With a market cap of $27.8 billion, Iron Mountain Incorporated (IRM) is a global leader in information management, storage, and data center services. Founded in 1951 and headquartered in New Hampshire, the company serves businesses worldwide across various industries, including healthcare, legal, financial, and government.

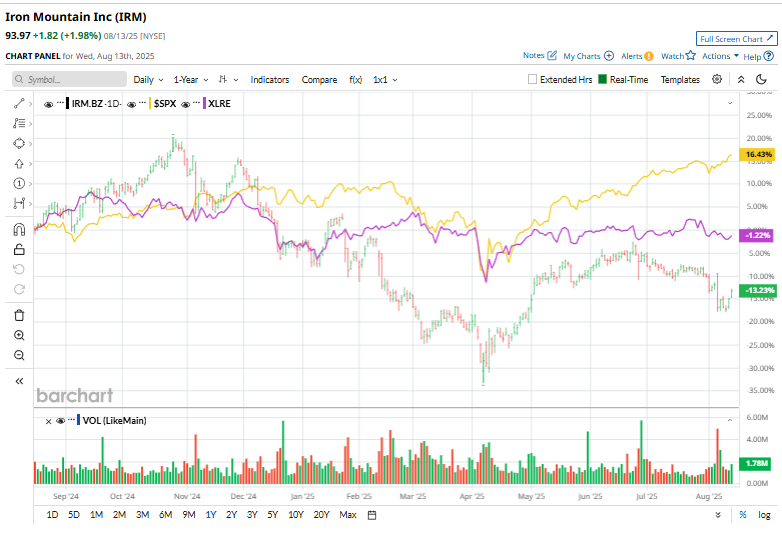

IRM shares have dropped 12.9% over this period, trailing the broader S&P 500 Index ($SPX) has gained 19%. Moreover, shares of IRM are down 19% on a YTD basis, compared to SPX’s 10% return.

Looking closer, the company has also outpaced the Real Estate Select Sector SPDR Fund’s (XLRE) 1.2% decline over the past 52 weeks and 1.7% rise in 2025.

On Aug. 6, IRM shares dipped 5.8% after the company reported its second-quarter earnings. It posted a record revenue of $1.7 billion, up 11.6% year-over-year, driven by strong growth in storage rental and services. Adjusted EBITDA rose 15% to $628 million, with margins improving to 36.7%, while AFFO increased 15% to $370 million and $1.24 per share. Despite these gains, the company reported a net loss of $43 million, compared to a $35 million profit a year earlier, primarily due to currency-related impacts on intercompany balances.

For the current fiscal year, ending in December 2025, analysts expect IRM’s adjusted FFO to increase 160.5% year-over-year to $4.61 per share. The company's earnings surprise history is solid. It beat the consensus estimates in the last four quarters.

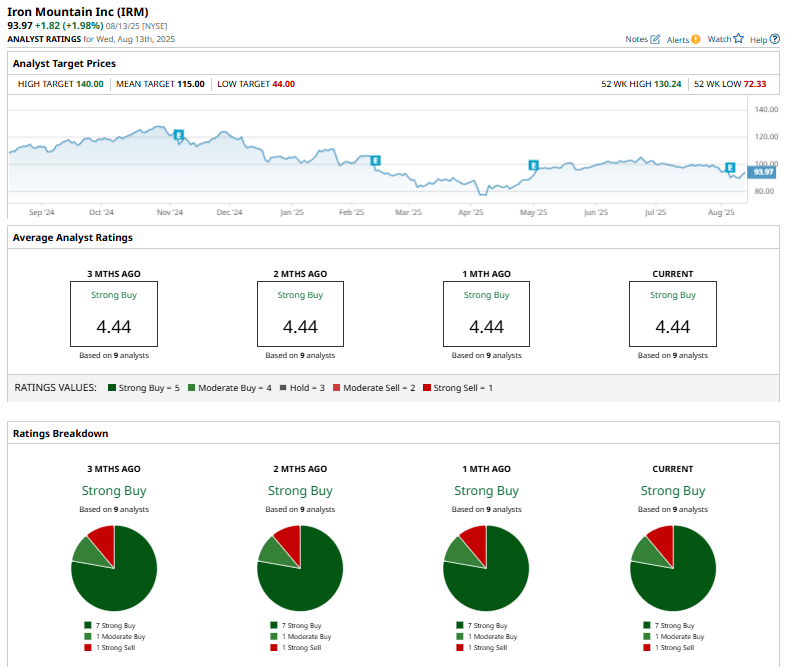

Among the nine analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and one “Strong Sell.”

On August 7, 2025, JPMorgan Chase & Co. (JPM) analyst Andrew Steinerman maintained an “Overweight” rating on Iron Mountain but cut the price target from $112 to $100, a 10.71% reduction, reflecting lowered expectations for the stock’s near-term performance.

Iron Mountain’s mean price target of $115 represents a 22.4% premium to the current market prices. The Street-high price target of $140 implies a potential upside of a staggering 49%.