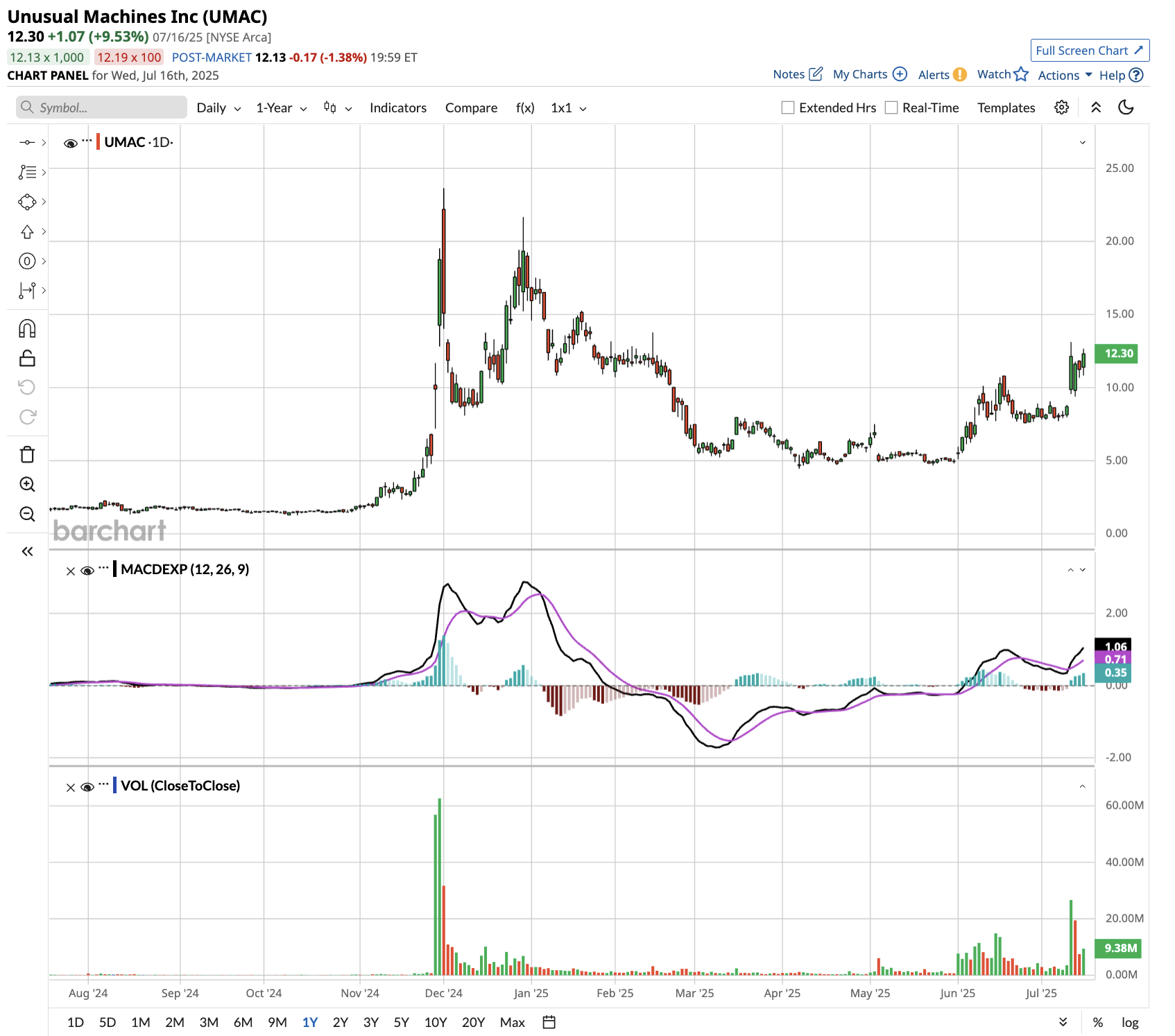

Unusual Machines (UMAC) presents a speculative buying opportunity following its 40% surge after Defense Secretary Pete Hegseth announced plans to ramp up drone production. The small-cap commercial drone company appears positioned to benefit from the Pentagon’s aggressive push for American-made drones.

Hegseth’s July 11 announcement rescinding restrictive drone production policies creates tailwinds for domestic manufacturers like Unusual Machines. The Defense Department’s emphasis on off-the-shelf components for rapid production aligns with the company’s commercial drone and component distribution model, which utilizes B2B sales, e-commerce, and retail channels.

The policy shift represents a fundamental change in defense procurement. The Pentagon’s goal to arm combat units with low-cost American drones, combined with President Donald Trump’s executive order streamlining production approval processes, opens market opportunities for agile domestic players.

While the macro environment is favorable, Unusual Machines remains a small player in a competitive landscape dominated by larger defense contractors. Its commercial focus may require adaptation to meet military specifications and security requirements.

The 18-month concept-to-development timeline showcased at the Pentagon demonstrates the rapid innovation cycle favoring nimble companies. For risk-tolerant investors seeking exposure to America’s drone modernization initiative, UMAC offers leveraged upside potential, though position sizing should reflect the inherent volatility of small-cap stocks.

Is UMAC Stock a Good Buy Right Now?

Unusual Machines delivered its strongest quarter ever in Q1, achieving $2 million in revenue, a 59% increase over the prior year. This marked the fourth consecutive record-breaking quarter for the commercial drone company, demonstrating consistent growth momentum despite challenging market conditions, including tariff uncertainties and sanctions against Chinese suppliers.

UMAC successfully completed a $40 million financing at $5 per share. CEO Allan Evans emphasized this raise was from a position of strength rather than necessity, with management, board members, and existing investors participating.

The capital will enable UMAC to secure a priority position with both large government contractors, such as Lockheed Martin (LMT), and critical suppliers facing supply chain disruptions.

UMAC is aggressively pursuing domestic manufacturing capabilities, with plans to open a 17,000-square-foot motor production facility in Orlando by September 2025. This strategic move addresses the critical gap left by sanctioned Chinese suppliers, such as T-Motor, while positioning the company for NDAA-compliant government contracts. The facility targets a production capacity of hundreds of thousands to millions of motors annually.

The timing appears favorable as government spending begins to unlock following budget resolutions, with management noting early signs of order activity. Enterprise sales remained steady at 13% of revenue despite government spending delays, suggesting underlying demand resilience.

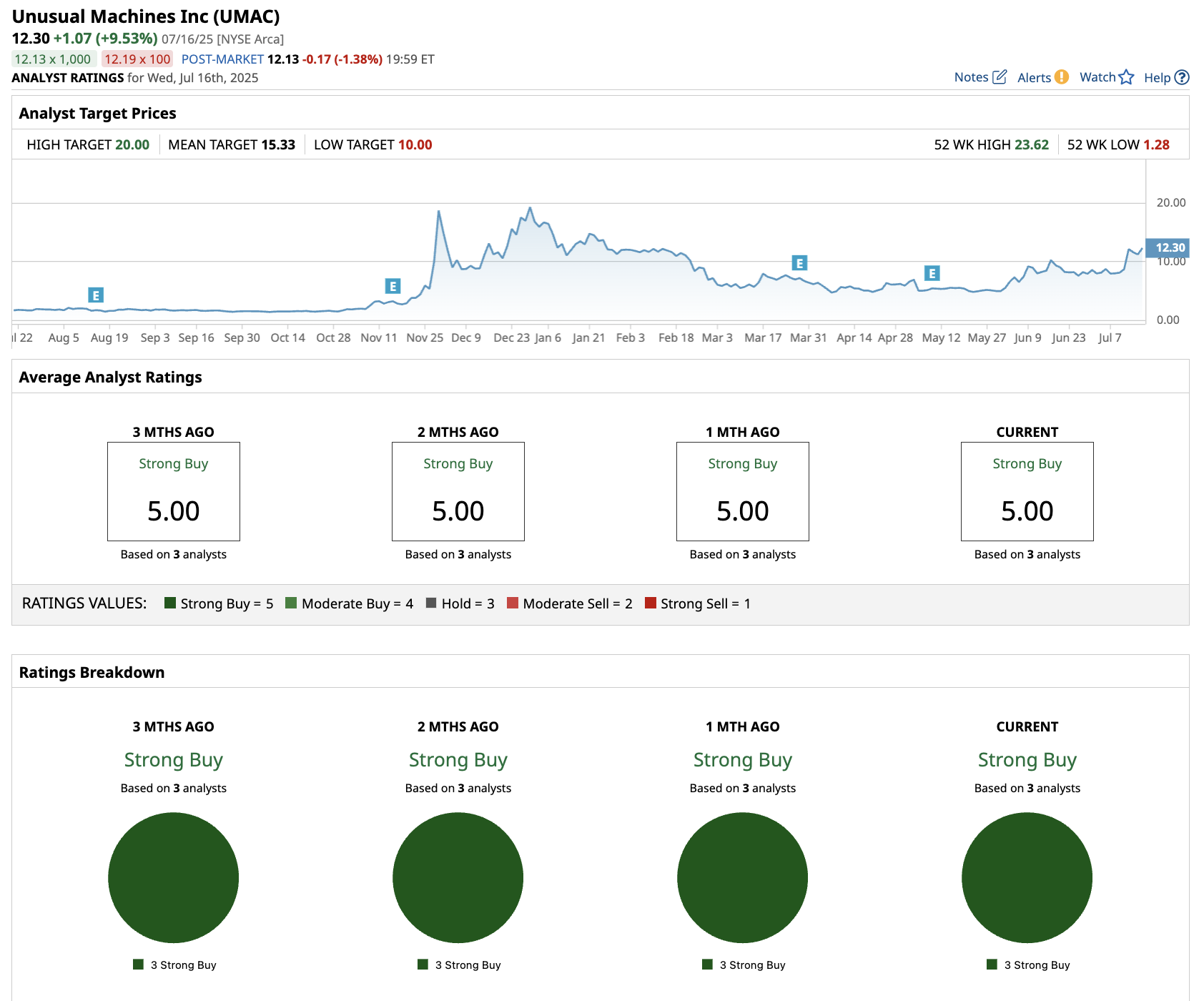

What Is the Target Price for UMAC Stock?

Each of the three analysts covering UMAC stock has a “Strong Buy” recommendation. The average target price for UMAC stock is $15.33, 33% above the current trading price. UMAC is forecast to increase sales from $5.57 million in 2024 to $21.14 million in 2026. Its adjusted losses per share are expected to narrow from $0.84 to $0.22 in this period.

Management projects reaching cash flow positivity within 4-6 quarters, requiring $15 million to $20 million in annual revenue. With growing defense spending priorities, domestic manufacturing advantages, and a strong balance sheet, UMAC appears well-positioned to capitalize on the shift toward American-made drone components, although execution risks remain given the company’s early stage manufacturing transition.