/Trimble%20Inc%20logo%20on%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

With a market cap of $19.5 billion, Trimble Inc. (TRMB) is a leading technology company that provides advanced positioning, surveying, and machine control solutions. Its portfolio integrates GPS, GNSS, optical, laser, and wireless communications with software to deliver real-time positioning, data processing, analytics, and automation tools.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Trimble fits this criterion perfectly. Serving industries such as construction, transportation, logistics, and agriculture, Trimble helps professionals and organizations worldwide enhance productivity, streamline operations, and transform workflows.

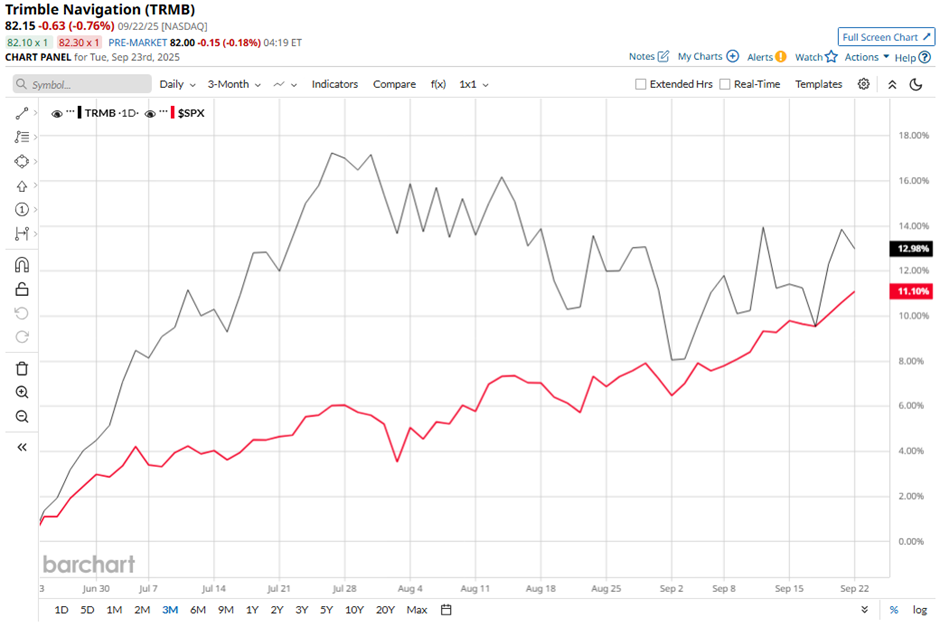

Shares of the Westminster, Colorado-based company have fallen 6.3% from its 52-week high of $87.50. Trimble’s shares have increased 12.8% over the past three months, slightly outpacing the broader S&P 500 Index’s ($SPX) 12.2% gain over the same time frame.

In the longer term, TRMB stock is up 16.1% on a YTD basis, outperforming SPX’s 13.8% rise. Moreover, shares of the GPS manufacturer have climbed 40% over the past 52 weeks, compared to the 17.4% return of the SPX over the same time frame.

Despite recent fluctuations, the stock has been trading above its 50-day and 200-day moving averages since May.

Shares of Trimble rose 1.7% on Aug. 6 after the company reported Q2 2025 adjusted EPS of $0.71 and revenue of $875.7 million, above the forecasts. The company raised its annual revenue guidance to $3.5 billion - $3.6 billion and lifted its adjusted EPS outlook to $2.90 - $3.06. Investor optimism was further fueled by strong demand for its integrated hardware and software solutions, successful bundling of prepackaged product suites, and growing use of AI tools in customer workflows.

In comparison, rival Coherent Corp. (COHR) has outpaced TRMB stock on a YTD basis, gaining 21.8%. However, COHR stock has soared 30.9% over the past 52 weeks, lagging behind TRMB’s performance.

Due to the stock’s strong performance over the past year, analysts remain strongly optimistic on TRMB. It has a consensus rating of “Strong Buy” from the 12 analysts in coverage, and the mean price target of $95.58 is a premium of 16.3% to current levels.