With a market cap of $16.7 billion, Bunge Global SA (BG) is a leading integrated agribusiness and food company that operates across the entire farm-to-consumer value chain on five continents. Through its four segments: Agribusiness; Refined and Specialty Oils; Milling; and Sugar and Bioenergy, the company provides essential food, feed, and fuel products to customers worldwide.

Shares of the Chesterfield, Missouri-based company have underperformed the broader market over the past 52 weeks. BG stock has dropped 13.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.3%. Moreover, shares of the company are up 7.3% on a YTD basis, compared to SPX’s 8.3% rise.

Narrowing the focus, shares of the agribusiness and food company have lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.3% return over the past 52 weeks.

Shares of Bunge climbed 5.2% on Jul. 30 after the company posted Q2 2025 adjusted EPS of $1.31, beating analyst estimates. Profit benefited from a late-quarter jump in soy crush margins, as soybean prices fell while soyoil prices rallied on favorable biofuel policy moves in the U.S. and Brazil. Investor sentiment was further boosted by regulatory approval and the closing of its long-delayed Viterra acquisition on July 2, alongside the completed sale of its U.S. corn milling business.

For the fiscal year ending in December 2025, analysts expect BG’s adjusted EPS to decline 15.7% year-over-year to $7.75. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

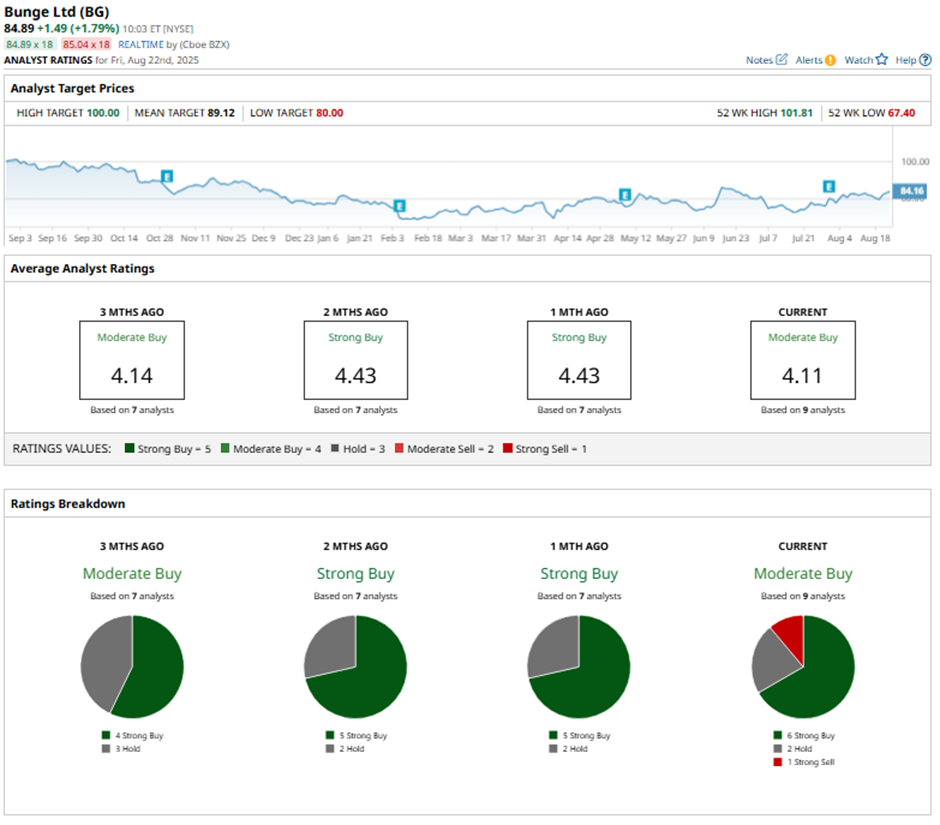

Among the nine analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, two “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Aug. 12, Morgan Stanley analyst Steven Haynes increased its price target on Bunge to $83 while maintaining an “Equal Weight” rating.

The mean price target of $89.12 represents a nearly 5% premium to BG’s current price levels. The Street-high price target of $100 suggests a 17.8% potential upside.