/CME%20Group%20Inc%20Chicago%20office-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $98.7 billion, CME Group Inc. (CME) is the world’s largest futures exchange by trading volume and notional value. It operates major markets including CME, CBOT, NYMEX, and COMEX, offering a wide range of futures, options, clearing, and market data services across multiple asset classes.

The Chicago, Illinois-based company's shares have outperformed the broader market over the past 52 weeks. CME stock has climbed nearly 32% over this time frame, while the broader S&P 500 Index ($SPX) has rallied around 19%. In addition, shares of the company are up nearly 18% on a YTD basis, compared to SPX’s nearly 10% gain.

Looking closer, CME stock has also outpaced the Financial Select Sector SPDR Fund’s (XLF) 24.1% return over the past 52 weeks.

CME Group shares recovered marginally on Jul. 23 as investors reacted to its Q2 2025 results, with adjusted EPS of $2.96 and revenue rising 10.4% to a record $1.7 billion, topping Wall Street’s estimates. The quarter saw record average daily volumes of 30.2 million contracts, up 16% year-over-year, driven by heightened market volatility, record participation from retail traders (+57% new accounts), and strong demand for interest-rate products.

For the fiscal year ending in December 2025, analysts expect CME’s adjusted EPS to grow 8.6% year-over-year to $11.14. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

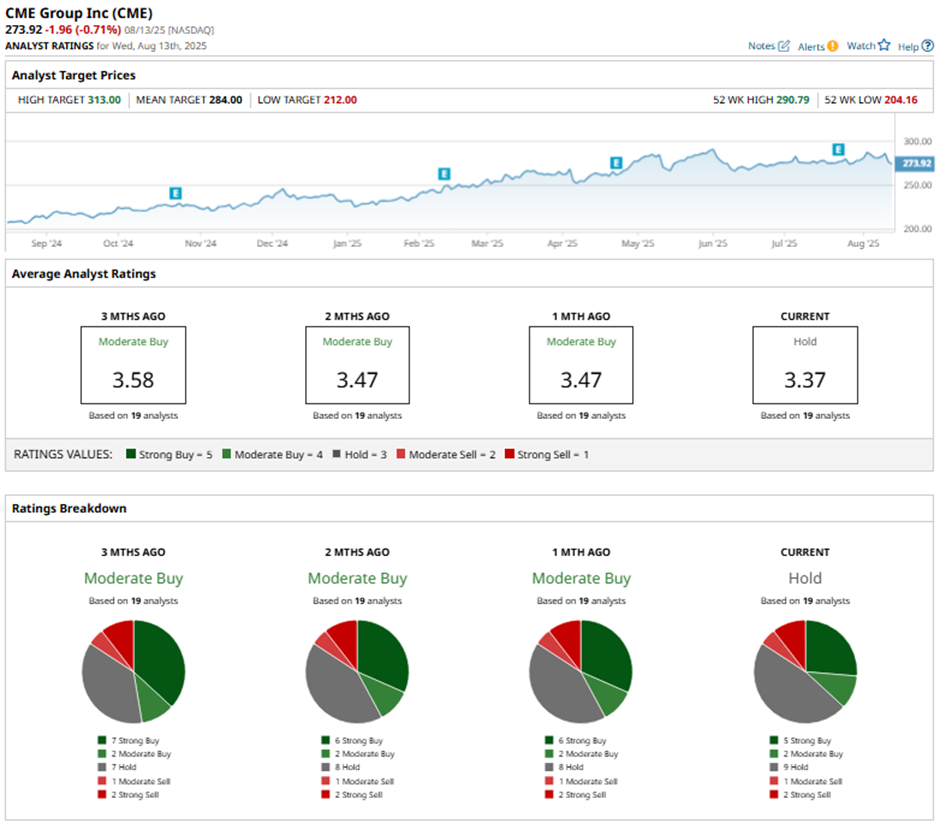

Among the 19 analysts covering the stock, the consensus rating is a “Hold.” That’s based on five “Strong Buy” ratings, two “Moderate Buys,” nine “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is less bullish than three months ago, with seven “Strong Buy” ratings on the stock.

On Jul. 24, Barclays’ Benjamin Budish cut CME Group’s price target to $298 and kept an “Equal Weight” rating.

As of writing, the stock is trading below the mean price target of $284. The Street-high price target of $313 implies a potential upside of 14.3% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.