Houston, Texas-based Kinder Morgan, Inc. (KMI) operates as an energy infrastructure company. Valued at $65.3 billion by market cap, the company owns and operates pipelines that transport natural gas, gasoline, crude oil, carbon dioxide, and other products, as well as terminals that store petroleum products and chemicals and handle bulk materials like coal and petroleum coke.

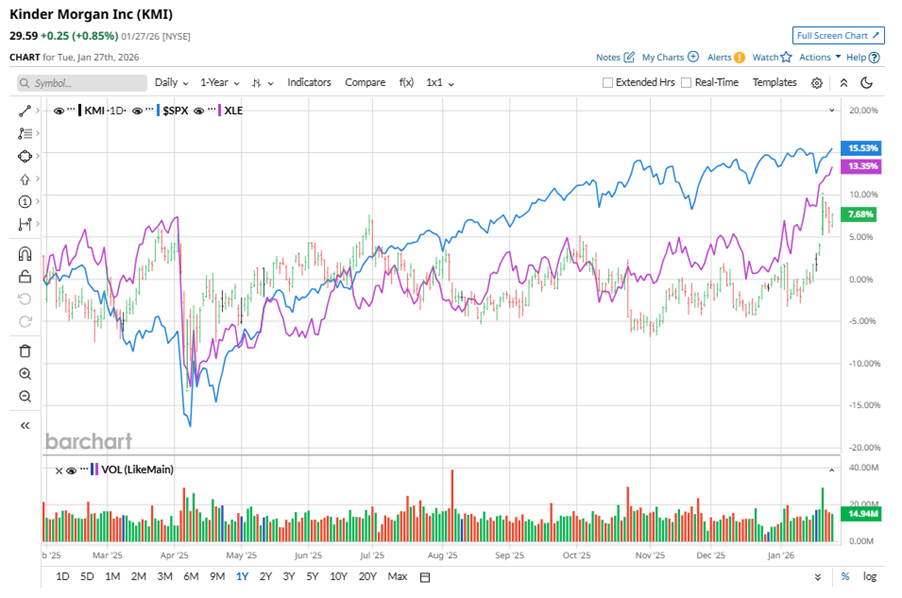

Shares of this midstream giant have underperformed the broader market over the past year. KMI has gained 7.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. However, in 2026, KMI stock is up 7.6%, surpassing the SPX’s 1.9% rise on a YTD basis.

Narrowing the focus, KMI’s underperformance looks less pronounced compared to the Energy Select Sector SPDR Fund (XLE). The exchange-traded fund has gained about 9.9% over the past year. Moreover, the ETF’s 11.1% returns on a YTD basis outshine the stock’s single-digit gains over the same time frame.

On Jan. 21, KMI shares closed up more than 2% after reporting its Q4 results. Its adjusted EPS of $0.39 topped Wall Street expectations of $0.37. The company’s revenue was $4.5 billion, topping Wall Street forecasts of $4.4 billion. KMI expects full-year adjusted EPS to be $1.36.

For the current fiscal year, ending in December, analysts expect KMI’s EPS to grow 6.2% to $1.38 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

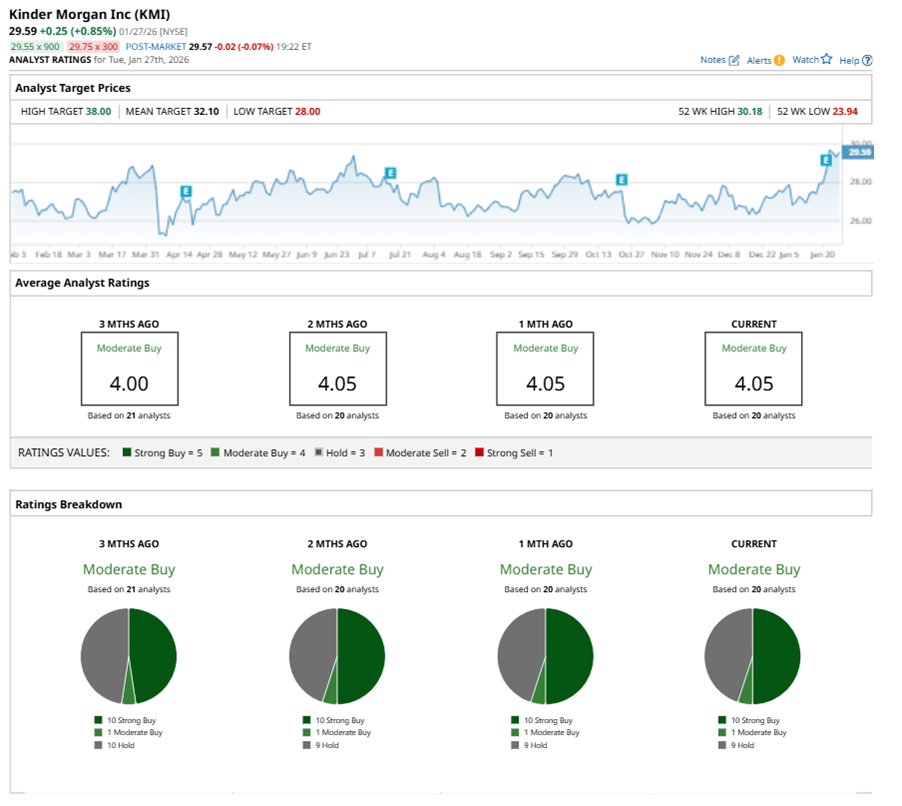

Among the 20 analysts covering KMI stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

The configuration has been fairly stable over the past three months.

On Jan. 26, Jefferies Financial Group Inc. (JEF) analyst Julien Dumoulin Smith reiterated a “Hold” rating on KMI and set a price target of $31, implying a potential upside of 4.8% from current levels.

The mean price target of $32.10 represents an 8.5% premium to KMI’s current price levels. The Street-high price target of $38 suggests an upside potential of 28.4%.