/Hasbro%2C%20Inc_%20logo%20with%20potato%20head%20by-%20JHEVPhoto%20via%20iStock.jpg)

With a market cap of $11.2 billion, Hasbro, Inc. (HAS) is a global leader in the design, manufacture, and marketing of toys, games, and entertainment content. The company’s diverse portfolio includes iconic brands such as MAGIC: THE GATHERING, NERF, TRANSFORMERS, PLAY-DOH, and MY LITTLE PONY, along with licensed partnerships with major franchises like STAR WARS, MARVEL, and The Lord of the Rings.

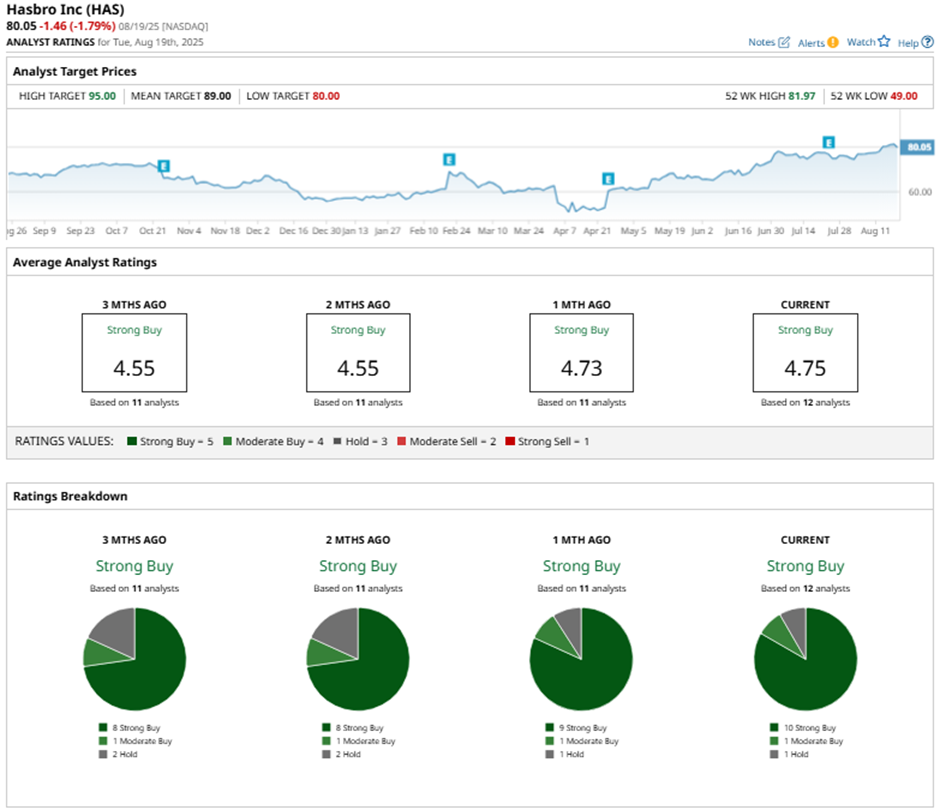

Shares of the Pawtucket, Rhode Island-based company have outperformed the broader market over the past 52 weeks. HAS stock has increased 20.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. In addition, shares of the company have climbed 43.2% on a YTD basis, compared to SPX’s over 9% rise.

However, the toy maker stock has slightly lagged behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) nearly 24% return over the past 52 weeks.

Despite posting better-than-expected Q2 2025 adjusted EPS of $1.30 and revenue of $980.8 million, Hasbro shares fell marginally on Jul. 23. Investors were concerned about a 16% drop in consumer products sales, driven by U.S. retailers delaying orders amid tariff uncertainty. Additionally, the company still expects around $60 million in incremental tariff-related costs and relies heavily on China for nearly 50% of its sourcing, which, despite plans to reduce to 40% by 2027.

For the fiscal year ending in December 2025, analysts expect HAS’ adjusted EPS to grow 21.5% year-over-year to $4.87. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

Among the 12 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and one “Hold.”

This configuration is more bullish than three months ago, with eight “Strong Buy“ ratings on the stock.

On Jul. 24, JPMorgan raised Hasbro’s price target to $94, maintaining an “Overweight“ rating.

As of writing, the stock is trading below the mean price target of $89. The Street-high price target of $95 implies a potential upside of 18.7% from the current price levels.