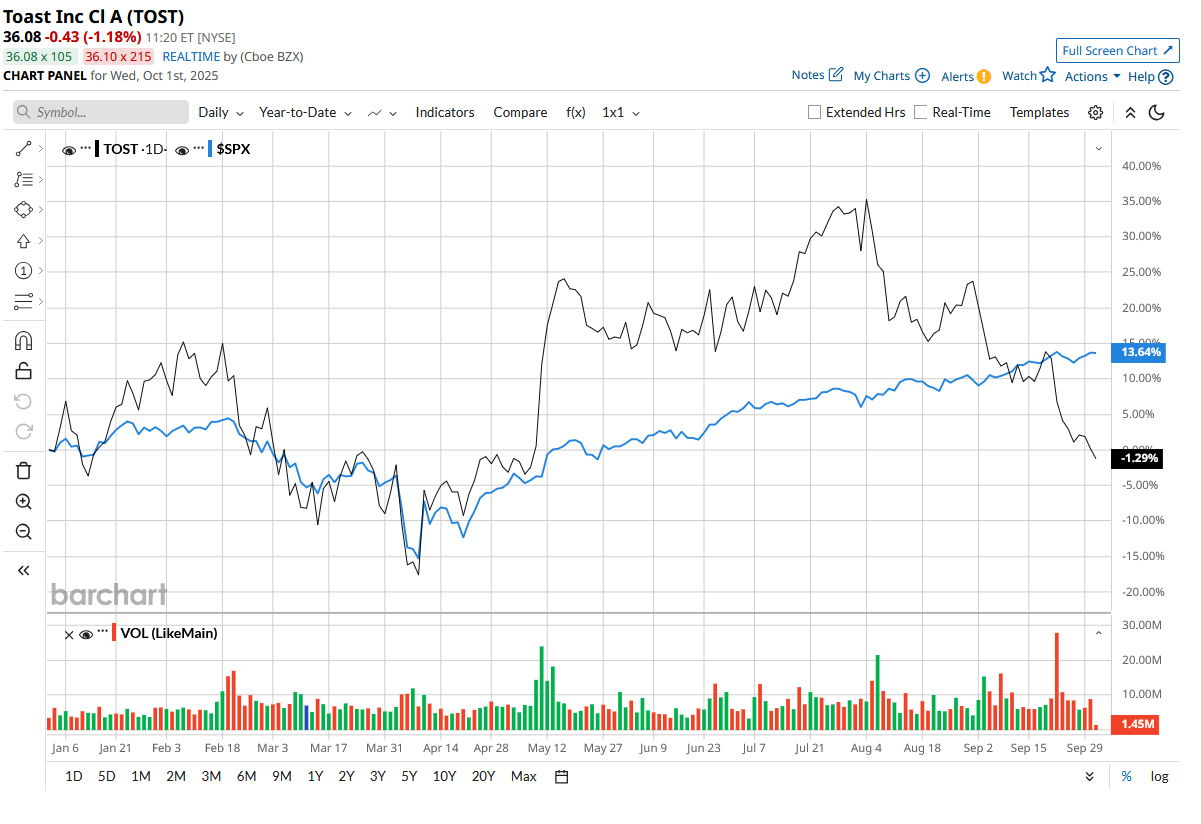

Valued at $21.6 billion, Toast (TOST) is a restaurant-tech company that has built an all-in-one technology platform tailored particularly for restaurants. From cloud-based point-of-sale (POS) systems to payments, finance, and AI-powered tools, the company is establishing itself as the digital backbone of the restaurant industry. Toast stock is up 1.55% year to date (YTD), compared to the broader market.

With rapid growth in new locations, rising recurring profits, and expanding international reach, can Toast serve long-term gains? Let’s find out.

About Toast

Toast offers POS systems, banking services, and software solutions tailored exclusively for restaurants. Toast earns most of its money from payment processing, then adds steady subscription fees for the use of Toast’s POS software, inventory tools, loyalty programs, and other features. Additionally, the company makes money from hardware sales.

Strong Quarter, Stronger Momentum

In the second quarter, Toast added 8,500 net new locations, gaining market share in nearly every small- and medium-business market it serves. Altogether, Toast now serves 148,000 locations worldwide, up 24% from last year. Toast posted a robust second quarter, with annual recurring revenue (ARR) up 31% year-over-year (YoY) to $1.9 billion. Gross Payment Volume (GPV) also jumped 23% to $49.9 billion. SaaS ARR grew 30%, while Payments ARR rose 32% in the quarter.

Toast strives to strike a balance between investment and profitability. Operating expenses increased 18%, driven by sales and marketing as the firm expands worldwide and into retail, while R&D increased 9% to support innovations such as Toast Go 3 and Toast IQ, which uses artificial intelligence (AI). Adjusted EBITDA totaled $161 million, with margins expanding to 35%. Toast also reported GAAP net income of $80 million in Q2, a drastic increase from $14 million in the year-ago quarter. Furthermore, the company generated $208 million in free cash flow despite rising spending. CEO Aman Narang attributed the company's second-quarter success to its mission-driven focus on assisting restaurants in pleasing guests, streamlining processes, and thriving financially.

Expanding Beyond Core Restaurants

While the core U.S. restaurant business remains the foundation, Toast is rapidly diversifying. In the quarter, Toast welcomed Firehouse Subs, a 1,300-location quick-service chain, indicating that the company is gaining pace with larger brands. The company crossed 10,000 live locations in enterprise, international, and retail segments, milestones that collectively are expected to deliver $100 million in ARR by year-end.

Toast is also forming collaborations to grow its platform. A new multi-year agreement with American Express (AXP) incorporates Resy, Tock, and Toast Tables reservations into Toast's Local app. The company also launched in Australia, its fourth new market after the U.K., Ireland, and Canada, displaying its capacity to expand globally with speed and scale. On the product side, the company introduced Toast Go 3 and Toast IQ, its AI-driven intelligence engine, highlighting how technology can directly impact restaurant operations. Importantly, Toast is showing discipline in scaling. Given its strong performance in Q2, Toast raised its full-year guidance. For the full year, it now projects 29% growth in recurring gross profit and adjusted EBITDA in the range of $565 million to $585 million, with a 32% margin. Analysts expect Toast’s earnings to increase by 76% in 2025, followed by another 24% the next year. Priced at 31 times forward earnings, Toast is trading at a premium.

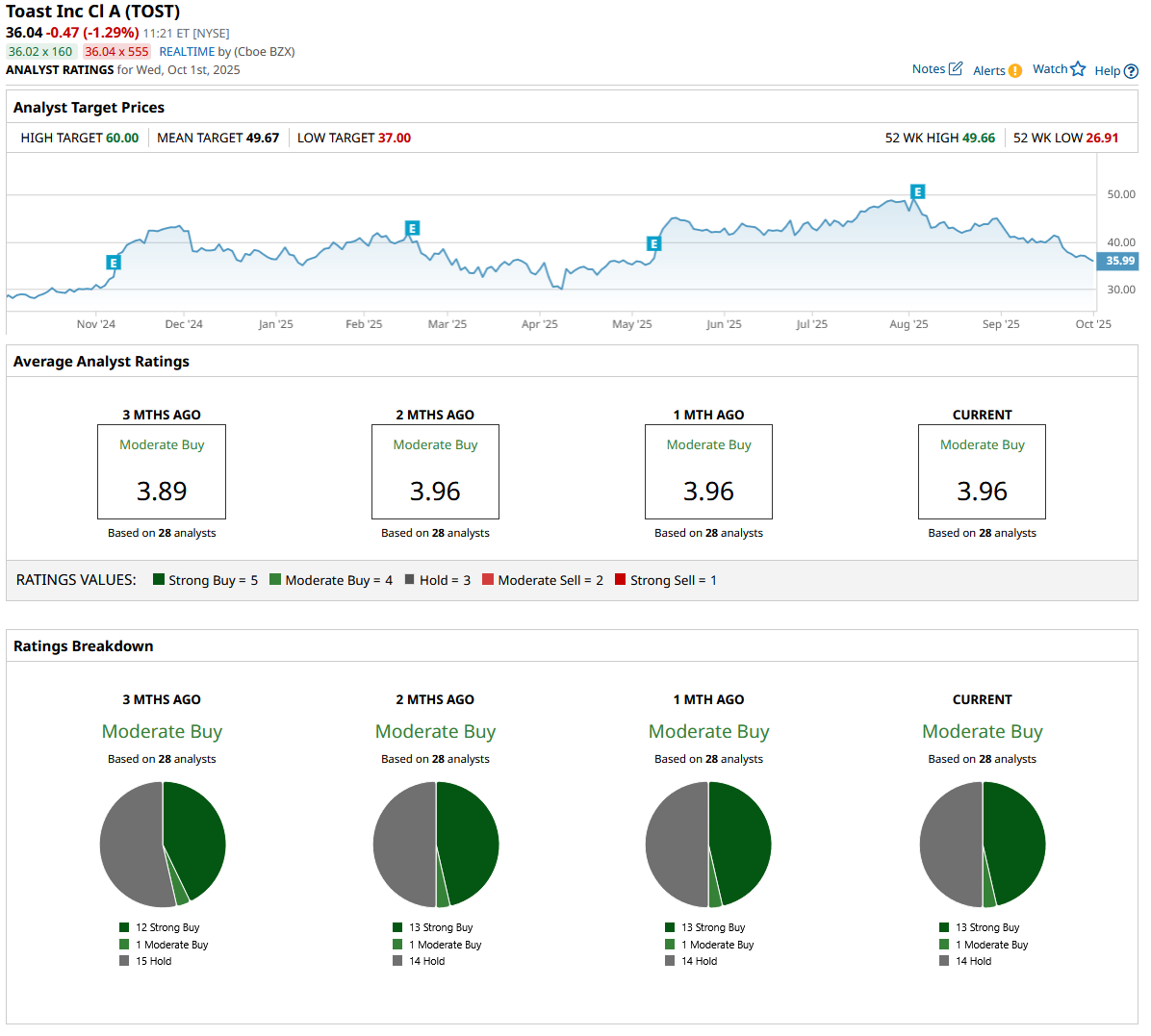

What Does Wall Street Say About Toast Stock?

Overall, Wall Street rates Toast stock as a “Moderate Buy.” Out of the 28 analysts who cover the stock, 13 have given it a “Strong Buy” rating, while one analyst says it is a “Moderate Buy,” and 14 suggest a “Hold” rating. Based on the mean target price of $49.67, Toast stock has upside potential of 37% from current levels. However, the high target price of $60 suggests that the stock could rise more than 66% over the next 12 months.

Toast’s second-quarter results reflected a rapidly growing tech stock with a combination of growth, scale, and profitability. The company is gaining traction across its core restaurant market while successfully proving its model in enterprise, retail, and international segments. With SaaS and FinTech growth driving recurring revenue, improving margins, and a disciplined expansion strategy, Toast appears to be well-positioned to provide long-term gains.