/Vertex%20Pharmaceuticals%2C%20Inc_%20HQ%20in%20Boston-by%20Tada%20Images%20via%20Shuttershock.jpg)

With a market cap of $101.6 billion, Vertex Pharmaceuticals Incorporated (VRTX) is a leading U.S.-based biotechnology company headquartered in Boston, Massachusetts. Founded in 1989, it specializes in the discovery, development, manufacturing, and commercialization of transformative therapies, particularly for serious and rare diseases.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Vertex Pharmaceuticals fits this criterion perfectly. It holds a commanding lead in cystic fibrosis care, anchored by a portfolio of highly effective, disease-modifying therapies that set the standard in treatment. Beyond this core strength, the company is advancing a diversified pipeline in high-impact areas such as genetic diseases, kidney disorders, type 1 diabetes, and non-opioid pain management, positioning itself for sustained growth well beyond cystic fibrosis.

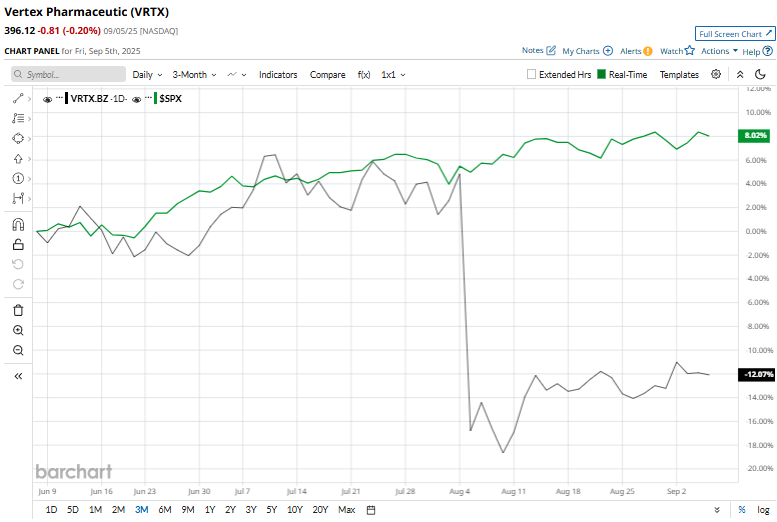

However, the biopharmaceutical titan has fallen 23.8% from its 52-week high of $519.88 touched on Nov. 8, 2024. Over the last three months, VRTX shares have slumped 10.8%, underperforming the S&P 500 Index ($SPX), which has returned 9.1% over the same time frame.

Longer term, VRTX has plunged 1.6% on a YTD basis, lagging behind $SPX’s 10.2% rise. Additionally, shares of Vertex Pharmaceuticals have declined 15.5% over the past 52 weeks, while the $SPX has surged 17.8% in the same period.

VRTX has dipped below its 50-day and 200-day moving averages since early August, indicating a downtrend.

On Aug. 4, Vertex Pharmaceuticals released its Q2 results, and its shares plummeted 20.6%. Driven by continued momentum, the company’s topline for the quarter surged 12.1% year-over-year to $2.96 billion, exceeding the consensus estimates by 2.6%. Further, the company reported a massive improvement in profitability. Its non-GAAP net income for the quarter came in at $1.2 billion, up from the net loss of $3.3 billion reported in the same quarter last year. Moreover, its adjusted EPS of $4.52 surpassed the Street’s estimates by 6.6%.

Its top rival, Regeneron Pharmaceuticals, Inc. (REGN), has underperformed VRTX. Shares of REGN have declined 50.2% in the last 52 weeks and 19.5% on a YTD basis.

Among the 34 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $488.77 implies an upside potential of 23.4% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.