/Merck%20%26%20Co%20Inc%20HQ%20-by%20Sundry%20Photography%20via%20iStock.jpg)

Valued at $199.1 billion by market cap, Merck & Co., Inc. (MRK) is a leading American biopharmaceutical company based in Rahway, New Jersey. With a strong global presence, Merck develops prescription medicines, vaccines, biologic therapies, and animal health products, chiefly across oncology, immunology, infectious disease, and cardio-metabolic areas.

Shares of Merck have slid 30.3% over the past year, significantly lagging behind the S&P 500 Index’s ($SPX) 14.5% rise. This downward trend has persisted into 2025, with MRK down 20.3% year-to-date, in sharp contrast to the S&P 500’s 6.1% gain.

MRK has also trailed the iShares U.S. Pharmaceuticals ETF (IHE), which is down 3.4% over the past year and has posted a modest 1.6% gain so far in 2025.

On Jul. 29, Merck released its Q2 2025 results, with revenue dipping 2% year-over-year to $15.8 billion, missing analyst expectations, while adjusted EPS beat estimates at $2.13. Keytruda sales remained strong, rising 9% to around $8 billion, but this was offset by a steep 55% decline in Gardasil revenue due to weak demand in China and other international markets. As a result, its shares dipped 1.7% post earnings release.

For fiscal 2025, ending in December 2025, analysts expected MRK’s EPS to grow 17% to $8.95 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

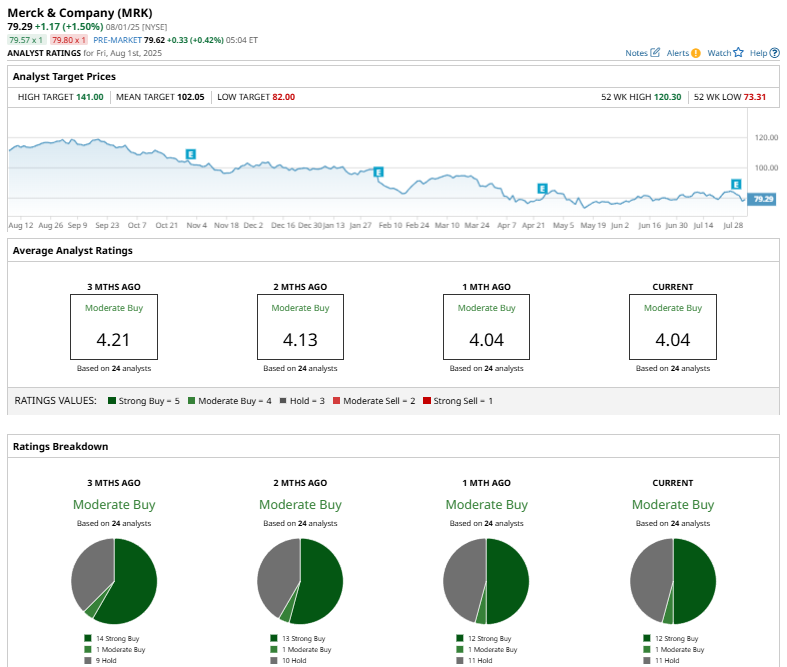

Among the 24 analysts covering MRK stock, the consensus is a “Moderate Buy.” The current consensus is based on 12 “Strong Buys” one “Moderate Buy,” and 11 “Hold” ratings.

This configuration is less bullish than two months ago, with 13 analysts suggesting a “Strong Buy.”

On July 30, Wells Fargo & Company (WFC) analyst Mohit Bansal maintained an "Equal-Weight" rating on Merck but lowered the price target from $97 to $90, reflecting a 7.2% downward revision despite no change in the overall rating.

The mean price target of $102.05 represents a 28.7% premium to MRK’s current price levels. The Street-high price target of $141 suggests an ambitious upside potential of 77.8%.