centers, autonomous vehicles, and cutting-edge AI applications.

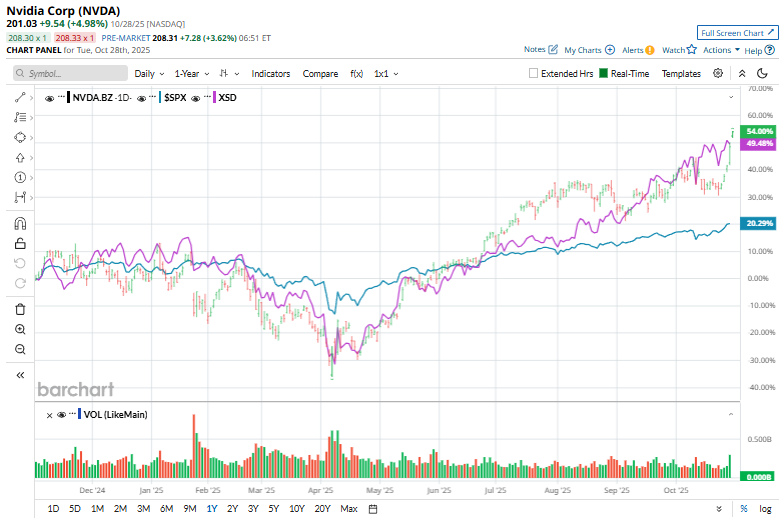

NVIDIA continues to be the star of the market rally. Over the past year, the chip powerhouse has surged 43.1%, while the broader S&P 500 Index ($SPX) has rallied nearly 18.3%. And 2025 has been even impressive, NVDA is already up 49.7% year-to-date, blowing past the SPX’s 17.2% rise.

Even among its semiconductor peers, NVIDIA still wears the crown. The stock has slightly surpassed the industry-focused SPDR S&P Semiconductor ETF (XSD), which has gained about 42% over the past year and 41% on a YTD basis.

On Oct. 28, Nvidia shares surged 5.2% after CEO Jensen Huang delivered a highly bullish GTC keynote, revealing visibility into $500 billion in demand over the next five to six quarters as global appetite for “AI factories” accelerates. The company announced major partnerships, which reinforced confidence that NVIDIA’s AI leadership and expansion into massive new markets are still in the early stages.

For the current fiscal year, ending in January 2026, analysts expect NVDA’s EPS to grow 44% to $4.22 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

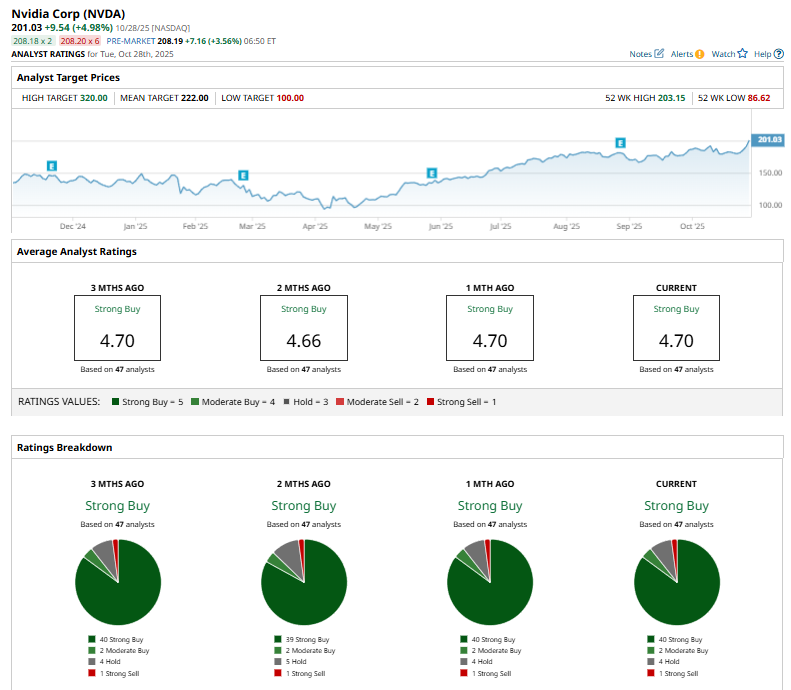

Among the 47 analysts covering NVDA stock, the consensus is a “Strong Buy.” That’s based on 40 “Strong Buy” ratings, two “Moderate Buys,” four “Holds,” and one “Strong Sell.”

This configuration is more bullish than two months ago, with 39 analysts suggesting a “Strong Buy.”

On Oct. 15, HSBC upgraded NVIDIA to “Buy” from Hold, highlighting expectations that the AI GPU market will expand beyond hyperscalers and drive sustained earnings growth. The firm also raised its price target to $320 from $200, which is also the Street-high target, suggesting an ambitious upside potential of 59%.

The mean price target of $222 represents a 10% premium to NVDA’s current price levels.