/Eli%20Lilly%20and%20Co_%20by%20Sergio%20Photone%20via%20Shutterstock.jpg)

Eli Lilly and Company (LLY), headquartered in Indianapolis, Indiana, is a major American pharmaceutical company. Established in 1876, the firm has a rich legacy of innovation and is currently valued at a market capitalization of $728.8 billion.

Shares of the drugmaker have underperformed the broader market over the past 52 weeks. LLY shares have decreased 1.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 21.5%. Moreover, in 2025, LLY stock has dropped marginally, compared to $SPX's 7.1% YTD rise.

Looking closer, Eli Lilly and Company has outpaced the Health Care Select Sector SPDR Fund's (XLV) 9.8% fall over the past 52 weeks and a 3.7% drop in this year.

On Aug. 1, Eli Lilly shares rose by more than 2% following a Washington Post report that the U.S. government is planning a five-year pilot program to allow Medicare and Medicaid to cover high-cost GLP-1 weight-loss drugs, including Mounjaro and Zepbound, starting in April 2026 for Medicaid and January 2027 for Medicare, under the direction of the CMS Innovation Center.

For fiscal 2025, which ends in December, analysts expect LLY’s non-GAAP earnings to rise 69.8% to $22.05 per share. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

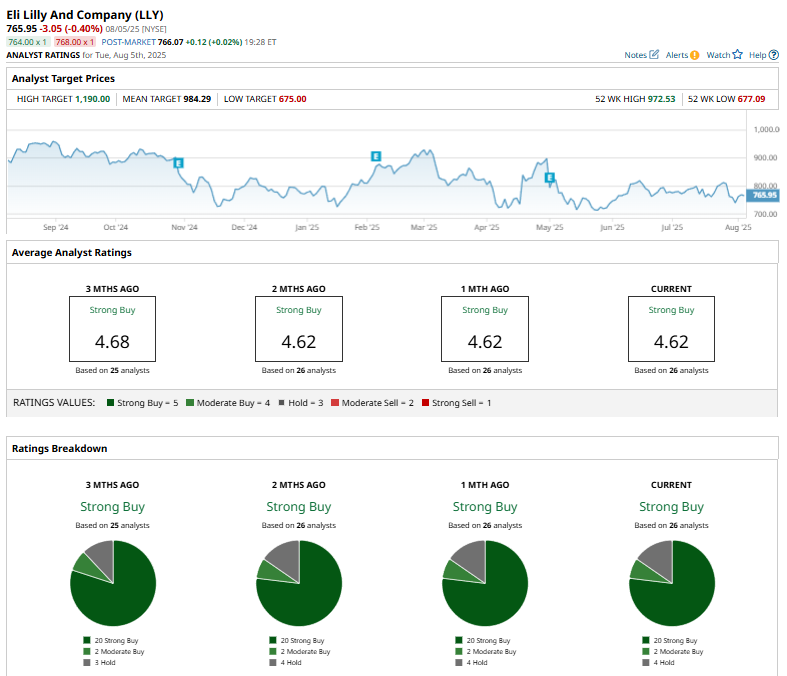

Among the 26 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 20 “Strong Buy” ratings, two “Moderate Buys,” and four “Holds.”

On Jul. 11, Guggenheim raised its price target on Eli Lilly to $942 from $936 while maintaining a “Buy” rating ahead of the company’s Q2 earnings.

LLY’s mean price target of $984.29 represents a premium of 28.5% from the current price levels. The Street-high price target of $1,190 implies a modest potential upside of 55.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.