/Copart%2C%20Inc_%20app%20and%20car-by%20Tricky_Shark%20via%20Shutterstock.jpg)

Valued at a market cap of $44 billion, Copart, Inc. (CPRT) is a Dallas‑based global leader in online vehicle auctions and remarketing, serving insurance firms, dealerships, fleet operators, and individual buyers across 11 countries through its patented VB3 platform and associated brands like BID4U and CrashedToys.

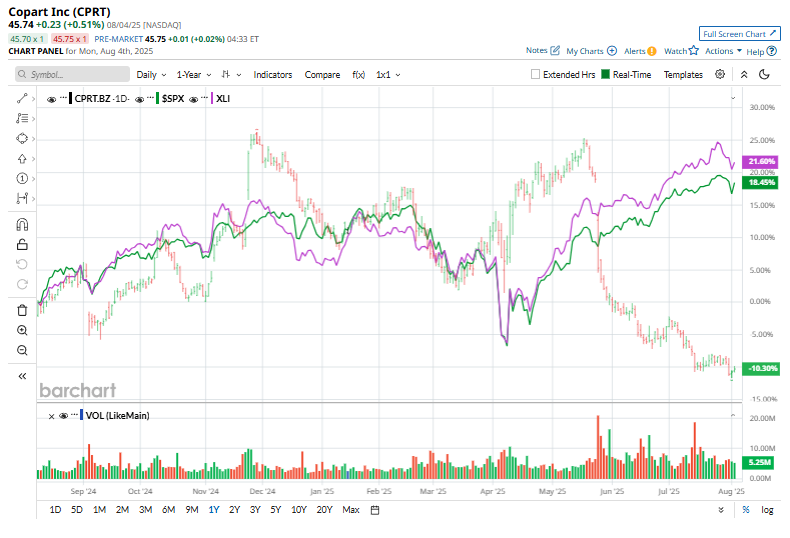

Shares of CPRT have lagged behind the broader market over the past 52 weeks. Copart has dipped 12% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.4%. Moreover, on a YTD basis, the stock is down 20.3%, compared to SPX’s 7.6% rise.

Zooming in further, Copart has also struggled to keep up with the Industrial Select Sector SPDR Fund’s (XLI) 23.1% uptick over the past 52 weeks and 14.7% rise on a YTD basis.

Copart released its Q3 2025 earnings on May 22, and its shares slumped 11.5%. While revenue grew 7.5% year-over-year to $1.2 billion, it missed consensus estimates by 2.5%, primarily due to a 2.1% decline in vehicle sales. Service revenues rose 9.3% year-over-year to $1 billion. Its EPS stood at $0.42, up 7.7% from the prior-year quarter and in line with analysts' expectations.

For the fiscal year that ended in July, analysts expect Copart’s EPS to grow 11.4% year over year to $1.56. The company’s earnings surprise history is mixed. It exceeded or met the consensus estimates in three of the last four quarters, while missing on another occasion.

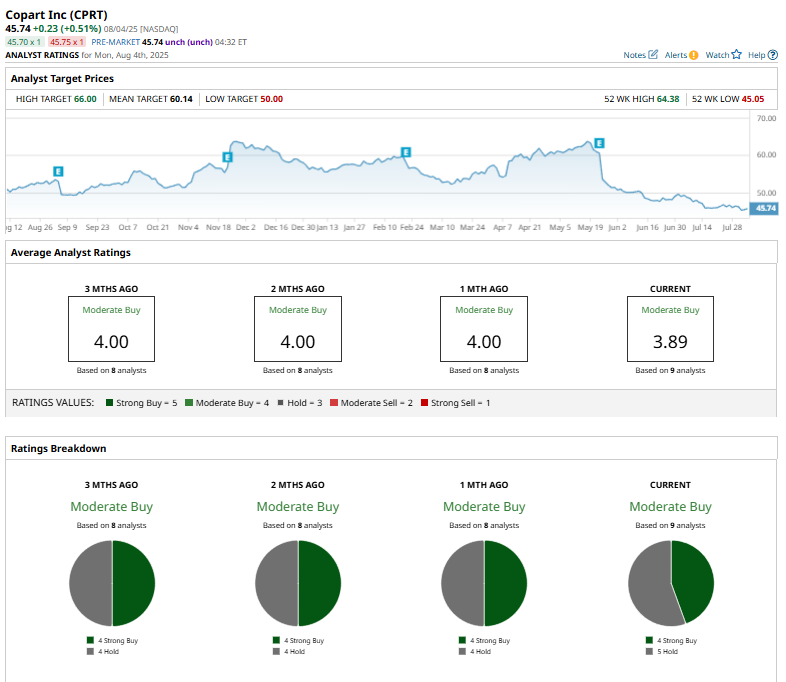

Among the nine analysts covering the stock, the consensus rating is a “Moderate Buy” which is based on four “Strong Buy,” and five “Hold” ratings.

On Jul. 17, Baird reaffirmed its “Outperform” rating for Copart but lowered the price target from $64 to $55, signaling a more tempered near-term outlook while maintaining confidence in the company’s long-term potential.

The mean price target of $60.14 represents a 31.5% premium from CPRT’s current price levels, while the Street-high price target of $66 suggests an upside potential of 44.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.