/Carnival%20Corp_%20logo%20on%20ship%20by-%20Ihor%20Koptilin%20via%20Shutterstock.jpg)

With a market cap of $34.7 billion, Carnival Corporation & plc (CCL) is one of the world’s largest cruise companies. It operates a portfolio of well-known cruise brands, including Carnival Cruise Line, Princess Cruises, Holland America Line, and Costa Cruises, among others. The company serves a global customer base with cruise itineraries across North America, Europe, Australia, and Asia.

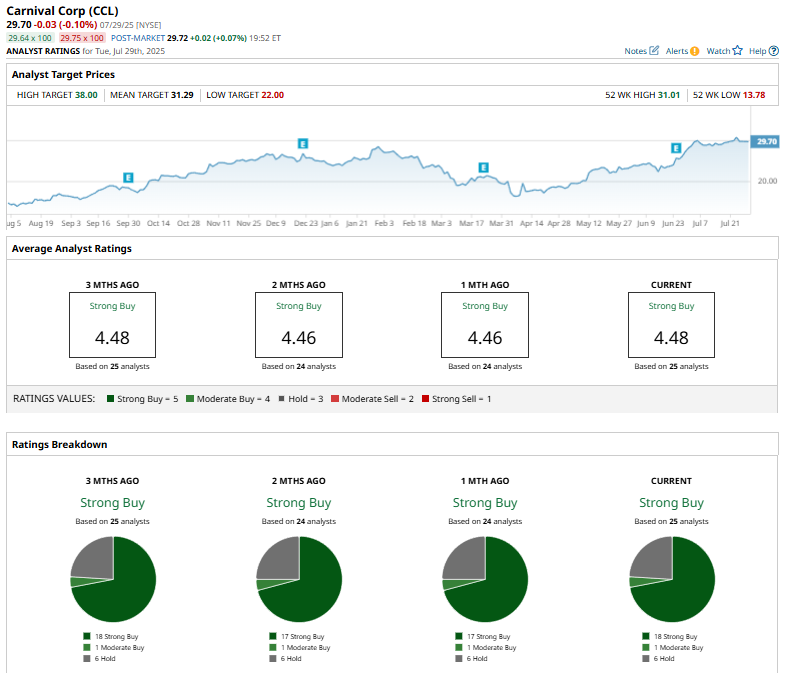

The cruise giant’s shares have significantly outperformed the broader market over the past year. CCL has surged 72.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.6%. CCL’s stock is up 19.2% in 2025, compared to the $SPX’s 8.3% return on a YTD basis.

Narrowing the focus, CCL has also outperformed the Dynamic Leisure and Entertainment Invesco ETF (PEJ). The exchange-traded fund has climbed 28.6% over the past year and 10.8% in 2025.

On June 27, Carnival shares rose over 4% after Moody’s Corporation (MCO) upgraded the company’s long-term corporate rating from Ba3 to Ba2.

For the current fiscal year, ending in November, analysts expect CCL’s EPS to rise 40.9% year over year to $2 on a diluted basis. The company has an impressive track record of outperforming expectations, having surpassed the consensus estimate in all of the last four quarters

Among the 25 analysts covering CCL stock, the consensus is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is more bullish than a month ago, when 17 analysts gave the stock a “Strong Buy.”

On Jul. 29, Tigress Financial raised its price target on Carnival from $32 to $38, maintaining a “Buy” rating, citing strong demand, positive booking trends, and fleet modernization as key drivers of expected revenue and cash flow growth.

The mean price target of $31.29 represents a 5.4% premium to CCL’s current price levels.