With a market cap of $65.3 billion, Air Products and Chemicals, Inc. (APD) is a global leader in industrial gases, offering process and specialty gases along with advanced equipment and services. The Allentown, Pennsylvania-based company serves a diverse range of industries, specializing in the design and production of air separation units, natural gas liquefaction systems, and cryogenic storage solutions.

Shares of APD have underperformed the broader market over the past 52 weeks, gaining 9.1%, while the broader S&P 500 Index ($SPX) has gained 16.1%. In addition, APD stock is up 3.2% on a YTD basis, compared to SPX's 10% gain.

However, the industrial gases giant has outperformed the Materials Select Sector SPDR Fund's (XLB) marginal rise over the past 52 weeks.

On Jul. 31, APD released its fiscal third-quarter earnings, and its shares dipped 2.1% in the next trading session. Its revenue rose 1% to $3.02 billion, driven by pricing and currency gains offsetting lower volumes. Adjusted EPS of $3.09 beat guidance but fell 3% year over year. While Europe and Asia delivered strong growth, the Americas faced margin pressure from volume declines.

For the fiscal year ending in September 2025, analysts expect APD's adjusted EPS to decline 3.3% year-over-year to $12.02. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

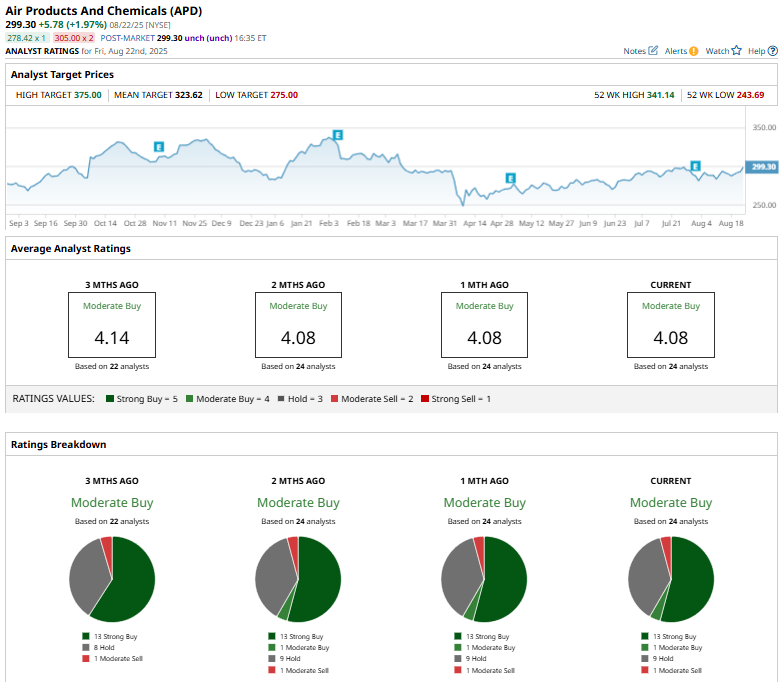

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Moderate Sell.”

On July 15, Mizuho analyst John Roberts reaffirmed an “Outperform” rating on Air Products and raised the price target from $310 to $325, a 4.84% increase, reflecting a positive outlook for the stock’s market performance.

APD’s mean price target of $323.62 indicates a marginal premium from the current market prices. The Street-high price target of $375 implies a modest potential upside of 25.3% from the current price levels.