/TJX%20Companies%2C%20Inc_%20shopping%20cart%20by-Jhanggo%20via%20iStock.jpg)

Valued at a market cap of $155 billion, The TJX Companies, Inc. (TJX) is the leading off-price apparel and home fashions retailer in the U.S. and worldwide. Through its flagship chains, T.J. Maxx, Marshalls, HomeGoods, Winners, Homesense, and TK Maxx, the company offers brand-name and designer merchandise at discounted prices. Headquartered in Framingham, Massachusetts, TJX operates thousands of stores across North America, Europe, and Australia, catering to value-conscious consumers with a constantly changing assortment of apparel, footwear, accessories, and home décor.

Companies worth $10 billion or more are generally described as “large-cap stocks”, and TJX Companies definitely fits that description.

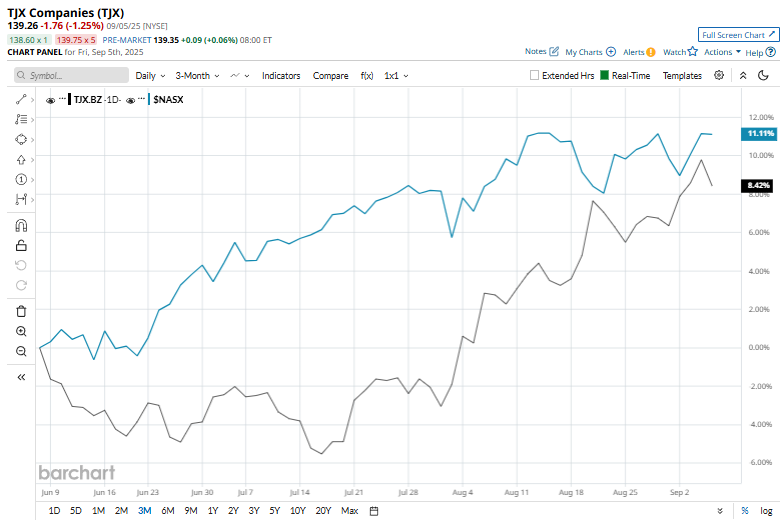

TJX has dropped 4.3% from its 52-week high of $145.58 achieved recently on Aug. 20. TJX stock has soared 9.3% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 12.5% rise over the same time frame.

In addition, TJX has soared 18% over the last 52 weeks, while $NASX has surged 26.7% in the same period. However, TJX has surged 15.3% on a YTD basis, beating $NASX’s 12.4% gain.

TJX has been mostly trading above its 200-day moving average for the past year. It has climbed above its 50-day moving average since early August, indicating a bullish trend.

On Aug. 20, TJX released its second-quarter earnings, and its shares climbed 2.7%. It posted net sales of $14.4 billion, up 7% year-over-year, and comparable store sales rose 4%. Net income grew to $1.23 billion, with EPS increasing 15% to $1.10 from $0.96 last year. Profitability also improved, as pretax profit margin expanded to 11.4% and gross margin rose to 30.7%. The company returned $1 billion to shareholders through dividends and buybacks, and raised its full-year guidance to EPS of $4.52–$4.57 and comparable sales growth of about 3%.

In the competitive retail industry, key rival Ross Stores, Inc. (ROST) has lagged behind, with a marginal dip in 2025 and a 1.4% fall over the past year.

TJX has a consensus rating of “Strong Buy” from the 22 analysts covering the stock. Its mean price target of $150.99 indicates a premium of 8.4% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.