Valued at a market cap of $23 billion, Corpay, Inc. (CPAY) is a global payments and expense-management company offering solutions for corporate, vehicle, and lodging costs. The Atlanta, Georgia-based company offers a comprehensive suite of digital payment solutions, including accounts payable automation, commercial cards, cross-border payments, and vehicle-related expense management such as fuel and toll payments.

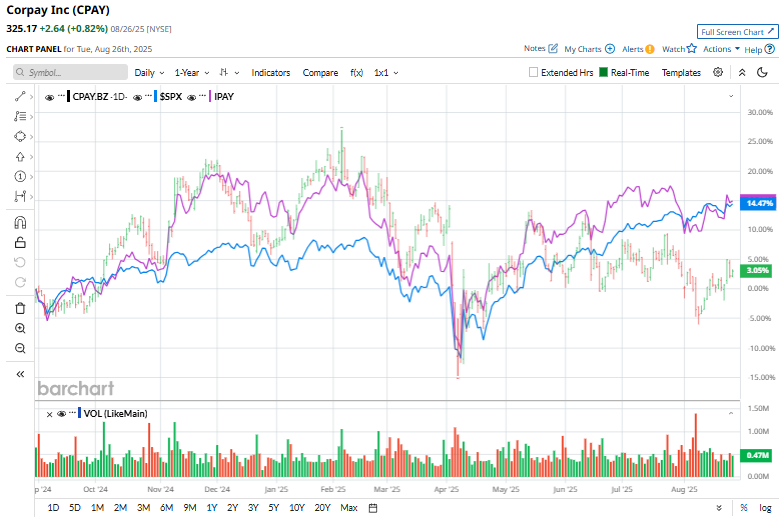

Shares of CPAY have rallied 8.1% over this time frame, lagging behind the broader S&P 500 Index ($SPX), which has gained 15.1%. On a YTD basis, the stock is down 3.9%, trailing the SPX’s 9.9% rise.

Zooming in further, CPAY has also underperformed the Amplify Digital Payments ETF’s (IPAY) 17.4% return over the past 52 weeks and a 2.5% downtick on a YTD basis.

On Aug. 6, Corpay released its Q2 2025 results, reporting $1.1 billion in revenue, a 13% year-over-year increase, and EPS of $5.13, driven by strong corporate payments. The company raised its full-year revenue and EPS guidance, signaling continued momentum. However, its shares dipped 1.1% after earnings due to a decline in revenue in the lodging segment.

For the current fiscal year, ending in December, analysts expect CPAY’s EPS to grow 13% year over year to $20.03. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

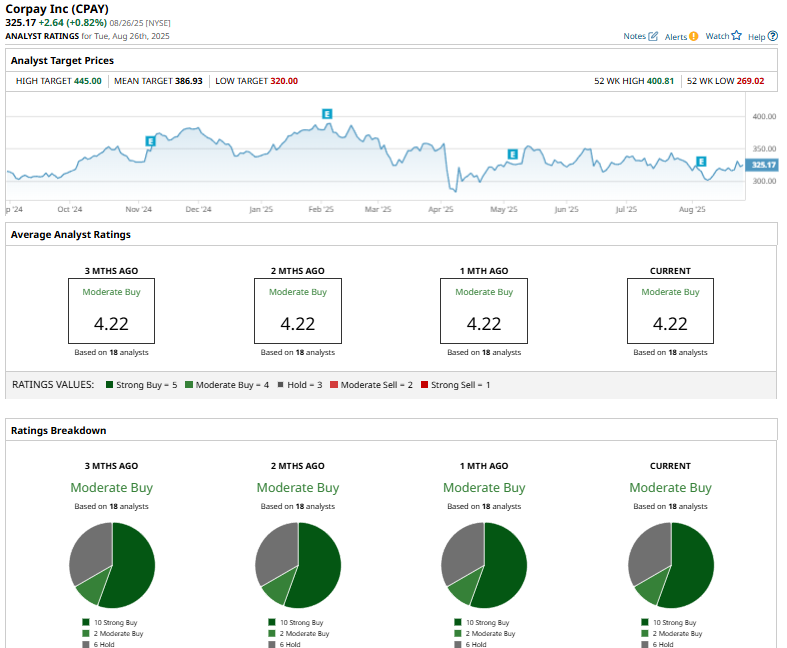

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on 10 “Strong Buy,” two “Moderate Buy,” and six “Hold” ratings.

On Aug. 11, Morgan Stanley analyst James Faucette reiterated an “Equal-Weigh”t rating on Corpay and lowered the price target to $356 from $360, a 1.11% decrease.

The mean price target of $386.93 represents a 19% premium from CPAY’s current price levels, while the Street-high price target of $445 suggests an upside potential of 36.9%.