/Darden%20Restaurants%2C%20Inc_%20Red%20Lobster%20by-%20Ken%20Wolter%20via%20Shutterstock.jpg)

Orlando, Florida-based Darden Restaurants, Inc. (DRI) owns and operates full-service restaurants. With a market cap of $24.2 billion, the company owns and operates a variety of seafood and Italian restaurants under a multitude of brand names, serving customers in the U.S. and Canada.

Shares of this leading full-service restaurant operator have considerably outperformed the broader market over the past year. DRI has gained 43.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.4%. In 2025, DRI stock is up 11.1%, surpassing the SPX’s 9.7% rise on a YTD basis.

Zooming in further, DRI’s outperformance is also apparent compared to the AdvisorShares Restaurant ETF (EATZ). The exchange-traded fund has gained about 13% over the past year. Moreover, DRI’s low double-digit returns on a YTD basis outshine the ETF’s 1.9% gains over the same time frame.

On Jun. 20, DRI shares closed up more than 1% after reporting its Q4 results. Its adjusted EPS of $2.98 surpassed Wall Street expectations of $2.96. The company’s revenue was $3.3 billion, matching Wall Street forecasts. DRI expects full-year adjusted EPS to be $10.50 to $10.70.

For fiscal 2026, ending in May 2026, analysts expect DRI’s EPS to grow 11.3% to $10.63 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

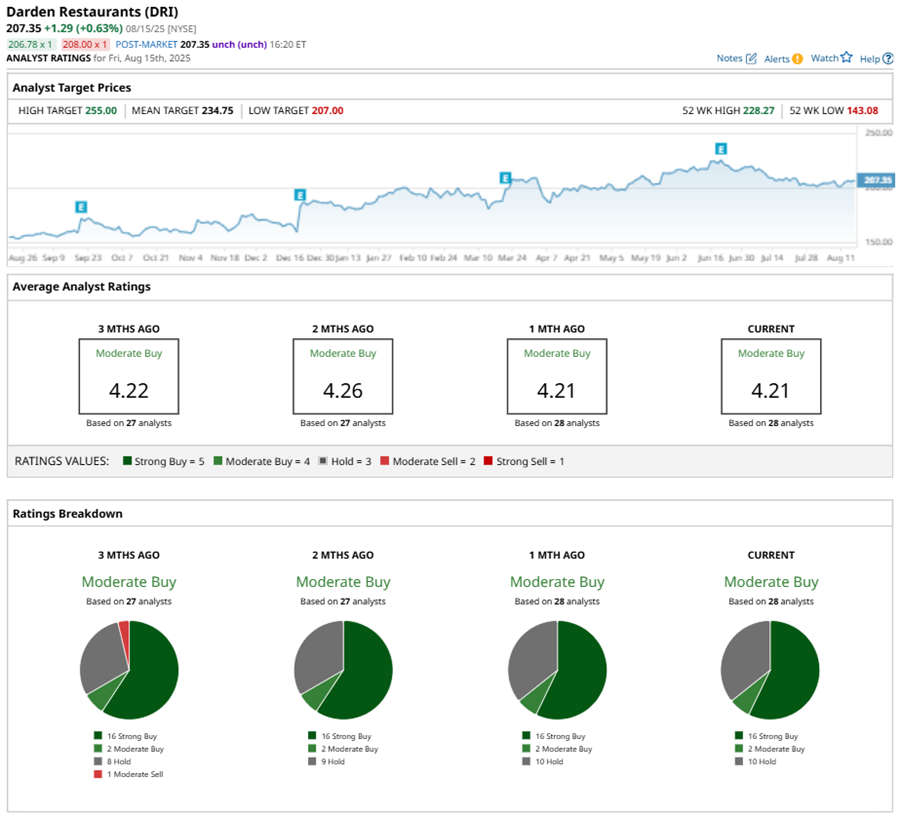

Among the 28 analysts covering DRI stock, the consensus is a “Moderate Buy.” That’s based on 16 “Strong Buy” ratings, two “Moderate Buys,” and 10 “Holds.”

This configuration is less bearish than three months ago, with one analyst suggesting a “Moderate Sell.”

On Jul. 31, Barclays PLC (BCS) analyst Jeff Bernstein maintained a “Buy” rating on DRI and set a price target of $255, the Street-high price target, implying a potential upside of 23% from current levels.

The mean price target of $234.75 represents a 13.2% premium to DRI’s current price levels.