/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

Minnetonka, Minnesota-based UnitedHealth Group Incorporated (UNH) operates as a diversified healthcare company. With a market cap of $275.2 billion, UnitedHealth provides a range of healthcare products and services, and operates through UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx segments.

Companies worth $200 billion or more are generally described as "mega-cap stocks." UnitedHealth fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the healthcare plans industry. The company serves millions of people and employs hundreds of thousands of people across the globe.

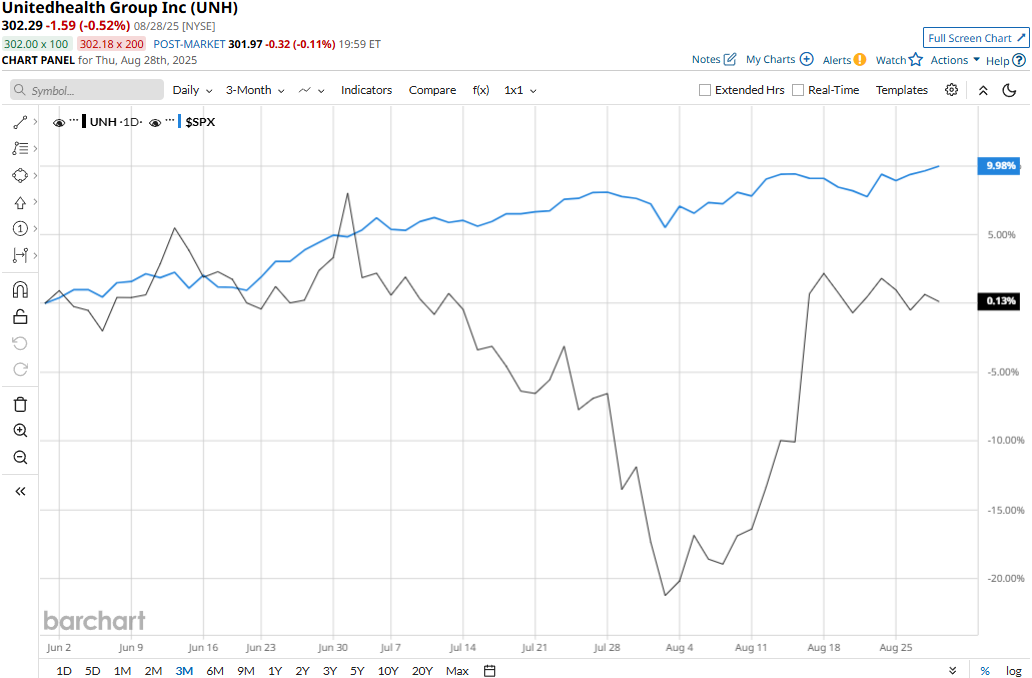

Despite its notable strengths, UnitedHealth stock has tanked 52.1% from its all-time high of $630.73 achieved on Nov. 11, 2024. UNH stock has observed a modest 1.4% uptick over the past three months, underperforming the S&P 500 Index’s ($SPX) 10.4% surge over the past three months.

UnitedHealth has underperformed the broader market over the long term as well. UNH stock has declined 48.6% over the past 52 weeks and 40.2% on a YTD basis, compared to SPX’s 16.3% gains over the past year and 10.6% returns in 2025.

To confirm the downtrend, UNH stock has remained mostly below its 50-day and 200-day moving averages since December 2024, with some fluctuations.

UnitedHealth’s stock prices plunged 7.5% in a single trading session following the release of its mixed Q2 results on Jul. 29. The company’s revenues from premium collection, products, and services observed a notable uptick, leading to a robust 12.9% year-over-year growth in overall topline to $111.6 billion, surpassing the Street’s expectations by a small margin. However, UnitedHealth’s margins suffered due to a sharp increase in operating costs. Its adjusted EPS for the quarter declined by a staggering 40% year-over-year to $4.08, missing the consensus estimates by 15.7%.

When compared to its peer, UnitedHealth has notably underperformed Elevance Health, Inc.’s (ELV) 43.7% decline over the past year and 15.9% drop in 2025.

Nonetheless, UNH has a consensus “Moderate Buy” rating among the 25 analysts covering the stock. Its mean price target of $309.38 represents a modest 2.3% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.