Valued at a market cap of $22.9 billion, The Trade Desk, Inc. (TTD) is a leading independent digital advertising technology company. Headquartered in Ventura, California, the company offers a self-service, cloud-based platform that enables advertisers to plan, manage, and optimize digital campaigns across various channels, including display, video, audio, native, and social media.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Trade Desk fits this criterion perfectly. Its focus on transparency, data-driven insights, and cross-channel capabilities positions it as a significant player in the digital advertising ecosystem.

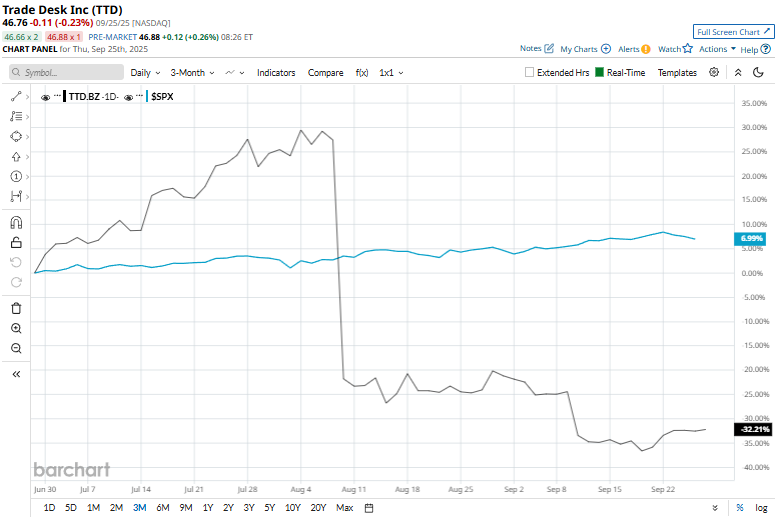

TTD has been on a rough ride, shedding 67% from its 52-week high of $141.53 touched on Dec. 4, 2024. TTD's stock has dipped 33% over the past three months, underperforming the S&P 500 Index ($SPX), which has returned 8.4% over the same time frame.

Over the past year, the stock has plunged 57.8%, lagging the S&P 500’s 15.4% rise. Moreover, on a year-to-date basis, TTD has dropped 60.2% compared with the index’s 12.3% surge.

Technicals paint a similarly bleak picture. The stock has been below its 50-day moving average since mid-August and under its 200-day moving average since mid-February, signaling a prolonged bearish trend.

On September 10, shares of Trade Desk sank more than 11% after Morgan Stanley (MS) downgraded the stock from “Overweight” to “Equal-Weight.” The downgrade reflected the firm’s more cautious stance on the company’s near-term growth outlook, suggesting limited upside potential at current valuations.

Compared to its peer, Omnicom Group Inc. (OMC) has outperformed TTD stock. OMC stock has declined 24.6% over the past 52 weeks and has dropped 11.8% on a YTD basis.

TTD has a consensus rating of “Moderate Buy” from the 38 analysts covering the stock. Additionally, the mean price target of $72.94 indicates a premium of 56% from the current market prices.