/CVS%20Health%20Corp%20corporate%20office-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $104.6 billion, CVS Health Corporation (CVS) is a leading U.S. health solutions company operating through its Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments. The company provides a wide range of services, including health insurance, pharmacy benefit management, and retail pharmacy products, to individuals, employers, and government organizations.

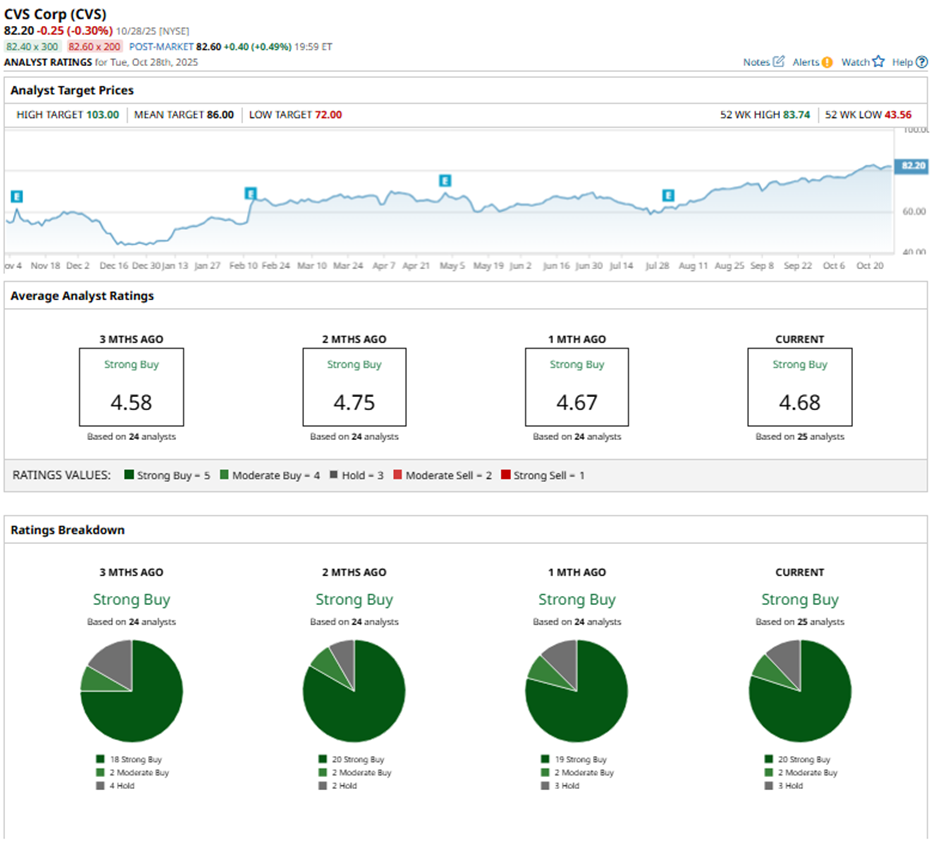

Shares of the Woonsocket, Rhode Island-based company have significantly outperformed the broader market over the past 52 weeks. CVS stock has surged 43.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.3%. In addition, CVS stock has climbed 83.1% on a YTD basis, compared to SPX's 17.2% YTD gain.

Looking closer, shares of the drugstore chain and pharmacy benefits manager have also outpaced the Health Care Select Sector SPDR Fund's (XLV) 2.3% decline over the past 52 weeks.

Despite reporting stronger-than-expected Q2 2025 adjusted EPS of $1.81 and revenue of $98.92 billion, CVS shares fell marginally on Jul. 31. The company's GAAP earnings dropped sharply to $0.80 per share from $1.41 a year earlier, and net cash from operating activities fell to $6.45 billion from $7.99 billion. Additionally, CVS’ plans to close 250 pharmacies and reduce government-sponsored insurance plans raised concerns.

For the current fiscal year, ending in December 2025, analysts expect CVS' adjusted EPS to grow 17.3% year-over-year to $6.36. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

Among the 25 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 20 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

This configuration is more bullish than three months ago, with 18 “Strong Buy” ratings on the stock.

On Oct. 15, Morgan Stanley analyst Erin Wright raised CVS Health’s price target to $89 and maintained an “Overweight” rating.

The mean price target of $86 represents a premium of 4.6% to CVS' current price. The Street-high price target of $103 suggests a 25.3% potential upside.