/Illinois%20Tool%20Works%2C%20Inc_%20logo%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Founded in 1912, Illinois Tool Works Inc. (ITW) is a global manufacturing giant headquartered in Glenview, Illinois. The company thrives across seven segments – from automotive and food equipment to welding and electronics. Its famed ITW Business Model drives innovation, strong margins, and steady growth, making it a go-to name in engineered components and specialty systems worldwide. Its market capitalization stands at around $76.1 billion.

Shares of Illinois Tool Works have surged 3.4% on a year-to-date (YTD) basis, while the S&P 500 Index ($SPX) has outperformed with an 8.3% gain. Meanwhile, over the past 52 weeks, ITW rose 6.6%, remaining well below the SPX’s 13.3% return.

Zooming in further, Industrial Select Sector SPDR Fund (XLI) has gained 14.5% YTD and 17.9% over the past 52 weeks, surging past ITW stock.

So far in 2025, ITW has delivered modest but positive returns, with the stock’s performance closely tied to quarterly results. In the first quarter, Illinois Tool Works’ revenue declined, but in the second quarter report, posted on July 30, the company showcased positive results, including $4.1 billion in revenue, up 1% year-over-year (YoY), and EPS of $2.58, marking a new Q2 high. These results allowed management to raise full-year EPS guidance to a range of $10.35 to $10.55.

Broader macroeconomic headwinds, particularly persistent inflation, elevated interest rates, and higher borrowing costs, have been dampening industrial demand, leading customers to delay capital equipment purchases and limiting the company’s ability to fully capitalize on its execution strengths.

For the current fiscal year, ending in December 2025, analysts expect Illinois Tool Works to report EPS growth of 2.5% YoY to $10.40, on a diluted basis. The company has an impressive earnings surprise history. It has topped the Street’s bottom-line estimates in each of the past four quarters.

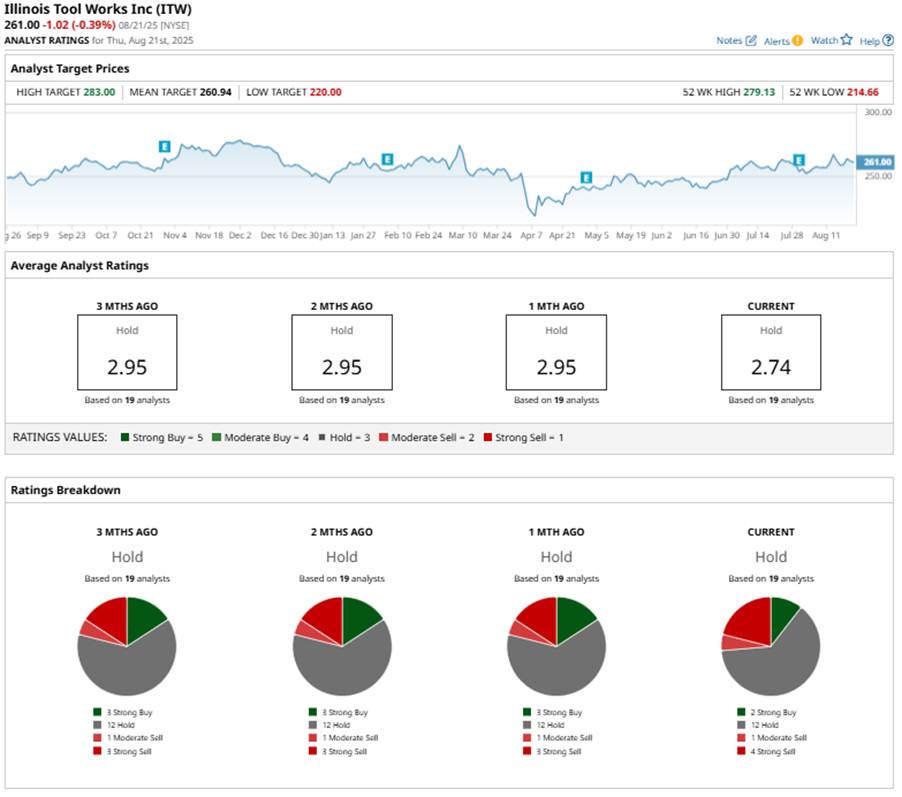

Overall, Wall Street appears cautious about ITW stock, with a consensus “Hold” rating. Of the 19 analysts offering recommendations, two are all in with a “Strong Buy,” 12 maintain a “Hold,” one advises a “Moderate Sell,” and the remaining four have a “Strong Sell” rating.

The current setup has stayed relatively stable, but sentiment has softened compared to a month ago. “Strong Sell” ratings have inched up from three to four, while “Strong Buy” ratings slipped from three to two, signaling a more cautious, slightly bearish outlook.

Barclays downgraded ITW from an “Equalweight” to an “Underweight” rating, with a $243 price target, citing limited upside as the anticipated recovery in organic sales is already priced in.

ITW is currently trading above its average analyst price target of $260.94 by a slight margin, but the Street-high target price of $283 suggests the stock can still rise by 8.4%.