/W_W_%20Grainger%20Inc_%20supply%20warehouse-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

W.W. Grainger, Inc. (GWW), headquartered in Lake Forest, Illinois, distributes maintenance, repair, and operating products and services. Valued at $48 billion by market cap, the company's products include motors, HVAC equipment, lighting, hand and power tools, pumps, packaging, material handling, adhesives, safety, janitorial, electrical, and metalworking equipment.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and GWW perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the industrial distribution industry. Grainger's strengths lie in its diversified product portfolio, strong brand equity, and financial resilience, which create a competitive moat. Its extensive distribution network and advanced logistics capabilities ensure timely delivery, while its technological capabilities in e-commerce and digital solutions drive growth. These strengths enable Grainger to navigate economic challenges and invest in future initiatives.

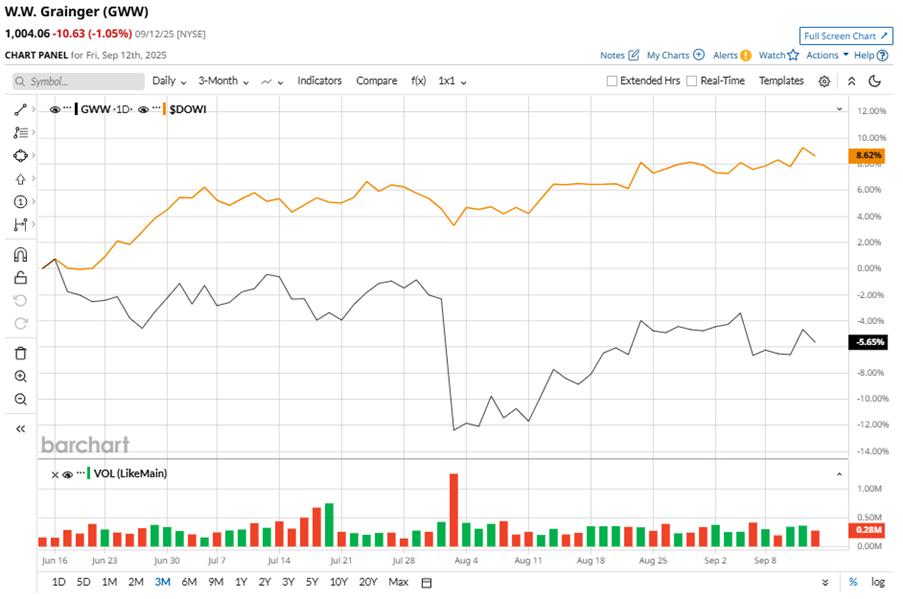

Despite its notable strength, GWW slipped 18.2% from its 52-week high of $1,227.66, achieved on Nov. 11, 2024. Over the past three months, GWW stock declined 7.2%, underperforming the Dow Jones Industrials Average’s ($DOWI) 6.7% gains during the same time frame.

In the longer term, shares of GWW dipped 4.7% on a YTD basis but climbed marginally over the past 52 weeks, underperforming DOWI’s YTD gains of 7.7% and 11.5% returns over the last year.

To confirm the bearish trend, GWW has been trading below its 50-day and 200-day moving averages since mid-June.

On Aug. 1, GWW shares closed down more than 10% after reporting its Q2 results. Its adjusted EPS of $9.97 fell short of Wall Street expectations of $10. The company’s revenue was $4.6 billion, topping Wall Street forecasts of $4.5 billion. GWW expects full-year adjusted EPS in the range of $38.50 to $40.25, and expects revenue in the range of $17.9 billion to $18.2 billion.

In the competitive arena of industrial distribution, Core & Main, Inc. (CNM) has taken the lead over GWW, showing resilience with a 4.4% downtick on a YTD basis and 21.9% gains over the past 52 weeks.

Wall Street analysts are cautious on GWW’s prospects. The stock has a consensus “Hold” rating from the 17 analysts covering it, and the mean price target of $1,044.55 suggests a potential upside of 4% from current price levels.